Net Present Value-Unequal Lives Project 1 requires an original investment of $57,000. The project will yield cash flows of $9,000 per year for 8 years. Project 2 has a computed net present value of $11,900 over a six-year life. Project 1 could be sold at the end of six years for a price of $37,000. Use the Present Value of $1 at Compound Interest and the Present Value of an Annuity of $1 at Compound Interest tables shown below. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4. 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 0.705 0.564 0.507 0.432 0.335 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162

Net Present Value-Unequal Lives Project 1 requires an original investment of $57,000. The project will yield cash flows of $9,000 per year for 8 years. Project 2 has a computed net present value of $11,900 over a six-year life. Project 1 could be sold at the end of six years for a price of $37,000. Use the Present Value of $1 at Compound Interest and the Present Value of an Annuity of $1 at Compound Interest tables shown below. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4. 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 0.705 0.564 0.507 0.432 0.335 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 5BE

Related questions

Question

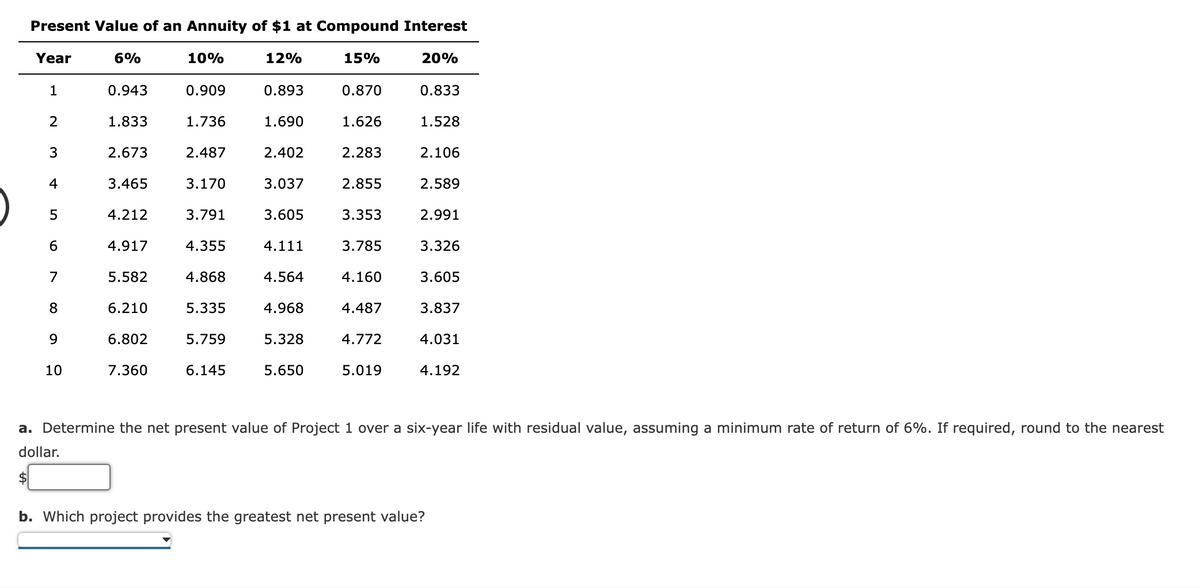

Transcribed Image Text:Present Value of an Annuity of $1 at Compound Interest

Year

6%

10%

12%

15%

20%

1

0.943

0.909

0.893

0.870

0.833

2

1.833

1.736

1.690

1.626

1.528

2.673

2.487

2.402

2.283

2.106

4

3.465

3.170

3.037

2.855

2.589

4.212

3.791

3.605

3.353

2.991

6.

4.917

4.355

4.111

3.785

3.326

7

5.582

4.868

4.564

4.160

3.605

8

6.210

5.335

4.968

4.487

3.837

6.802

5.759

5.328

4.772

4.031

10

7.360

6.145

5.650

5.019

4.192

a. Determine the net present value of Project 1 over a six-year life with residual value, assuming a minimum rate of return of 6%. If required, round to the nearest

dollar.

b. Which project provides the greatest net present value?

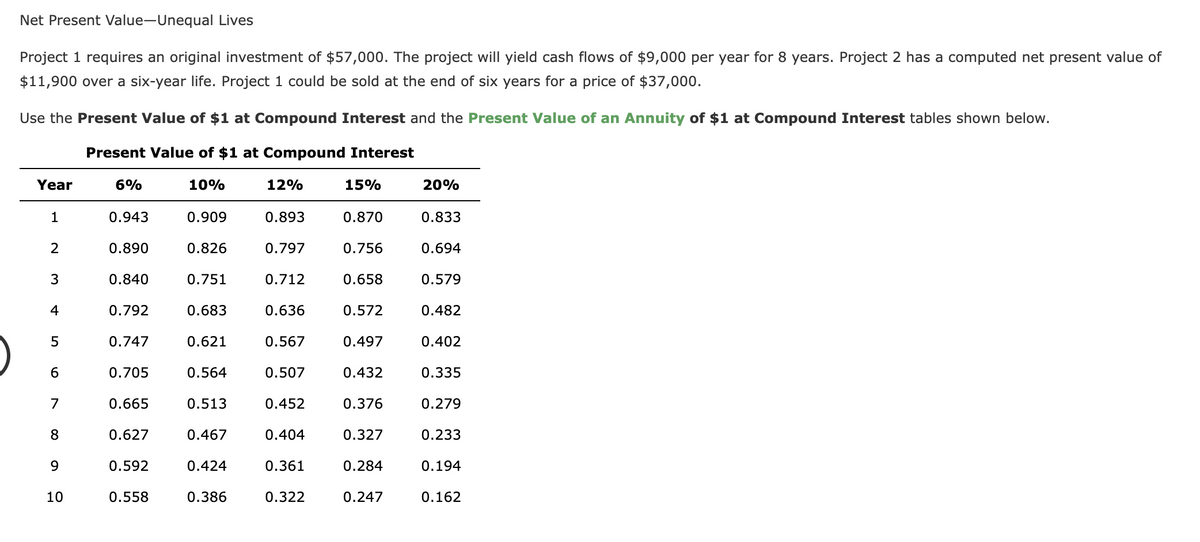

Transcribed Image Text:Net Present Value-Unequal Lives

Project 1 requires an original investment of $57,000. The project will yield cash flows of $9,000 per year for 8 years. Project 2 has a computed net present value of

$11,900 over a six-year life. Project 1 could be sold at the end of six years for a price of $37,000.

Use the Present Value of $1 at Compound Interest and the Present Value of an Annuity of $1 at Compound Interest tables shown below.

Present Value of $1 at Compound Interest

Year

6%

10%

12%

15%

20%

1

0.943

0.909

0.893

0.870

0.833

0.890

0.826

0.797

0.756

0.694

3

0.840

0.751

0.712

0.658

0.579

4

0.792

0.683

0.636

0.572

0.482

5

0.747

0.621

0.567

0.497

0.402

6.

0.705

0.564

0.507

0.432

0.335

7

0.665

0.513

0.452

0.376

0.279

8

0.627

0.467

0.404

0.327

0.233

9.

0.592

0.424

0.361

0.284

0.194

10

0.558

0.386

0.322

0.247

0.162

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT