ncurrent Liabilities eference Share Capital, P1,000 par, 8% cumulative dinary Share Capital, P100 par tained Earnings 3 6 8 2

ncurrent Liabilities eference Share Capital, P1,000 par, 8% cumulative dinary Share Capital, P100 par tained Earnings 3 6 8 2

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 76E

Related questions

Question

Using Problem 1, in case RED Corporation is liquidated, how much would be the total amount to be received by an investor who holds 2,000 ordinary shares and 1,000

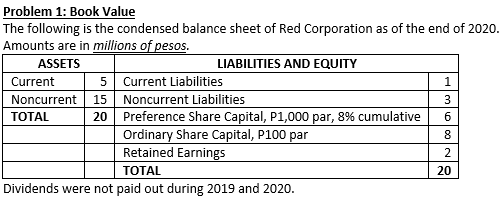

Transcribed Image Text:Problem 1: Book Value

The following is the condensed balance sheet of Red Corporation as of the end of 2020.

Amounts are in millions of pesos.

ASSETS

LIABILITIES AND EQUITY

Current

5 Current Liabilities

1.

Noncurrent

15

Noncurrent Liabilities

3

20 Preference Share Capital, P1,000 par, 8% cumulative

Ordinary Share Capital, P100 par

Retained Earnings

ТОTAL

6

8

ТOTAL

20

Dividends were not paid out during 2019 and 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning