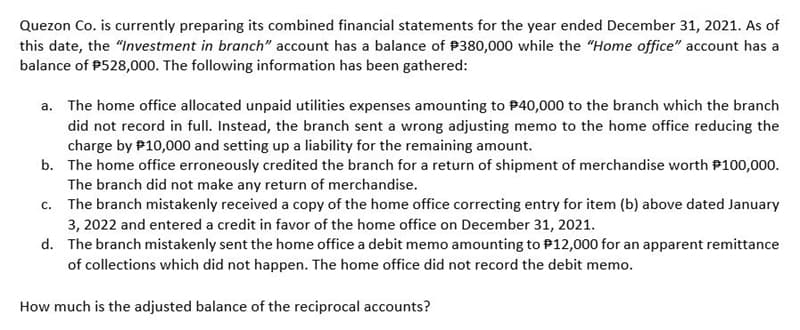

Quezon Co. is currently preparing its combined financial statements for the year ended December 31, 2021. As of this date, the "Investment in branch" account has a balance of P380,000 while the "Home office" account has a balance of $528,000. The following information has been gathered: a. The home office allocated unpaid utilities expenses amounting to $40,000 to the branch which the branch did not record in full. Instead, the branch sent a wrong adjusting memo to the home office reducing the charge by P10,000 and setting up a liability for the remaining amount. b. The home office erroneously credited the branch for a return of shipment of merchandise worth $100,000. The branch did not make any return of merchandise. c. The branch mistakenly received a copy of the home office correcting entry for item (b) above dated January 3, 2022 and entered a credit in favor of the home office on December 31, 2021. d. The branch mistakenly sent the home office a debit memo amounting to P12,000 for an apparent remittance of collections which did not happen. The home office did not record the debit memo. How much is the adjusted balance of the reciprocal accounts?

Quezon Co. is currently preparing its combined financial statements for the year ended December 31, 2021. As of this date, the "Investment in branch" account has a balance of P380,000 while the "Home office" account has a balance of $528,000. The following information has been gathered: a. The home office allocated unpaid utilities expenses amounting to $40,000 to the branch which the branch did not record in full. Instead, the branch sent a wrong adjusting memo to the home office reducing the charge by P10,000 and setting up a liability for the remaining amount. b. The home office erroneously credited the branch for a return of shipment of merchandise worth $100,000. The branch did not make any return of merchandise. c. The branch mistakenly received a copy of the home office correcting entry for item (b) above dated January 3, 2022 and entered a credit in favor of the home office on December 31, 2021. d. The branch mistakenly sent the home office a debit memo amounting to P12,000 for an apparent remittance of collections which did not happen. The home office did not record the debit memo. How much is the adjusted balance of the reciprocal accounts?

Chapter6: Business Expenses

Section: Chapter Questions

Problem 44P

Related questions

Question

Transcribed Image Text:Quezon Co. is currently preparing its combined financial statements for the year ended December 31, 2021. As of

this date, the "Investment in branch" account has a balance of $380,000 while the "Home office" account has a

balance of $528,000. The following information has been gathered:

a. The home office allocated unpaid utilities expenses amounting to $40,000 to the branch which the branch

did not record in full. Instead, the branch sent a wrong adjusting memo to the home office reducing the

charge by $10,000 and setting up a liability for the remaining amount.

b. The home office erroneously credited the branch for a return of shipment of merchandise worth $100,000.

The branch did not make any return of merchandise.

c. The branch mistakenly received a copy of the home office correcting entry for item (b) above dated January

3, 2022 and entered a credit in favor of the home office on December 31, 2021.

d.

The branch mistakenly sent the home office a debit memo amounting to $12,000 for an apparent remittance

of collections which did not happen. The home office did not record the debit memo.

How much is the adjusted balance of the reciprocal accounts?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning