nerine College, a private 1 P5,000,000 from alumni for construction of a new wing on the science building to be constructed in 2018. II. P 1,000,000 from a donor who stipulated that the contribution be invested indefinitely and that the earnings be used for scholarships. As of December 31, 2017, earnings from investments amounted to P50,000. ront college, during 2017:

nerine College, a private 1 P5,000,000 from alumni for construction of a new wing on the science building to be constructed in 2018. II. P 1,000,000 from a donor who stipulated that the contribution be invested indefinitely and that the earnings be used for scholarships. As of December 31, 2017, earnings from investments amounted to P50,000. ront college, during 2017:

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 45P

Related questions

Question

100%

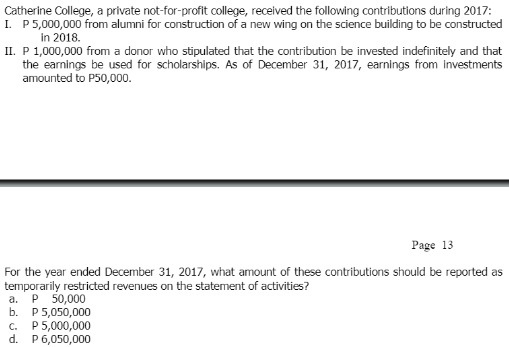

Transcribed Image Text:Catherine College, a private not-for-profit college, received the following contributions during 2017:

I. P5,000,000 from alumni for construction of a new wing on the science building to be constructed

in 2018.

II. P 1,000,000 from a donor who stipulated that the contribution be invested indefinitely and that

the earnings be used for scholarships. As of December 31, 2017, earnings from Investments

amounted to P50,000.

Page 13

For the year ended December 31, 2017, what amount of these contributions should be reported as

temporarily restricted revenues on the statement of activities?

P 50,000

b. P 5,050,000

c. P5,000,000

d. P6,050,000

a.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT