nis occurs, the commercial banks respond to in the demand for loans by.. An increase; buying government securities from the Bank of Canada, against which they can extend new loans. A decrease; selling government securities to the Bank of Canada and calling in existing loans. A decrease; buying government securities from the Bank of Canada in exchange for cash, and calling in existing loans. An increase; borrowing cash from the Bank of Canada with which they can extend new loans. An increase; selling government securities to the Bank of Canada in exchange for cash, with which they can extend new loar

nis occurs, the commercial banks respond to in the demand for loans by.. An increase; buying government securities from the Bank of Canada, against which they can extend new loans. A decrease; selling government securities to the Bank of Canada and calling in existing loans. A decrease; buying government securities from the Bank of Canada in exchange for cash, and calling in existing loans. An increase; borrowing cash from the Bank of Canada with which they can extend new loans. An increase; selling government securities to the Bank of Canada in exchange for cash, with which they can extend new loar

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter16: The Influence Of Monetary And Fiscal Policy On Aggregate Demand

Section: Chapter Questions

Problem 6CQQ

Related questions

Question

100%

choose correct option plz. Asap

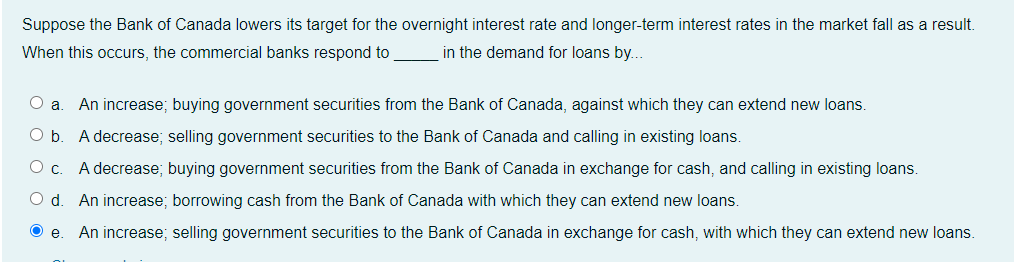

Transcribed Image Text:Suppose the Bank of Canada lowers its target for the overnight interest rate and longer-term interest rates in the market fall as a result.

When this occurs, the commercial banks respond to

in the demand for loans by...

O a

An increase; buying government securities from the Bank of Canada, against which they can extend new loans.

Ob.

A decrease; selling government securities to the Bank of Canada and calling in existing loans.

Oc.

A decrease; buying government securities from the Bank of Canada in exchange for cash, and calling in existing loans.

An increase; borrowing cash from the Bank of Canada with which they can extend new loans.

O e

An increase; selling government securities to the Bank of Canada in exchange for cash, with which they can extend new loans.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning