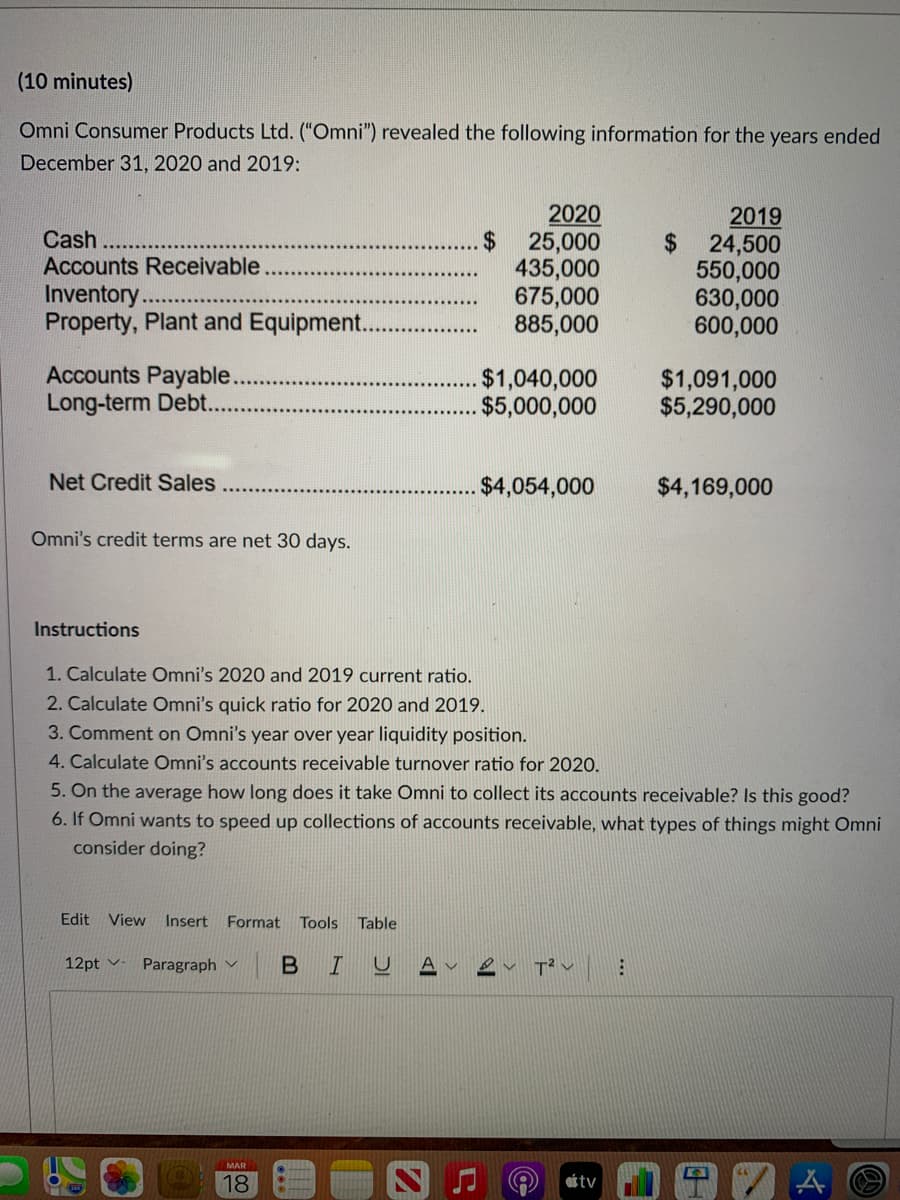

(10 minutes) Omni Consumer Products Ltd. ("Omni") revealed the following information for the years ended December 31, 2020 and 2019: 2020 25,000 435,000 675,000 885,000 2019 $24,500 550,000 630,000 600,000 Cash ... Accounts Receivable .... $ Inventory.... Property, Plant and Equipment.. Accounts Payable... Long-term Debt... $1,040,000 $5,000,000 $1,091,000 $5,290,000 Net Credit Sales $4,054,000 $4,169,000 Omni's credit terms are net 30 days. Instructions 1. Calculate Omni's 2020 and 2019 current ratio. 2. Calculate Omni's quick ratio for 2020 and 2019. 3. Comment on Omni's year over year liquidity position.

(10 minutes) Omni Consumer Products Ltd. ("Omni") revealed the following information for the years ended December 31, 2020 and 2019: 2020 25,000 435,000 675,000 885,000 2019 $24,500 550,000 630,000 600,000 Cash ... Accounts Receivable .... $ Inventory.... Property, Plant and Equipment.. Accounts Payable... Long-term Debt... $1,040,000 $5,000,000 $1,091,000 $5,290,000 Net Credit Sales $4,054,000 $4,169,000 Omni's credit terms are net 30 days. Instructions 1. Calculate Omni's 2020 and 2019 current ratio. 2. Calculate Omni's quick ratio for 2020 and 2019. 3. Comment on Omni's year over year liquidity position.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 24CE

Related questions

Question

Transcribed Image Text:(10 minutes)

Omni Consumer Products Ltd. ("Omni") revealed the following information for the years ended

December 31, 2020 and 2019:

2020

25,000

435,000

675,000

885,000

2019

Cash

Accounts Receivable

Inventory..

Property, Plant and Equipment..

2$

24,500

550,000

630,000

600,000

Accounts Payable.

Long-term Debt..

$1,040,000

. $5,000,000

$1,091,000

$5,290,000

Net Credit Sales

$4,054,000

$4,169,000

Omni's credit terms are net 30 days.

Instructions

1. Calculate Omni's 2020 and 2019 current ratio.

2. Calculate Omni's quick ratio for 2020 and 2019.

3. Comment on Omni's year over year liquidity position.

4. Calculate Omni's accounts receivable turnover ratio for 2020.

5. On the average how long does it take Omni to collect its accounts receivable? Is this good?

6. If Omni wants to speed up collections of accounts receivable, what types of things might Omni

consider doing?

Edit

View Insert Format

Tools

Table

12pt v Paragraph v

MAR

18

ottv

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College