Nick's Novelties, Incorporated, is considering the purchase of new electronic games to place in its amusement houses. The games would cost a total of $310,000, have a fifteen-year useful life, and have a total salvage value of $31,000. The company estimates that annual revenues and expenses associated with the games would be as follows: Revenues Less operating expenses: Commissions to amusement houses Insurance Depreciation Maintenance Net operating income Exercise 12-8 Part 1 (Algo) $ 90,000 58,000 18,600 70,000 $ 280,000 236,600 $ 43,400 Required: 1a. Compute the payback period associated with the new electronic games. 1b. Assume that Nick's Novelties, Incorporated, will not purchase new games unless they provide a payback period of years or less. Would the company purchase the new games?

Nick's Novelties, Incorporated, is considering the purchase of new electronic games to place in its amusement houses. The games would cost a total of $310,000, have a fifteen-year useful life, and have a total salvage value of $31,000. The company estimates that annual revenues and expenses associated with the games would be as follows: Revenues Less operating expenses: Commissions to amusement houses Insurance Depreciation Maintenance Net operating income Exercise 12-8 Part 1 (Algo) $ 90,000 58,000 18,600 70,000 $ 280,000 236,600 $ 43,400 Required: 1a. Compute the payback period associated with the new electronic games. 1b. Assume that Nick's Novelties, Incorporated, will not purchase new games unless they provide a payback period of years or less. Would the company purchase the new games?

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 11P: REPLACEMENT ANALYSIS St. Johns River Shipyards is considering the replacement of an 8-year-old...

Related questions

Question

![ces

W

[The following information applies to the questions displayed below.]

Nick's Novelties, Incorporated, is considering the purchase of new electronic games to place in its

amusement houses. The games would cost a total of $310,000, have a fifteen-year useful life, and have a

total salvage value of $31,000. The company estimates that annual revenues and expenses associated

with the games would be as follows:

Revenues

Less operating expenses:

Commissions to amusement houses

Insurance

Depreciation

Maintenance

Net operating income

Exercise 12-8 Part 1 (Algo)

Complete this question by entering your answers in the tabs below.

Req 1A

$ 90,000

58,000

18,600

70,000

Required:

1a. Compute the payback period associated with the new electronic games.

1b. Assume that Nick's Novelties, Incorporated, will not purchase new games unless they provide a payback period of five

years or less. Would the company purchase the new games?

Req 1B.

< Prev

S

2 3 of 6

$ 280,000

www

www

www

236,600

$ 43,400

Next >](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fe9583b3e-6ff6-40fa-a6f7-68d8d6061725%2Fe8060a52-09ae-40a8-bd20-a71088fc381e%2Fycgth3c_processed.jpeg&w=3840&q=75)

Transcribed Image Text:ces

W

[The following information applies to the questions displayed below.]

Nick's Novelties, Incorporated, is considering the purchase of new electronic games to place in its

amusement houses. The games would cost a total of $310,000, have a fifteen-year useful life, and have a

total salvage value of $31,000. The company estimates that annual revenues and expenses associated

with the games would be as follows:

Revenues

Less operating expenses:

Commissions to amusement houses

Insurance

Depreciation

Maintenance

Net operating income

Exercise 12-8 Part 1 (Algo)

Complete this question by entering your answers in the tabs below.

Req 1A

$ 90,000

58,000

18,600

70,000

Required:

1a. Compute the payback period associated with the new electronic games.

1b. Assume that Nick's Novelties, Incorporated, will not purchase new games unless they provide a payback period of five

years or less. Would the company purchase the new games?

Req 1B.

< Prev

S

2 3 of 6

$ 280,000

www

www

www

236,600

$ 43,400

Next >

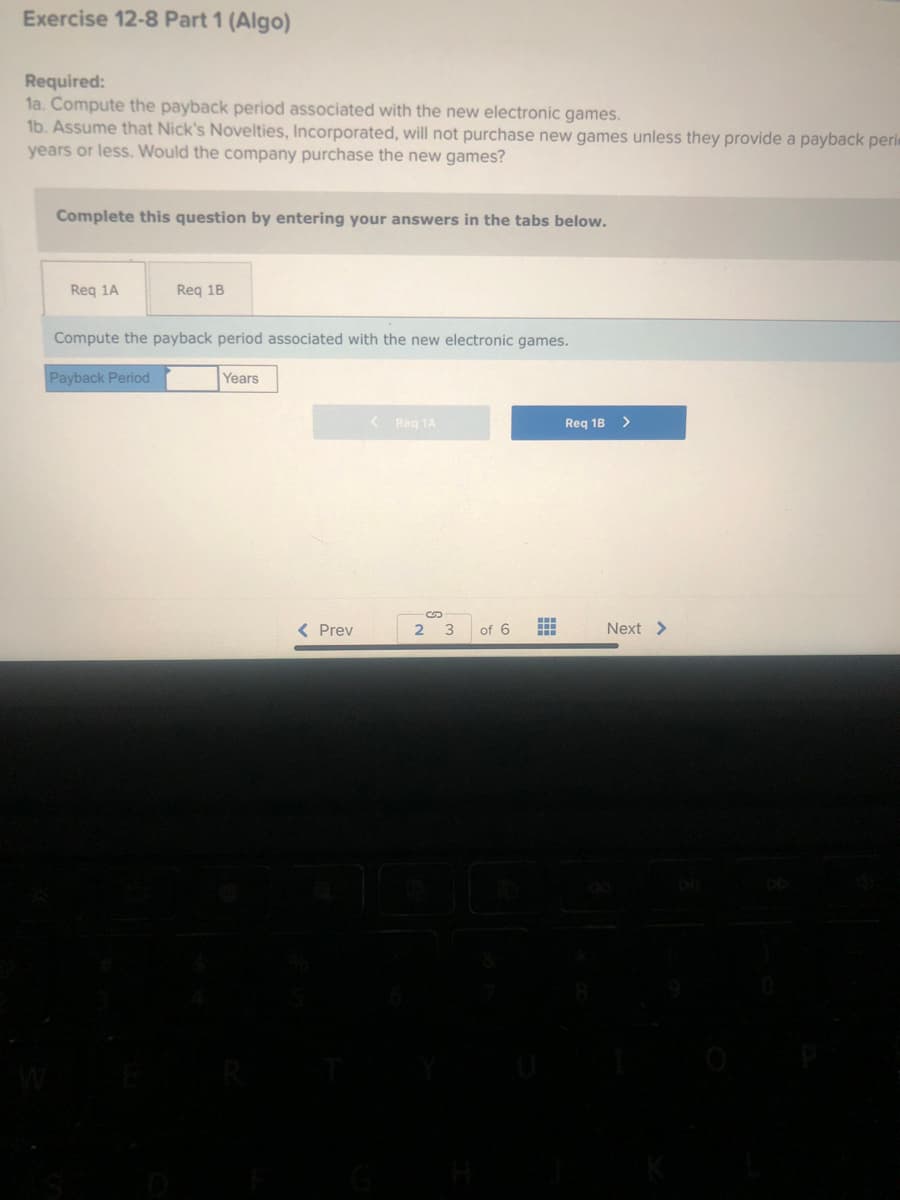

Transcribed Image Text:Exercise 12-8 Part 1 (Algo)

Required:

1a. Compute the payback period associated with the new electronic games.

1b. Assume that Nick's Novelties, Incorporated, will not purchase new games unless they provide a payback peri

years or less. Would the company purchase the new games?

Complete this question by entering your answers in the tabs below.

Req 1A

Req 1B

Compute the payback period associated with the new electronic games.

Payback Period

Years

< Prev

< Req 1A

2

S

3

of 6

H

Req 1B >

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning