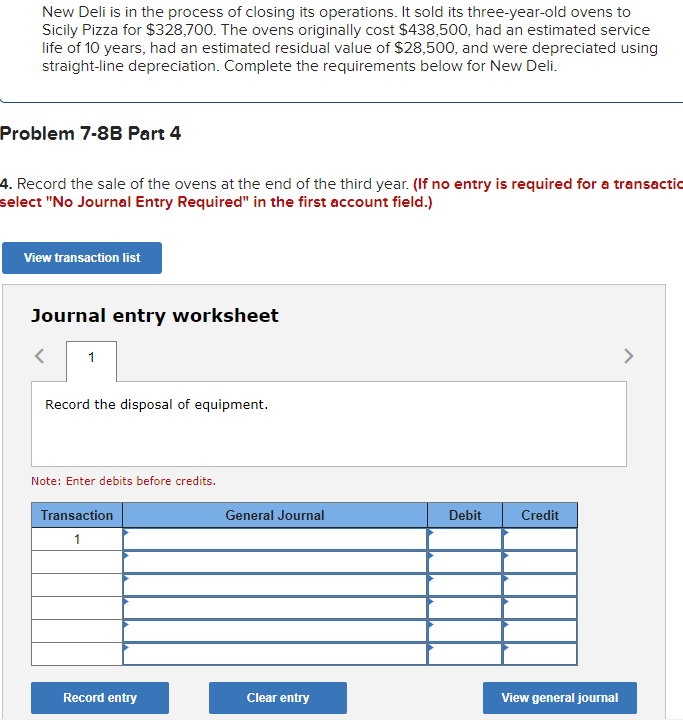

New Deli is in the process of closing its operations. It sold its three-year-old ovens to Sicily Pizza for $328,700. The ovens originally cost $438,500, had an estimated service life of 10 years, had an estimated residual value of $28,500, and were depreciated using straight-line depreciation. Complete the requirements below for New Deli. blem 7-8B Part 4

New Deli is in the process of closing its operations. It sold its three-year-old ovens to Sicily Pizza for $328,700. The ovens originally cost $438,500, had an estimated service life of 10 years, had an estimated residual value of $28,500, and were depreciated using straight-line depreciation. Complete the requirements below for New Deli. blem 7-8B Part 4

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 7E: Loban Company purchased four cars for 9,000 each and expects that they will be sold in 3 years for...

Related questions

Question

Transcribed Image Text:New Deli is in the process of closing its operations. It sold its three-year-old ovens to

Sicily Pizza for $328,700. The ovens originally cost $438,500, had an estimated service

life of 10 years, had an estimated residual value of $28,500, and were depreciated using

straight-line depreciation. Complete the requirements below for New Deli.

Problem 7-8B Part 4

4. Record the sale of the ovens at the end of the third year. (If no entry is required for a transactic

select "No Journal Entry Required" in the first account field.)

View transaction list

Journal entry worksheet

1

Record the disposal of equipment.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

1

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning