ange in net inter percentage poi

Q: Sharon Guenther and Robert Firmin, both of whom are CPAS, form a partnership, with Guenther investin...

A: A general partnership is an agreement in which two or more partners agree to share the profits and l...

Q: On January 1, 2021, the generol ledger of Tripley Company included the following account balances: A...

A: The question is based on the concept of Financial Accounting. As per the Bartleby guidelines we are ...

Q: ny produces floor mats used in gyms and dojos. The sales budget for four months of the year is as sh...

A: Ending inventory and beginning inventory must be according the budgeted sales and budgeted growth in...

Q: 1.Compute for the units produced for the second quarter. 2.Compute for the units produced for the f...

A: Answer:- Standard Pillow Neck Roll Units to be produced for the second quarter 7200 4850 ...

Q: The following information pertains to Lacson Corporation defined benefit plan for the year 2022: Def...

A: The urealized gain or loss along with the other gain and losses accumulated in prior year is account...

Q: On December 31, 2019, Ana Inc. sold merchandise for P750,000 to Ysa Inc. The terms of the sales were...

A: Solution Calculation of Inventory wrongly recorded- = 750000 / (100+25%). = 600000.

Q: If the firm's dividend policy was to pay PO.25 per share each period except when earnings exceed P1....

A: In the given question, the earnings of the company for 2020 are P 3.50 per share. As per company’s p...

Q: Deflecta Corporation uses a standard cost system. The standard cost for direct materials is $7 per p...

A: Materials price variance = (Actual price - Standard price)*Actual quantity Materials quantity varian...

Q: 20 Accounts Payable 30,000 Cash 30,000 Payment to creditors Cash 21 Gasoline Expense 6,000 Cash 6,00...

A: Trial balance is inclusive of all the ledger accounts prepared from the journal entries. The total o...

Q: The following are the year end balances in a business' ledgers: Sales 628,000 Cost of sales 458,000 ...

A: Introduction: Trial Balance: All the final ledger account balances are posted in Trial balance. To c...

Q: I - PROBLEM SOLVING: Eugene and Alfred are partners in their Ghost Fighting business. Alfred is the ...

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for y...

Q: An inventory of supplies showed $3,000 were used up. 2. There was $500 of depreciation on Furniture ...

A: An income statement is a financial report that indicates the revenue and expenses of a business. It ...

Q: Steak Town Company leased equipment for its nine-year useful life, agreeing to pay P500,000 at the s...

A: For the determination of lease liability and interest expense for the year December 31, 2022, We hav...

Q: of the country to treat road surfaces. Suppose you have been asked to provide a list of factors to c...

A: Cost considerations: Combination of beet juice and rock salt will be costlier when compared to the r...

Q: The fixed costs incurred by a automotive shop are $200,000 per year. Variable costs are 60% of the a...

A: Introduction: Income statement: All revenues and expenses are shown in income statement. It tells th...

Q: The following data have been gathered for Syncronics, Inc.: Thė July 31 bank balance was $4,000, b. ...

A: Preparation of the July 31 bank reconciliation for Syncronics, Inc is as follows:

Q: You bought 400 shares of Heavy Metal Inc. at ₱300 per share over the year, you received ₱75 per shar...

A: The total return on shares will comprise of capital gain and dividend on shares.

Q: ials Added ng Overhead

A: Given as, January 1 Bal. $ 0Transfer from Mo...

Q: Based on their budget, Bryce and Sylvia have determined they can afford up to $2,500 per month for t...

A: Private mortgage insurance (PMI) is the insurance payable on the balance of the loan per year. At fi...

Q: Cost of Units Transferred Out and Ending Work in Process The costs per equivalent unit of direct mat...

A: GIVEN Cost of Units Transferred Out and Ending Work In Process The costs per equivalent unit of ...

Q: E G City Debt

A: City Debt having five type of debts which are General Bond , Lease Bond , Revenue Bond , Loan and Ca...

Q: Morgan Company issues 10%, 20-year bonds with a par value of $820,000 that pay interest semiannually...

A: Given, Face value = $820,000 Coupon rate = 10%/2 Coupon rate = 5%

Q: Burlington Corp. has a single class of shares. At its year end December 31, 2020, the company had 5,...

A: Journal entry is the act of keeping or making records of any transaction either economic and non-eco...

Q: #items Şunit cost $unit retail $total cost $total MU% retail Style 1 Style 2 Style 3 10 $66 45% 15 $...

A: Retail price is the one at which the customers purchase the product from the retail market. This is ...

Q: Harrington Manufacturing Inc. began operation 5 years ago producing the probo, a new type of instrum...

A: A fixed asset is a long-term tangible product or piece of equipment that a corporation owns and uses...

Q: Balance sheet can be prepared in vertical, net asset and horizontal format. What is the difference b...

A: Balance sheet refers to the financial statement of the business entity. It is divided into two parts...

Q: ompany’s financial year. The company is owned by Samuel Maximo and is in the business of buying and ...

A: Financial Statements - Financial Statements includes income Statement, Statement of Owner's Equity, ...

Q: On January 1, 2017, Sydney Inc. issued P 5,000,000 face value, 5-year bonds at 109. Each P1,000 bond...

A: Compound financial instruments are instruments that have both debt and equity components. Both the c...

Q: ompany has liabilities of $15,500 and $20,200 of owners' equity at the year end

A: Accounting equation (AE) is the equation which forms the basic of accounting and this equation helps...

Q: # 3. Answer the following five questions. Complete sentences and well written posts only! Remember t...

A: Note: Hi! Thank you for the question, As per the honor code, we are allowed to answer three sub-part...

Q: Your company declared $13,800 cash dividen dividends payable at the beginning of the year and $2,800...

A: Answer) Calculation of Dividends Paid during the year Dividend paid during the year = Beginning bala...

Q: Campbell Corporation sells products for $31 each that have variable costs of $18 per unit. Campbell'...

A: Formula: Contribution margin per unit = Selling price per unit - Variable cost per unit

Q: The balance according to the BCA bank statement shows a balance of IDR 7,175,000. Differences with c...

A: Bank Reconciliation Statement is statement for adjustments made between Bank balance as per cash boo...

Q: Question A1 The following budgeted information relates to two departments in AB Ltd for the next fin...

A: Answer a) Department A: this department involves machine intensive production activities as its mac...

Q: Wookie Company issues 9%, five-year bonds, on January 1 of this year, with a par value of $109,000 a...

A: Number of periods = 5*2 = 10 Coupon rate= 9%/2 = 4.5% As the beginning carrying value is more than ...

Q: A manufacturing firm just received a shipment of 20 assembly parts, of slightly varied sizes, from a...

A: Given information, Total parts = 20 Suitable parts = 15 Non-suitable parts = total - suitable parts ...

Q: The problem to be resolved: The following trial balance was extracted from the books of Movies To T...

A: Note: Hi! Thank you for the question, As per the honor code, we are allowed to answer three sub-part...

Q: solve the question with explanation asap

A: Current assets are the assets that are expected to be converted within one year Calculation of total...

Q: a) Prepare a statement of equivalent production to determine the equivalent units for direct materia...

A: 1)statement of equivalent production Input output Input cost Direct Material Added Conversion cos...

Q: e Company's Statement of Cash nd finnnri

A: Free Cash Flow refer how much money company has left after payment of all Necessary Expenditure.

Q: Prepare year-end adjusting entries for the following transactions. Omit explanation.

A: 1. In 3rd entry, adjustment entry will be passed for rent Expired which is ($36,000 - $ ...

Q: On June 1, 2019, YODA CORP. acquired a 5-year, 10%, P1,000,000 face value bonds at 92. The company p...

A: As per IFRS 9, a debt financial instrument is measured at fair value through OCI if it satisfies the...

Q: statements be different in a leasing situation (for both operating leases and finance leases) for th...

A: Leasing means an agreement between lessor and lessee in which lessor shall allowed to use the asset ...

Q: The following are facts about a company's activities: Cash flows from operating activities was $33,0...

A: Formula: Cash flow statement: All cash in and out flows are shown in cash flow statements. It tells ...

Q: Don Johnson is the management accountant for Cari-Blocks (CB), which manufactures specialty blocks. ...

A: Variance analysis shows the difference between the actual and budgeted results during the year.

Q: Oahu Kiki tracks the number of units purchased and sold throughout each accounting perlod but applle...

A: Lets understand some basics Inventory is the accounting of items, component parts and raw materials ...

Q: a. What is the Sarbanes –Oxley Act? (SOX) b. What are the highlights of SOX c. What are the costs ...

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for...

Q: Sunni bought a $500 corporate bond. The bond pays 4.8% interest per year. If Sunni holds the bond fo...

A: Interest is the monetary amount charged for money borrowed, generally the rate of interest expressed...

Q: In year zero, a corporation acquires P300,000 worth of equipment. It decides to utilize straight lin...

A: Depreciation is a non-cash expense on which a tax shield is created. For calculating the total tax s...

Q: Jose and Jack have a partnership agreement which includes the following provisions regarding sharing...

A: Lets understand the basics. Partnership is a agreement between two or more person who works together...

