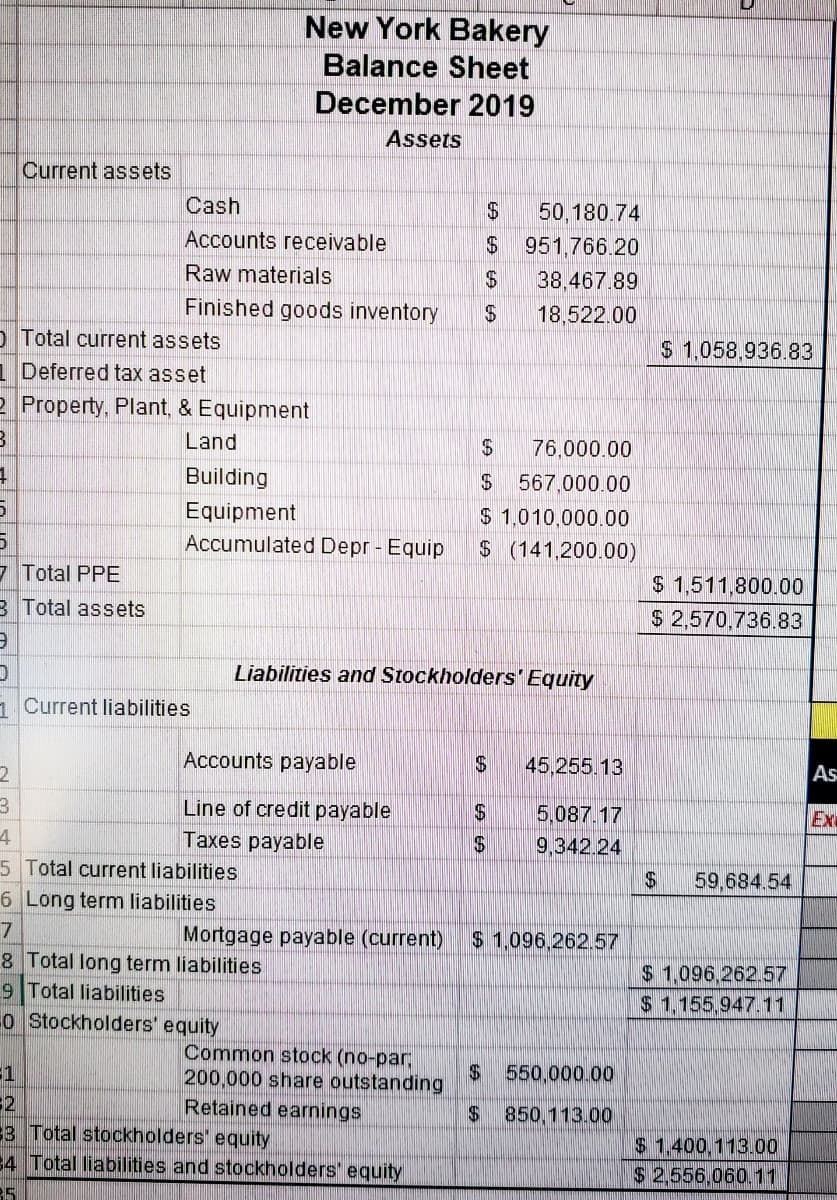

New York Bakery Balance Sheet December 2019 Assets Current assets Cash 50,180.74 Accounts receivable $ 951,766.20 Raw materials 24 38.467.89 Finished goods inventory 18,522.00 O Total current assets 1 Deferred tax asset 2 Property, Plant, & Equipment $ 1,058,936.83 Land 24 76,000.00 Building 567,000.00 Equipment $ 1,010,000.00 $ (141.200.00) Accumulated Depr - Equip 7 Total PPE B Total assets $ 1,511.800.00 $ 2,570,736.83 Liabilities and Stockholders' Equity 1 Current liabilities Accounts payable 45,255.13 As Line of credit payable Taxes payable 5,087.17 9,342.24 Ex 5 Total current liabilities 6 Long term liabilities 59,684.54 Mortgage payable (current) $ 1,096,262.57 8 Total long term liabilities 9 Total liabilities o Stockholders' equity $ 1,096,262.57 $ 1,155,947.11 Common stock (no-par, 200,000 share outstanding Retained earnings $550,000.00 2$ 850,113.00 3 Total stockholders" equity 34 Total liabilities and stockholders' equity $1.400,113.00 $ 2,556,060.11

New York Bakery Balance Sheet December 2019 Assets Current assets Cash 50,180.74 Accounts receivable $ 951,766.20 Raw materials 24 38.467.89 Finished goods inventory 18,522.00 O Total current assets 1 Deferred tax asset 2 Property, Plant, & Equipment $ 1,058,936.83 Land 24 76,000.00 Building 567,000.00 Equipment $ 1,010,000.00 $ (141.200.00) Accumulated Depr - Equip 7 Total PPE B Total assets $ 1,511.800.00 $ 2,570,736.83 Liabilities and Stockholders' Equity 1 Current liabilities Accounts payable 45,255.13 As Line of credit payable Taxes payable 5,087.17 9,342.24 Ex 5 Total current liabilities 6 Long term liabilities 59,684.54 Mortgage payable (current) $ 1,096,262.57 8 Total long term liabilities 9 Total liabilities o Stockholders' equity $ 1,096,262.57 $ 1,155,947.11 Common stock (no-par, 200,000 share outstanding Retained earnings $550,000.00 2$ 850,113.00 3 Total stockholders" equity 34 Total liabilities and stockholders' equity $1.400,113.00 $ 2,556,060.11

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 4RE: Refer to RE22-2. Assume Heller Company had sales revenue of 510,000 in 2019 and 650,000 in 2020....

Related questions

Question

What is the inventory turnover? What analysis is it, liquidity, profitability, or Solvency? What does it tell us?

Transcribed Image Text:New York Bakery

Balance Sheet

December 2019

Assets

Current assets

Cash

50,180.74

Accounts receivable

$ 951,766.20

Raw materials

24

Finished goods inventory

38.467.89

18,522.00

O Total current assets

1 Deferred tax asset

2 Property, Plant, & Equipment

$ 1,058,936.83

Land

24

76,000.00

Building

567,000.00

Equipment

$ 1,010,000.00

$ (141.200.00)

Accumulated Depr - Equip

7 Total PPE

$ 1,511.800.00

$ 2,570,736.83

B Total assets

Liabilities and Stockholders'Equity

1 Current liabilities

Accounts payable

45,255.13

As

Line of credit payable

Taxes payable

5,087.17

9,342.24

Ex

4.

5 Total current liabilities

59,684.54

6 Long term liabilities

Mortgage payable (current)

$ 1,096,262.57

8 Total long term liabilities

9 Total liabilities

o Stockholders' equity

$ 1,096,262.57

$ 1,155,947.11

Common stock (no-par,

200,000 share outstanding

$550,000.00

Retained earnings

850,113.00

3 Total stockholders' equity

34 Total liabilities and stockholders' equity

$1.400,113.00

$ 2,556,060.11

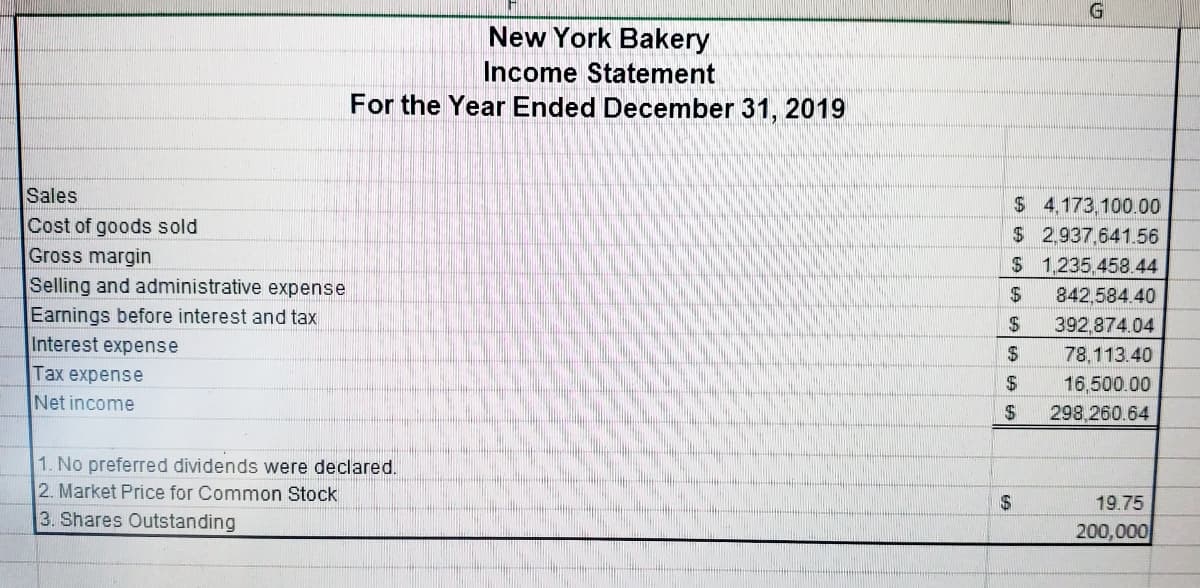

Transcribed Image Text:New York Bakery

Income Statement

For the Year Ended December 31, 2019

Sales

$ 4,173,100.00

Cost of goods sold

$2,937,641.56

Gross margin

$ 1,235.458.44

Selling and administrative expense

842,584.40

Earnings before interest and tax

Interest expense

$

392,874.04

78.113.40

Tаx expense

2$

16,500.00

Net income

298.260.64

1. No preferred dividends were declared.

2. Market Price for Common Stock

$4

19.75

3. Shares Outstanding

200,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning