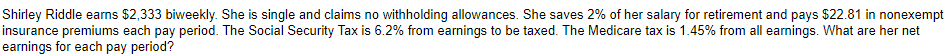

nirley Riddle earns $2,333 biweekly. She is single and claims no withholding allowances. She saves 2% of her salary for retirement and pays $22.81 in nonexemp surance premiums each pay period. The Social Security Tax is 6.2% from earnings to be taxed. The Medicare tax is 1.45% from all earnings. What are her net rnings for each pay period?

nirley Riddle earns $2,333 biweekly. She is single and claims no withholding allowances. She saves 2% of her salary for retirement and pays $22.81 in nonexemp surance premiums each pay period. The Social Security Tax is 6.2% from earnings to be taxed. The Medicare tax is 1.45% from all earnings. What are her net rnings for each pay period?

Chapter8: Taxation Of Individuals

Section: Chapter Questions

Problem 70TA

Related questions

Question

Transcribed Image Text:Shirley Riddle earns $2,333 biweekly. She is single and claims no withholding allowances. She saves 2% of her salary for retirement and pays $22.81 in nonexempt

insurance premiums each pay period. The Social Security Tax is 6.2% from earnings to be taxed. The Medicare tax is 1.45% from all earnings. What are her net

earnings for each pay period?

Expert Solution

Step 1

Net salary is the total salary one gets after all the mandatory deductions such as taxed that are made from the total gross salary. This is the total amount that gets credited to the bank account of the employee after all the deductions are done.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub