Nelson Nilam is a 74 year old resident of the Republic who workS in the motor industry. He has been married in communit

Nelson Nilam is a 74 year old resident of the Republic who workS in the motor industry. He has been married in communit

Chapter13: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 32CE

Related questions

Question

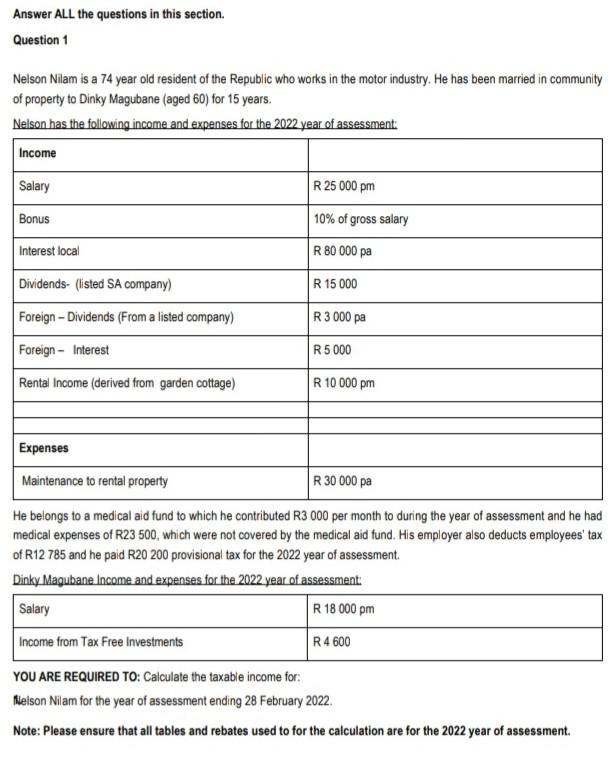

Transcribed Image Text:Answer ALL the questions in this section.

Question 1

Nelson Nilam is a 74 year old resident of the Republic who works in the motor industry. He has been married in community

of property to Dinky Magubane (aged 60) for 15 years.

Nelson has the following income and expenses for the 2022 year of assessment:

Income

Salary

R 25 000 pm

Bonus

10% of gross salary

Interest local

R 80 000 pa

Dividends- (listed SA company)

R 15 000

Foreign- Dividends (From a listed company)

R3 000 pa

Foreign - Interest

R5 000

Rental Income (derived from garden cottage)

R 10 000 pm

Expenses

Maintenance to rental property

R 30 000 pa

He belongs to a medical aid fund to which he contributed R3 000 per month to during the year of assessment and he had

medical expenses of R23 500, which were not covered by the medical aid fund. His employer also deducts employees' tax

of R12 785 and he paid R20 200 provisional tax for the 2022 year of assessment.

Dinky Magubane Income and expenses for the 2022 year of assessment

Salary

R 18 000 pm

Income from Tax Free Investments

R4 600

YOU ARE REQUIRED TO: Calculate the taxable income for:

Nelson Nilam for the year of assessment ending 28 February 2022.

Note: Please ensure that all tables and rebates used to for the calculation are for the 2022 year of assessment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning