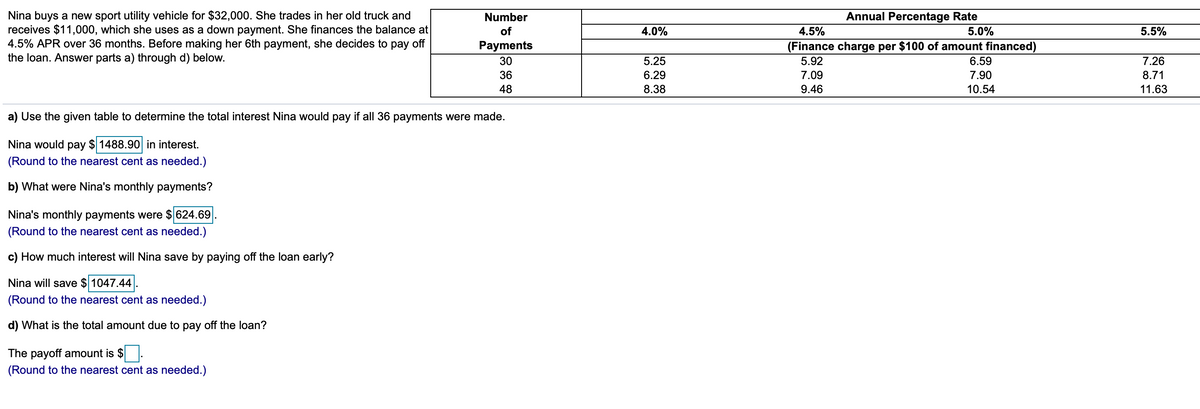

Nina buys a new sport utility vehicle for $32,000. She trades in her old truck and receives $11,000, which she uses as a down payment. She finances the balance at 4.5% APR over 36 months. Before making her 6th payment, she decides to pay off the loan. Answer parts a) through d) below. Annual Percentage Rate 5.0% Number of 4.0% 4.5% 5.5% Payments (Finance charge per $100 of amount financed) 30 5.25 5.92 6.59 7.26 36 6.29 7.09 7.90 8.71 48 8.38 9.46 10.54 11.63 a) Use the given table to determine the total interest Nina would pay if all 36 payments were made. Nina would pay $ 1488.90 in interest. (Round to the nearest cent as needed.) b) What were Nina's monthly payments? Nina's monthly payments were $ 624.69. (Round to the nearest cent as needed.) c) How much interest will Nina save by paying off the loan early? Nina will save $ 1047.44. (Round to the nearest cent as needed.) d) What is the total amount due to pay off the loan? The payoff amount is $. (Round to the nearest cent as needed.)

Nina buys a new sport utility vehicle for $32,000. She trades in her old truck and receives $11,000, which she uses as a down payment. She finances the balance at 4.5% APR over 36 months. Before making her 6th payment, she decides to pay off the loan. Answer parts a) through d) below. Annual Percentage Rate 5.0% Number of 4.0% 4.5% 5.5% Payments (Finance charge per $100 of amount financed) 30 5.25 5.92 6.59 7.26 36 6.29 7.09 7.90 8.71 48 8.38 9.46 10.54 11.63 a) Use the given table to determine the total interest Nina would pay if all 36 payments were made. Nina would pay $ 1488.90 in interest. (Round to the nearest cent as needed.) b) What were Nina's monthly payments? Nina's monthly payments were $ 624.69. (Round to the nearest cent as needed.) c) How much interest will Nina save by paying off the loan early? Nina will save $ 1047.44. (Round to the nearest cent as needed.) d) What is the total amount due to pay off the loan? The payoff amount is $. (Round to the nearest cent as needed.)

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.19E

Related questions

Question

Transcribed Image Text:Nina buys a new sport utility vehicle for $32,000. She trades in her old truck and

receives $11,000, which she uses as a down payment. She finances the balance at

4.5% APR over 36 months. Before making her 6th payment, she decides to pay off

the loan. Answer parts a) through d) below.

Number

Annual Percentage Rate

of

4.0%

4.5%

5.0%

5.5%

Payments

(Finance charge per $100 of amount financed)

30

5.25

5.92

6.59

7.26

36

6.29

7.09

7.90

8.71

48

8.38

9.46

10.54

11.63

a) Use the given table to determine the total interest Nina would pay if all 36 payments were made.

Nina would pay $ 1488.90 in interest.

(Round to the nearest cent as needed.)

b) What were Nina's monthly payments?

Nina's monthly payments were $ 624.69

(Round to the nearest cent as needed.)

c) How much interest will Nina save by paying off the loan early?

Nina will save $ 1047.44

(Round to the nearest cent as needed.)

d) What is the total amount due to pay off the loan?

The payoff amount is $

(Round to the nearest cent as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning