= new profit sharing ratio

Q: Which one of the following statement is true about profit maximization? a It foc US or Ountina

A: 1. Profit maximization is the concept that focuses on maximising the profits. This concept ignores…

Q: What are important profitability ratios?

A: Ratio analysis: The analysis of a company using the financial ratios and comparing its trends and…

Q: Calculate: Net noninterest margin Net operating margin Earnings spread

A: Net Non Interest Margin = Net Non interest income/Total Assets Net operating margin = Net Operating…

Q: Which one of the following is a measure of long term solvency? A. Price earning ratio B. Profit…

A: Solvency refers to a firm's ability to meet its long term financial obligations or debt.

Q: assumptions for the sales growth.

A: An organization always tries to maximize its profit and perform better than earlier. In order to do…

Q: why it is important to use profitability ratios

A: Ratio analysis is an evaluation tool used by the businesses with a view to obtain knowledge about…

Q: List and compare all advantages and disadvantages of Payback Period Rule, Average Accounting Return,…

A: Payback rule: The Payback period is the length of time required to recover the initial cost of a…

Q: PROFITABILITY RATIOS

A: Gross profit margin is stable for initial year but tends to reduce in future. Return on sales…

Q: Profitability

A: Profitability is the prime purpose of every business. Every corporation tries to maximize its…

Q: When sales volume increases, which company will experience a larger percentage increase in profit:…

A: Cost Volume Profit Analysis (CVP Analysis): This analysis is helpful in determining that how any…

Q: 3) Profitability Index 4) Internal Rate of Return

A: Profitability index is a kind of capital budgeting technique that evaluates a project based on its…

Q: What is Operating Profit Margin and how is it Calculated? What is a high quality of earnings?

A:

Q: Does an increase in the operating profitability ratio always causean increase in the value of…

A: Answer: Usually, company’s operating profitability ratio’s measure how far management will strive to…

Q: What is operating profitability ratio (OP)?

A: These ratios evaluate a firm’s ability to earn profits. They help the stakeholders of the company to…

Q: The internal rate of return for Company A is close to

A: IRR is a discount rate that makes the net present value (NPV) of all cash flows equal to zero in a…

Q: what is profitability ratio?

A: Financial ratios provide information related to the company. There are various types of ratios like…

Q: PROFITABILITY Solution and answer Interpretation Gross profit margin Operating profit margin Net…

A: Solution:- 1)Calculation of Gross profit margin as follows under:- Formula as follows under:-…

Q: ancial health of the given data b

A: Ratio Analysis - The ratio is the technique used by the prospective investor or an individual or…

Q: What would be the sales value or turnover corresponding to the threshold of profitability

A: Sales turnover: It is the company's total amount of services / products sold over a given period of…

Q: Help question 28

A: Operating leverage: It is a financial ratio that measures a company’s operating income to its sales…

Q: Trend analysis of net profit margin and leverage ratios help in identtyi

A: There are various types of risk a businessman needs to evaluate before starting up the business. The…

Q: = market value per share

A: When an entity declares stock dividend the entity does not get any cash inflow. However the value of…

Q: operating income will increase by

A: Due to increase in sales, only variable expenses would increase. There would be no change in fixed…

Q: Explain the calculation procedures for and significance of return on sales.

A: The return on sales (ROS) ratio is a statistic for evaluating a business's operational efficiency.…

Q: Explain profit margin on sales

A: Profit margin on sales is calculated by using the following formula: Gross Profit/Sales Revenue*100…

Q: Sales return is a?

A: Suppose a manufacturing entity sales 10,000 units($50,000) of erasers to wholesalers, then the buyer…

Q: Is there a point in a cost-volume-profit analysis when the company is expected to profit?

A: Is there a point in a cost-volume-profit analysis when the company is expected to profit? Answer:…

Q: Trend analysis of net profit margin and leverage ratios help in identifying

A: This ratio is used to measure the operational efficiency of the management. It shows whether the…

Q: profit margin ratio

A: Profit margin ratio = Net income * 100/Net sales

Q: Is it true that All else being equal, an increase in profit margin raise ROE?

