nares with nd rate o

Chapter15: Choice Of Business Entity—other Considerations

Section: Chapter Questions

Problem 80P

Related questions

Question

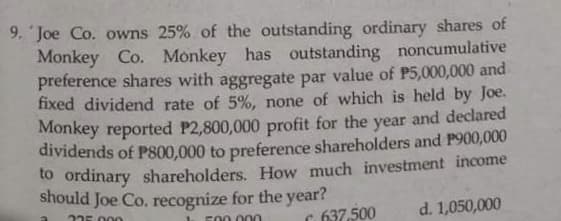

Transcribed Image Text:9. 'Joe Co. owns 25% of the outstanding ordinary shares of

Monkey Co. Monkey has outstanding noncumulative

preference shares with aggregate par value of P5,000,000 and

fixed dividend rate of 5%, none of which is held by Joe.

Monkey reported P2,800,000 profit for the year and declared

dividends of PS00,000 to preference shareholders and P900,000

to ordinary shareholders. How much investment income

should Joe Co. recognize for the year?

235 000

C 637,500

d. 1,050,000

F00 .000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning