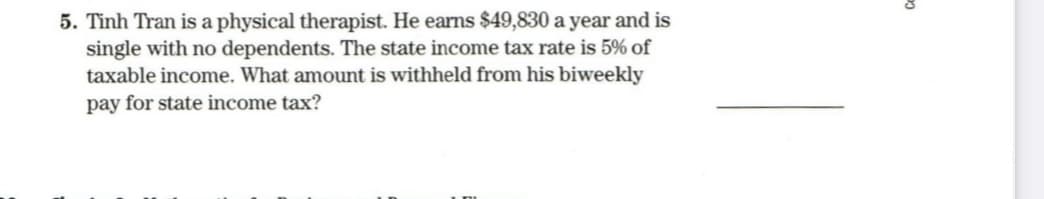

Tinh Tran is a physical therapist. He earns $49,830 a year and is single with no dependents. The state income tax rate is 5% of taxable income. What amount is withheld from his biweekly pay for state income tax?

Q: Mr. Jacob Marley is single with no children and takes the standard deduction and one exemption. If…

A: Annual Income - $81400 Single Standard Tax Deduction - $6300 Personal Exemption Amount - $4050

Q: Ridge is a generous individual. During the year, she made interest-free loans to various family…

A: Imputed interest is the interest that is estimated to be collected by the lender, regardless of what…

Q: Jessica makes $24,000 a year, but receives weekly paychecks. If 12% of her checks is withheld for…

A: Gross pay = Total annual pay /no of pay periods Total deduction /withholding =Federal tax +FICA…

Q: Miguel, a single teacher, earns $1,500 every two weeks (biweekly). He claims two allowances. What is…

A: Federal Income tax Withhold For calculating the Federal Income tax with by using Wage bracket method…

Q: If Jonathon worked for his mother's sole proprietorship, what salary would she have to pay him to…

A: Tax is the compulsory payment made by the taxpayer to his country's government.

Q: This year Lloyd, a single taxpayer, estimates that his tax liability will be $10,000. Last year, his…

A: Tax: It is the compulsory payment that arises on the corporation, individual, and the organisation…

Q: Last year Juni earned $49,800 from her job, and $42 in interest income. Her employer withheld $4800…

A: Tax-deferred retirement account: It is an employer-sponsored retirement savings plan , and employer…

Q: eorgina has four employees who earned $75,000, $27,000, $2,100, and $6,200 during 2020,…

A: Explanation: FUTA Tax rate = 6% less-Credit of SUTA Tax Rate FUTA Tax rate = 6%-5.4% FUTA Tax rate =…

Q: Ms. Nelson is a single mom with three children who live at home. She earned less than $40,000 in…

A: Ms. Nelson earned in 2018 ⩽$40,000. Ms. Nelson is a single mom with three children.

Q: Skylar is single and earns $410,000 in salary during 2018. What is the amount of 0.9 percent…

A: Employers are required to withhold additional Medicare tax, above the 1.45% Medicare tax rate, at a…

Q: Clarita is a single taxpayer with two dependent children, ages 10 and 12. Clarita pays $3,000 in…

A: Given, Clarita is a single taxpayer Dependent children = 2 (below age 13) Qualified child care…

Q: 8. Antwan Campbell earns $494 per week. He is married and claims 1 child as a dependent. The state…

A: Antwan Campbell Earnings : $494 per week Status : Married State tax rate : 2.25%

Q: Karen Most has a federal tax levy of $2,100.50 against her. If Most is single with two personal…

A: Tax: It is levied on individual and the Corporation by the Federal Government of the country.

Q: Paquito, a university instructor, earns a gross monthly salary of ₱46,200.00. Paquito is married and…

A: Net income is the final income received the employee from the employer after deducting all…

Q: Selerino and Maria are married and file their taxes jointly. Selerino earned $82,000 in wages last…

A: Tax Calculation According IRS (Internal Revenue Services) calculation and filling of taxes are…

Q: Johann and Marta are a married couple, both age 33. Johann works as a contract employee for the…

A: Disability Insurance -: Disability insurance is a category of insurance that is planned to provide…

Q: Maile is a full-time exempt employee in Boca Raton, Florida, who earns $1,559.15 per biweekly…

A: GIVEN DATA Maile is a full-time exempt employee in Boca Raton, Florida, who earns $1,559.15 per…

Q: Hugh, a self-employed individual, paid the following amounts during the year: Real estate tax on…

A: Real estate tax on lowa residence $ 3,800 Greater of sale tax or state income tax $ 1,750…

Q: Denise, a single, cash-method taxpayer, paid the following taxes in the current year: Denise's…

A: Answer:

Q: Francisco's gross income this year is $29,550. His employer withholds $55 per month to pay for his…

A: The taxable income is used to calculate the total gross income which is deduct with the employer pay…

Q: Jim and Mary Jean are married and have two dependent children under the age of 13. Both parents are…

A: The portion of your total income used to calculate how much tax you owe in a given tax year is known…

Q: Paquito, a university instructor, earns a gross monthly salary of ₱46,200.00. Paquito is married and…

A: Tax is financial charge or levy imposed by the government or taxation authorities of the country to…

Q: Robert and John are married and have 4 dependent children and earn a gross biweekly salary of…

A: The tax owed to the government by the employer or entity that made payment to the recipient is…

Q: 00 in salary and $6,400 in interest income during the year. Jeremy’s employer withheld $11,000 of…

A: In the given question, Jeremy, who is categorized under the head of household and has one qualifying…

Q: During the year, Brenda (70), a single taxpayer, received $18,000 in social security benefits. Her…

A: Introduction:- Calculation of how much of Brenda's social security benefits are taxable as follows:-…

Q: My daughter earns a salary of $40,800 per year, payable monthly. She is married and claims four…

A: Calculate total withholding allowance.

Q: Dennis is a self-employed hair stylist who operates a salon in his home. The property taxes and…

A: Concept used: Denis has Allowable deduction on the following: Taxes and interest Maintenance &…

Q: Karen most had a federal tax levy of 2100.50 against her. If Most is single with two personal…

A: Take home Pay = $ 499 per week Personal Exemption = $ 4,050

Q: Robert and John are married and have 5 dependent children and earn a gross biweekly salary of…

A: Sr No Particulars Amount in $ 1 Gross Salary ($ 5,782 * 26 Weeks) 150,332 2…

Q: Karen Most has a federal tax levy of $2,100.50 against her. If Most is single with two personal…

A: Federal tax levy: The amount of taxes levied on an employee's take-home pay, based on the levy rate…

Q: Frankie lives in NJ, is divorced with one child, and made $80,000 last year. He qualified for…

A: Taxable income is the part of gross income which is taxable by the government, calculated by adding…

Q: Kyle Struck's filing status is single, and he has earned gross pay of $2,360. Each period he makes a…

A: Given information: Gross pay = $2,360.

Q: This year Lloyd, a single taxpayer, estimates that his tax liability will be $12,400. Last year, his…

A: Solution:- Calculation of the amount of his underpayment penalty if federal short-term rate is 5…

Q: Carson Holiday has a federal tax levy of $4,119.90 against him. If Holiday is single with three…

A: Note: In the given question, it is assumed that the tax year is 2017 and taxes are to be filled in…

Q: Karen Thomas is single and has one dependent. She works as a clerk for the district judge and earns…

A: Short term capital gain/loss (S.T.C.G/L): When the capital assets are sold/disposed of after holding…

Q: Ed and Wendy are a married couple. They have a five-year-old son. They each earns $60,000 per year,…

A: A penalty usually occurs in low or high earning households. Couple who earns somewhere in between…

Q: Sally is self-employed as a consultant and she itemizes deductions every year. She has the following…

A: solution concept State and local income taxes are deductible as per the provisions of the income tax…

Q: How much of the above amounts is Frank entitled to deduct?

A: Tax: Tax is a percentage of income of individual or a company which is collected by the government…

Q: For the following taxpayers, indicate whether the taxpayer should file a tax return and why. a.…

A: based on the US tax rates and rules the individual and the body corporate need to file their tax…

Q: Nathan Upton earns $11.80/hour, and worked 42 hours during the most recent week. He does not make…

A: Social security tax refers to the benefit that is received each year by the person who is retired,…

Q: Kamryn Brown is single and earns $65,000 in taxable income and will use the following tax rate…

A: Income tax is charged by the government on the income of their citizen. It is calculated on the…

Q: Colby's gross income was $93,000 last year. If he had $1646.92 withheld for federal income tax from…

A: The gross income of a salaried person is the cost to the company. First, all the exemptions and…

Q: Andrew, who is single, retired from his job this year. He received a salary of $24,000 for the…

A: Gross income: It is the total of income of the individual from all the sources of income earning.

Q: Karen’s Moore is married, claims five withholding allowances, and earns $3,500 per month. In…

A: State tax = gross pay * tax rate = 3500 * 2.1% = $73.5 State disability insurance = gross pay * 1/2…

Q: Melba, age 58, takes a $12,000 distrubtion from her traditional IRA. She uses the distribution to…

A: Given, Melba, age 58, takes a $12,000 distribution from her traditional IRA, She uses the…

Q: Maggie is filing taxes as a single filer with no kids. Her gross yearly income is $136,680, and her…

A: Charitable Contribution: In general, most of the taxpayers do cash contributions as charities and…

Q: Hongtao is single and has a gross income of $92,700. His allowable deductions for adjusted gross…

A: Solution Taxable income refers to any individual's or business compensation that is used to…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Unmarried head of household with two dependent childrenGross Income: $70,000Adjustments: $2,000Deductions:$10,000 mortgage interest$2500 property taxes$1200 charitable contributionsTax Credit: NoneI. Find the Adjusted Gross Income.II. Find the Taxable Income.III. Find the tax owed.From the information given below, determine Steve's gross income for tax purposes. Salary $32,000 Interest (checking account) $25 Cash received as a birthday gift $1,000 Dividends (mutual funds) $5,500 Child support payments received from ex-wife $24,000 Life insurance benefits received from aunt's death $50,000Gabriela has the following income for the quarter: a. Professional income,P80,000 b. Income from her business, P30,000 c. Compensation income,P40,000 d. Interest income from bank deposit, P10,000. What amount ofincome will Gabriela report in her quarterly income tax return? P80,000P110,000P120,000P150,000

- Anna has the following income for the quarter: a. Professional income P80,000 b. Income from her business P30,000 c. Compensation income P40,000 d. Interest income from bank deposit P10,000. 1. What amount of income will Anna report in her quarterly income tax return? a. P80,000 b. P110,000 c. P120,000 d. P150,000 2. If Anna, opted to use 8% rate, how much is her income tax due in her quarterly ITR? a. P6,400 b. P8,800 c. P9,600 d. P12,0001. Label each item as Gross Income, (GI), Not Included, (NI) or Deductions for Adjusted Gross Income, (DAGI), and calculate adjusted gross income for Noelle Nelson. A gift from her mother Nia, $30,000 Noelle has a sole proprietorship, candy shop. The net income is $120,000 Salary $100,000. Bonus $40,000 Capital loss $20,000 Contribution to individual retirement account, $1,000 Child support received, $30,000 Alimony received $50,000. The divorce was signed on January 15, 2018. Noele won $20,000 in a national bowling tournament. Noelle received $20,000 from a legal settlement for a dog bite on her leg. Student loan interest paid $1,000. Noelle’s sister, Natasha, gave her $40,000, in repayment of a $35,000 loan from 2017. Workman’s compensation $30,000 Unemployment compensation $40,000 Interest from a City of Nashville Bond, $7,000 Treasury bill interest $10,000 Interest from CitiGroup Account $5,000 Penalty for early withdrawal from timed savings…Case study for Harry and Belinda Johnson. Given: Harry Johnson - Annual Income $73,000.00 contributed to a traditional IRA $3,000.00 Belinda Johnson - Annual Income $94,000.00 contribued to 401(k) $3,000.00 Earned Interst - checking & savings $400.00 Earned Interst -Trust (taxed same as check & sav) $3,000.00 1. What is the Johnson's reportable gross income on their joint tax return? 2. What is their adjusted gross income?

- For tax year 2023Cindy has work-related dependent care expenses of $3,200 for the care of one qualifying person, and work-related dependent care expenses of $3,800 for another qualifying person. What amount of these work-related expenses may Cindy use when figuring the Child and Dependent Care Credit? A) $2,800 B) $3.000 C) $7,000 D) $6,000From the following information, determine Marcie’s gross income for tax purposes. Salary $40,000 Interest (checking account) 50 Cash received as birthday gift 900 Dividends (mutual funds) 500 Inheritance received upon father’s death 22,000 Cash received from insurance for accident claim settlement 3,200 Cash dividend from stock 750An individual has taxable general income of £70,000 (before deducting the personal allowance). He also has savings income of £1,000. How much Income Tax will be payable on the savings income? £0 £200 £400 £300

- Mr Juan Jose, married, resident citizen with two qualified dependentchildren, has the following data for the year 2018: Salaries, net of P50,000withholding tax and other nontaxable amount P200,000; Tuition of childrenP10,000; Rent of apartment P24,000; Household expenses P60,000; Health andhospitalization insurance premium paid P3,400. How much is the taxablecompensation income? a. 47,600b. 147,600c. 200,000d. 250,000A married couple received $9,200 of social security benefits. a. Calculate the taxable amount of those benefits if the couple's provisional income is $20,500. b. Calculate the taxable amount of those benefits if the couple's provisional income is $38,000. c. Calculate the taxable amount of those benefits if the couple's provisional income is $56,000.Repaso is engaged in renting out 250 apartment units to small families forP13,000 per month. All units are occupied. Philippine, 2021.Determine the business tax and the business tax due. VAT; P390,000Percentage Tax ; P32,500VAT Exempt; P 0Percentage tax; P 0