A: According to DUPONT Analysis, ROE is the function of three ratios. ROE =profit margin × asset…

Q: ) Calculate New Profit Sharing Ratio and Sacrificing Ratio

A:

Q: In what way are profitability and efficiency related? How are profitability and liquidity related

A: The question explains about profitability and efficiency related and profitability and liquidity…

Q: Compute the Division's Profit Margin. Profit Margin = Profit margin Choose Numerator: Choose…

A: The profit margin is 23% The Investment turnover is 1.03

Q: A component of operating efficiency and profitability, calculated by expressing net profit as a…

A: Profit is the amount earned by an entity after deducting all the outlays from the revenues.

Q: what do the final numbers for each of these ratios mean i.e solvency ratio 0.0322 - is this good?…

A: Different ratios gives different interpretation, by ratio analysis we able to know financial…

Q: Define Return on sales

A: Ratio analysis: It refers to the quantitative technique of financial analysis that allows gaining an…

Q: Define Selling profit.

A: Net income: Net income is the excess amount of revenue that arises after deducting all the expenses…

Q: Profit maximization

A: Introduction: The term financial management refers to the art of planning, organizing, directing…

Q: overall profit

A: Definition: Net income: Earnings made by an individual or an entity after deducting any taxes or…

Q: Liquidity. The net profit / sales percentage measures which of the following? O Return on…

A: Ratio analysis: The analysis of a company using the financial ratios and comparing its trends and…

Step by step

Solved in 2 steps

- The partnership of Tatum and Brook shares profits and losses in a 60:40 ratio respectively after Tatum receives a 10,000 salary and Brook receives a 15,000 salary. Prepare a schedule showing how the profit and loss should be divided, assuming the profit or loss for the year is: A. $40,000 B. $25,000 C. ($5,000) In addition, show the resulting entries to each partners capital account. Tatums capital account balance is $50,000 and Brooks is $60,000.The partnership of Tasha and Bill shares profits and losses in a 50:50 ratio, and the partners have capital balances of $45,000 each. Prepare a schedule showing how the bonus should be divided if Ashanti joins the partnership with a $60,000 investment. The partners new agreement will share profit and loss in a 1:3 ratio.The partnership of Magda and Sue shares profits and losses in a 50:50 ratio after Mary receives a $7,000 salary and Sue receives a $6,500 salary. Prepare a schedule showing how the profit and loss should be divided, assuming the profit or loss for the year is: A. $10,000 B. $5,000 C. ($12,000) In addition, show the resulting entries to each partners capital account.

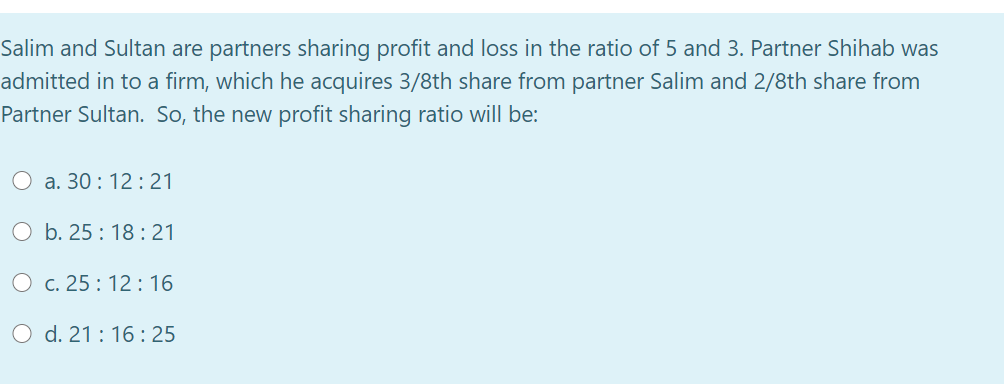

- Salim and Sultan are partners sharing profit and loss in the ratio of 5 and 3. Partner Shihab was admitted in to a firm, which he acquires 3/8th share from partner Salim and 2/8th share from Partner Sultan. So, the new profit sharing ratio will be: a. 25 : 18 : 21 b. 30 : 12 : 21 c. 21 : 16 : 25 d. 25 : 12 : 16 PLZ FASTThe firm also has two alternatives to find out the new ratio and sacrificing ratio of the partners areIf A and B are the partners sharing profits and losses in the ratio of 5:3, admitting C for 1/5th shareof future profits in which he acquires 3/16th from A and 1/16th from B and,If A and B are the partners and sharing profits and losses in the ratio of 4:1, admitting C as a newpartner in which he acquires 2/5th of A ’s share and 1/5 of B’s share.Calculate new ratio and sacrificing ratio of the partners and suggest which alternative is good forthe new partner? Comment it.Kavita and Lalit are partners sharing profits in the ratio of 2:1. They decide to admit Mohan with share in profits with a guaranteed amount of Rs. 25,000. Both Kavita and Lalita undertake to meet the liability arising out of Guaranteed amount toMohan in their respective profit sharing ratio. The profit sharing ratio between Kavita and Lalit does not change. The firm earned profits of Rs. 76,000 for the year 2006–07.Show the distribution of profit amongst the partners.

- Mohammed and Rashid are partners sharing profits in the ratio of 3:2 with capitals of OMR 50,000 and OMR 40,000 respectively. Interest on capital is agreed at 8% p.a. Interest on drawings is fixed at 10% p.a. The drawings of the partners were OMR 15,000 and OMR 10,000. Mohammed is entitled to a salary of OMR 12,000 p.a. and Rashid is entitled to get a commission of 10% on the Net Profit before charging such commission. The Net Profit of the firm before making the above adjustments was OMR 60,000 for the year ended 2021. Prepare the profit and loss appropriation account and capital Accountstephanie Calamba and Allan Brillantes decided to form a partnership. They agreed that Calamba will invest P200,000 and Brillantes, P300,000. Calamba will devote full time to the business, and Brillantes on part-time only. The following plans for the division of profits are being considered: Equal division In the ratio of original investments In the ratio of time devoted to the business Interest of 10% on original investments and the remainder in the ratio of 3:2 Interest of 10% on original investments, salary allowances of P340,000 to Calamba and P170,000 to Brillantes, and the remainder equally. Plan (e), except that Calamba is also to be allowed a bonus equal to the 20% of the amount by which profit exceeds the salary allowances. Determine the partners’ share in profit or loss for each of the situations above assuming: (1) Profit of P1,500,000 (2) Profit of P660,000 Question Stephanie Calamba and Allan Brillantes decided to form a partnership. They agreed that Calamba will invest…Stephanie Calamba and Allan Brillantes decided to form a partnership. They agreed that Calamba will invest P200,000 and Brillantes, P300,000. Calamba will devote full time to the business, and Brillantes on part-time only. The following plans for the division of profits are being considered: Equal division In the ratio of original investments In the ratio of time devoted to the business Interest of 10% on original investments and the remainder in the ratio of 3:2 Interest of 10% on original investments, salary allowances of P340,000 to Calamba and P170,000 to Brillantes, and the remainder equally. Plan (e), except that Calamba is also to be allowed a bonus equal to the 20% of the amount by which profit exceeds the salary allowances. Determine the partners’ share in profit or loss for each of the situations above assuming: (1) Profit of P1,500,000 (2) Profit of P660,000

- Asha, Deepa and Lata are partners in a firm sharing profits in the ratio of 3 : 2 : 1. Deepa retires. After making all adjustments relating to revaluation, goodwill and accumulated profit etc., the capital accounts of Asha and Lata showed a credit balance of Rs. 1,60,000 and Rs. 80,000 respectively. It was decided to adjust the capitals of Asha and Lata in their new profit sharing ratio. You are requiredto calculate the new capitals of the partners and record necessary journal entries for bringing in or withdrawal of the necessary amounts involved.Beth, Luz and Ana divide profit and loss in the ratio of 2:1:1 respectively, after giving a monthly salary of P10,000 to each partner and bonus of 20% to Beth. Determine the share of each partner and record the distribution on the following independent situations: a) Net income earned was P480,000 and bonus is based on the income before salaries and bonus. b) Net income earned was P480,000 and bonus is based on the income after salaries and bonus. c) Net loss for the year was P480,00 and bonus based on the net income before salaries and bonus.Stephanie Calamba and Allan Brillantes decided to form a partnership. They agreed that Calamba will invest P200,000 andBrillantes, P300,000. Calamba will devote full time to the business, and Brillantes on part-time only. The following plans forthe division of profits are being considered: a. Equal divisionb. In the ratio of original investmentsc. In the ratio of time devoted to the businessd. Interest of 10% on original investments and the remainder in the ratio of 3:2e. Interest of 10% on original investments, salary allowances of P340,000 to Calamba and P170,000 to Brillantes, andthe remainder equally.f. Plan (e), except that Calamba is also to be allowed a bonus equal to the 20% of the amount by which profit exceedsthe salary allowances. Determine the partners’ share in profit or loss for each of the situations above assuming:(1) Profit of P1,500,000(2) Profit of P660,000