Step by step

Solved in 2 steps

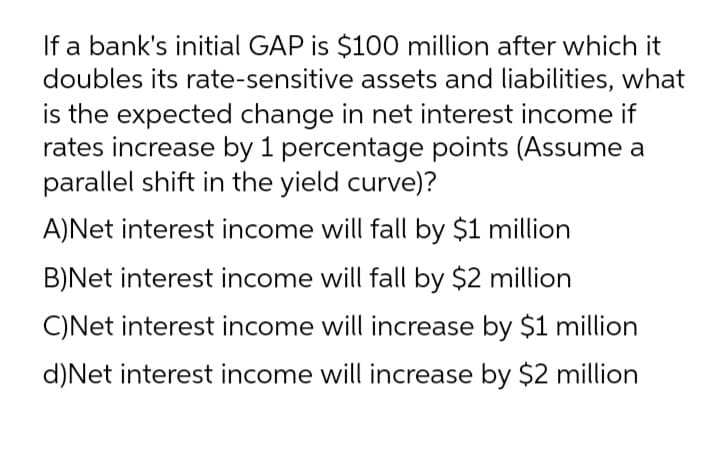

- Suppose Bank A has $35 million in rate-sensitive assets, $70 million in fixed rate assets, $70 million in rate sensitive liabilities, and $35 million in fixed rate liabilities and equity capital. Calculate the change in Bank A’s profit as a result of an increase in market interest rates of 2 percentage points.Suppose that you are the manager of a bank that has $15 million of fixed-rate assets, $30 million of rate-sensitive assets, $25 million of fixed-rate liabilities, and $20 million of rate-sensitive liabilities. Conduct a gap analysis LOADING... for the bank, and show what will happen to bank profits if interest rates rise by 5 percentage points. The change in bank profits is $nothing million.Suppose Bank A has $35 million in rate-sensitive assets, $70 million in fixed rate assets, $70 million in rate sensitive liabilities, and $35 million in fixed rate liabilities and equity capital. If you had believed that rates were going to rise by 2 percentage points (before it actually happened), explain how (if at all) you could have altered Bank A’s balance sheet and changed its interest rate risk exposure to improve its subsequent profit performance.

- The total in rate sensitive assets for a financial institution is $120 million and the total in rate sensitive liabilities is $95 million. What is the cumulative pricing gap (CGAP) and what is the interest rate sensitivity gap ratio if total assets equals $195 million? What would the projected change to net income be if interest rates rose by 2% on both assets and liabilities? What would the projected change to net income be if interest rates declined by 2% on both assets and liabilities? What would the projected change to net income be if interest rates rose by 1.8% on assets and 1.5% on liabilities? What would the projected change to net income be if interest rates declined by 1.8% on assets and 1.5% on liabilities?Suppose SBD Bank has RSA of $150m and RSL of $140m. If interest rates rise by 1 percent on both RSAs and RSLs, what would be the expected annual change in net interest income (ΔNII) based on $GAP? Show your work. ( How a commercial bank’s value would be affected by an increase in economic growth?Given the following information regarding Bank XYZ: DA = 3 years, DL = 5 years, A = $100 million, E = $10 million, we have a flat yield curve that is expected to fall from 8 to 7% in the next 6 months. Answer the following three questions related to this information: Which of the following statements is true? Select the correct answer: 1.- Assets increase from $100,000,000 to $104,629,630 (rounded) 2.- Assets decrease from $100,000,000 to $97,222,222 (rounded) 3.- Liabilities (“Liabilities”) increase from $90,000,000 to $94,166,667 (rounded) 4.- Liabilities (“Liabilities”) decreased from $90,000,000 to $85,833,333 (rounded)

- A DI has assets of $10 million consisting of $1 million in cash and $9 million in loans. The DI has core deposits of $6 million, subordinated debt of $2 million, and equity of $2 million. Increases in interest rates are expected to cause a net drain of $2 million in core deposits over the year. The average cost of deposits is 6 percent, and the average yield on loans is 8 percent. The DI decides to reduce its loan portfolio to offset this expected decline in deposits. What will be the effect on net interest income and the size of the DI after the implementation of this strategy? If the interest cost of issuing new short-term debt is expected to be 7.5 percent, what would be the effect on net interest income of offsetting the expected deposit drain with an increase in interest-bearing liabilities? What will be the size of the DI after the drain if the DI uses this strategy? What dynamic aspects of DI management would further support a strategy of replacing the deposit…Suppose that a bank has $10 billion of one-year loans and $30 billion of five-year loans. These are financed by $35 billion of one-year deposits and $5 billion of five-year deposits. The bank has equity totaling $2 billion and its return on equity is currently 12%. Estimate what change in interest rates next year would lead to the bank's return on equity being reduced to zero. Assume that the bank is subject to a tax rate of 30%.A firm is considering relaxing credit standards, which will result in annual sales increasing from P1.5 million to P1.75 million, the cost of annual sales increasing from P1,000,000 to P1,125,000, and the average collection period increasing from 40 to 55 days. The bad debt loss is expected to increase from 1 percent of sales to 1.5 percent of sales. The firm's required return on investments is 20 percent. The firm's cost of marginal investment in accounts receivable is? Format: 11,111.11

- If rate-sensitive assets equal $600 million and rate-sensitive liabilities equals $800 million, what is the expected change in net interest income if rates increase by 1%? a. Net interest income will increase by $2 million. b. Net interest income will fall by $2 million. c. Net interest income will increase by $20 million. d. Net interest income will fall by $20 million. e. Net interest income will be unchanged. its an objective questionSuppose Bank A has $35 million in rate-sensitive assets, $70 million in fixed rate assets, $70 million in rate sensitive liabilities, and $35 million in fixed rate liabilities and equity capital. What is the value of Bank A’s GAP?Assuming that the average duration of First National Bank's $100 million assets is five years, while the average duration of its $80 million liabilities is three years, then a 5 percentage point increase in interest rates will cause the net worth of First National to increase by $ (put a negative sign if it is a decrease) million dollars.