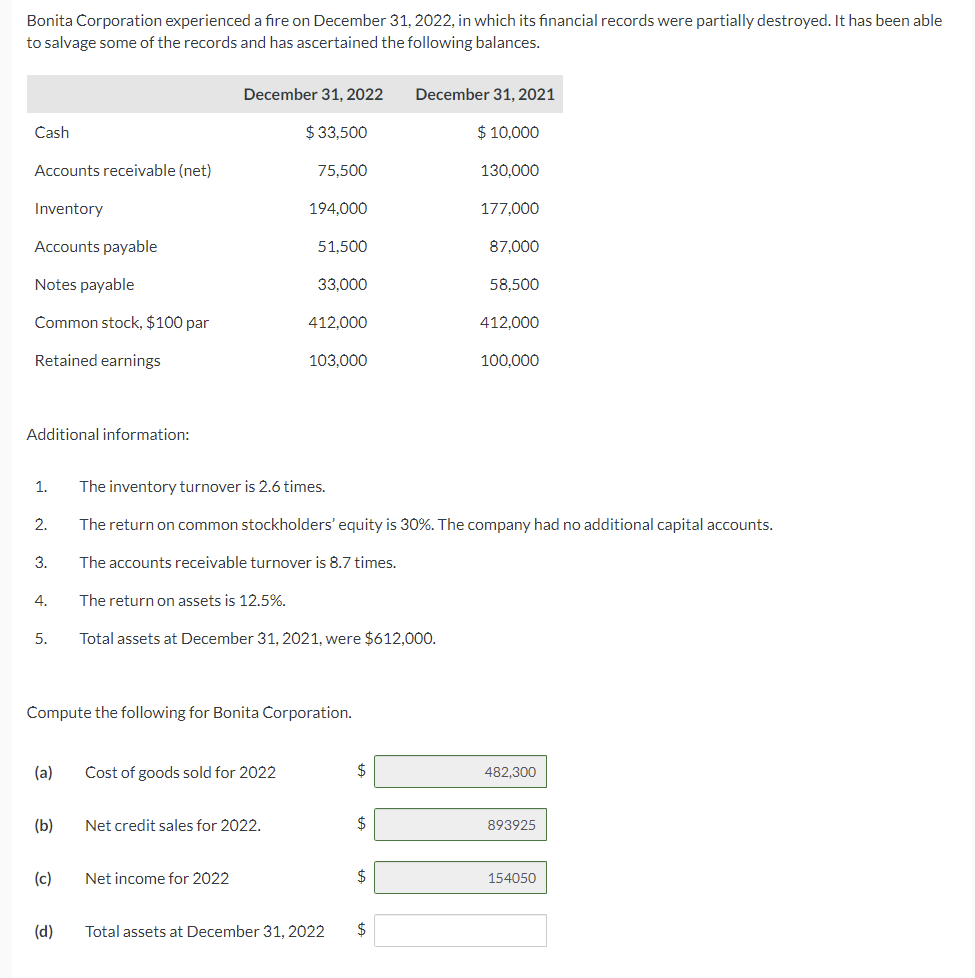

Bonita Corporation experienced a fire on December 31, 2022, in which its financial records were partially destroyed. It has been able to salvage some of the records and has ascertained the following balances. December 31, 2022 December 31, 2021 Cash $ 33,500 $ 10,000 Accounts receivable (net) 75,500 130,000 Inventory 194,000 177,000 Accounts payable 51,500 87,000 Notes payable 33,000 58,500 Common stock, $100 par 412,000 412,000 Retained earnings 103,000 100,000 Additional information: 1. The inventory turnover is 2.6 times. 2. The return on common stockholders' equity is 30%. The company had no additional capital accounts. 3. The accounts receivable turnover is 8.7 times. 4. The return on assets is 12.5%. 5. Total assets at December 31, 2021, were $612,000. Compute the following for Bonita Corporation. (a) Cost of goods sold for 2022 24 482,300 (b) Net credit sales for 2022. $ 893925 (c) Net income for 2022 154050 (d) Total assets at December 31, 2022 2$ %24 %24

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

need help answering part D on total assets for 2022