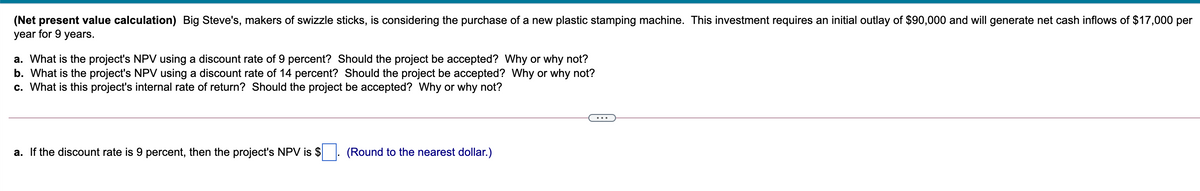

(Net present value calculation) Big Steve's, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $90,000 and will generate net cash inflows of $17,000 per year for 9 years. a. What is the project's NPV using a discount rate of 9 percent? Should the project be accepted? Why or why not? b. What is the project's NPV using a discount rate of 14 percent? Should the project be accepted? Why or why not? c. What is this project's internal rate of return? Should the project be accepted? Why or why not? a. If the discount rate is 9 percent, then the project's NPV is $ (Round to the nearest dollar.)

(Net present value calculation) Big Steve's, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $90,000 and will generate net cash inflows of $17,000 per year for 9 years. a. What is the project's NPV using a discount rate of 9 percent? Should the project be accepted? Why or why not? b. What is the project's NPV using a discount rate of 14 percent? Should the project be accepted? Why or why not? c. What is this project's internal rate of return? Should the project be accepted? Why or why not? a. If the discount rate is 9 percent, then the project's NPV is $ (Round to the nearest dollar.)

Question

Transcribed Image Text:(Net present value calculation) Big Steve's, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $90,000 and will generate net cash inflows of $17,000 per

year for 9 years.

a. What is the project's NPV using a discount rate of 9 percent? Should the project be accepted? Why or why not?

b. What is the project's NPV using a discount rate of 14 percent? Should the project be accepted? Why or why not?

c. What is this project's internal rate of return? Should the project be accepted? Why or why not?

a. If the discount rate is 9 percent, then the project's NPV is $

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.