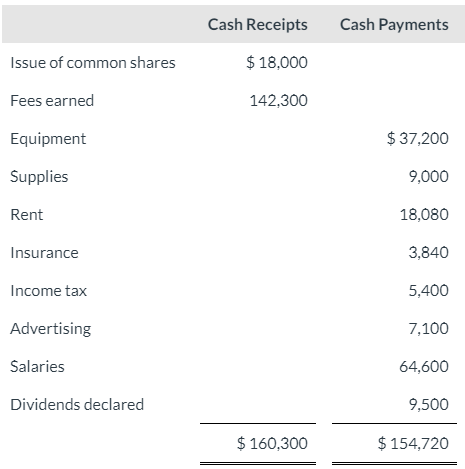

Near the end of its first year of operations, December 31, 2021, Vaughn Designs Ltd. approached the local bank for a $ 19,400 loan and was asked to submit financial statements prepared on an accrual basis. Although the company kept no formal accounting records, it did maintain a record of cash receipts and payments. The following information is available for the year ended December 31: Additional information: 1. Fees from design work earned but not yet collected amounted to $ 2,430. 2. The equipment was purchased at the beginning of January and has an estimated six-year useful life. The company uses straight-line depreciation. 3. Supplies on hand on December 31 were $ 1,230. 4. Rent payments included a $ 1,350 per month rental fee and a $ 1,880 deposit that is refundable at the end of the two-year lease. (Hint: Use the Prepaid Rent account for the refundable deposit.) 5. The insurance was purchased on February 1 for a one-year period expiring on January 31, 2022. 6. Salaries earned for the last four days in December and to be paid in January 2022 amounted to $ 3,000. 7. At year-end, it was determined that an additional $ 7,600 is owed for income tax. Cash Balance at Dec. 31 = 5580 Question: Please fill out

Near the end of its first year of operations, December 31, 2021, Vaughn Designs Ltd. approached the local bank for a $ 19,400 loan and was asked to submit financial statements prepared on an accrual basis. Although the company kept no formal accounting records, it did maintain a record of cash receipts and payments. The following information is available for the year ended December 31: Additional information: 1. Fees from design work earned but not yet collected amounted to $ 2,430. 2. The equipment was purchased at the beginning of January and has an estimated six-year useful life. The company uses straight-line depreciation. 3. Supplies on hand on December 31 were $ 1,230. 4. Rent payments included a $ 1,350 per month rental fee and a $ 1,880 deposit that is refundable at the end of the two-year lease. (Hint: Use the Prepaid Rent account for the refundable deposit.) 5. The insurance was purchased on February 1 for a one-year period expiring on January 31, 2022. 6. Salaries earned for the last four days in December and to be paid in January 2022 amounted to $ 3,000. 7. At year-end, it was determined that an additional $ 7,600 is owed for income tax. Cash Balance at Dec. 31 = 5580 Question: Please fill out

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 18MCQ

Related questions

Question

Near the end of its first year of operations, December 31, 2021, Vaughn Designs Ltd. approached the local bank for a $ 19,400 loan and was asked to submit financial statements prepared on an accrual basis. Although the company kept no formal accounting records, it did maintain a record of cash receipts and payments. The following information is available for the year ended December 31:

Additional information:

| 1. | Fees from design work earned but not yet collected amounted to $ 2,430. | |

| 2. | The equipment was purchased at the beginning of January and has an estimated six-year useful life. The company uses straight-line |

|

| 3. | Supplies on hand on December 31 were $ 1,230. | |

| 4. | Rent payments included a $ 1,350 per month rental fee and a $ 1,880 deposit that is refundable at the end of the two-year lease. (Hint: Use the Prepaid Rent account for the refundable deposit.) | |

| 5. | The insurance was purchased on February 1 for a one-year period expiring on January 31, 2022. | |

| 6. | Salaries earned for the last four days in December and to be paid in January 2022 amounted to $ 3,000. | |

| 7. | At year-end, it was determined that an additional $ 7,600 is owed for income tax. |

Cash Balance at Dec. 31 = 5580

Question: Please fill out

Transcribed Image Text:Cash Receipts

Cash Payments

Issue of common shares

$ 18,000

Fees earned

142,300

Equipment

$ 37,200

Supplies

9,000

Rent

18,080

Insurance

3,840

Income tax

5,400

Advertising

7,100

Salaries

64,600

Dividends declared

9,500

$ 160,300

$ 154,720

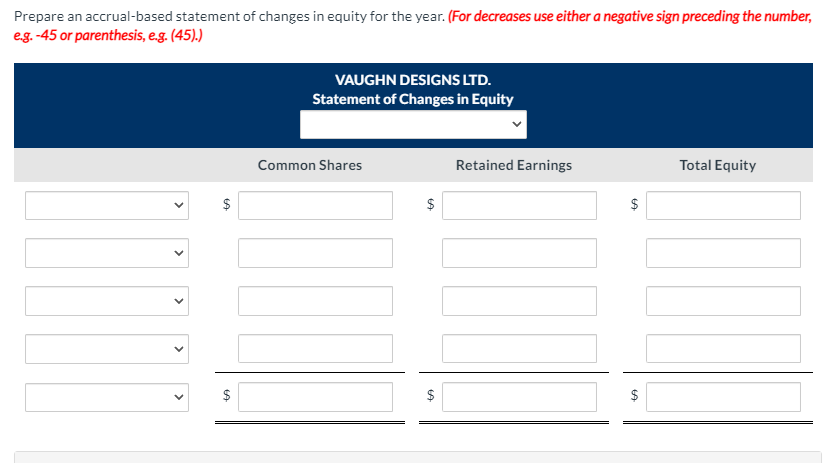

Transcribed Image Text:Prepare an accrual-based statement of changes in equity for the year. (For decreases use either a negative sign preceding the number,

eg. -45 or parenthesis, e.g. (45).)

VAUGHN DESIGNS LTD.

Statement of Changes in Equity

Common Shares

Retained Earnings

Total Equity

$

$

$

$

%24

24

%24

%24

%24

>

>

>

>

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage