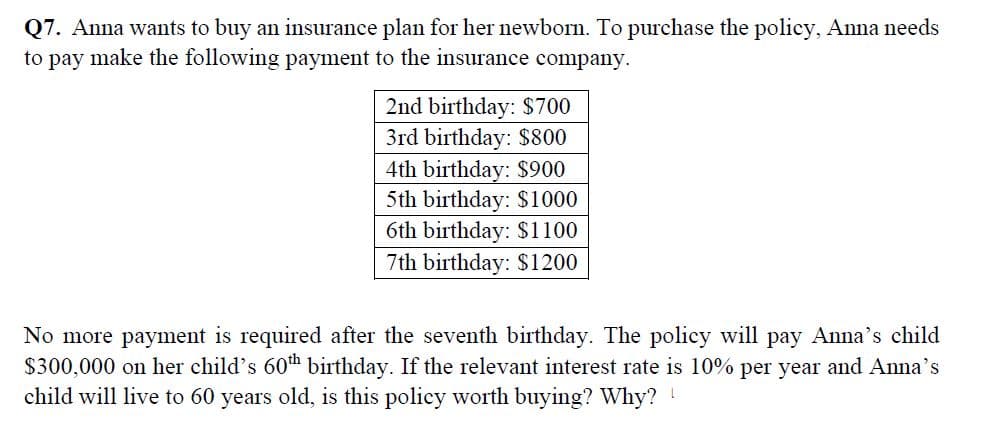

No more payment is required after the seventh birthday. The policy will pay Anna's child $300,000 on her child's 60th birthday. If the relevant interest rate is 10% per year and Anna's child will live to 60 years old, is this policy worth buying? Why?

Q: You are eligible for a 30 year fixed rate home mortgage with an interest rate of 3.6% per year. If…

A: Here, Time Period of Loan (n) is 30 years Interest Rate of Loan (r) is 3.6% Monthly Payment (PMT) is…

Q: Give typing answer with explanation and conclusion What is the Effective Annual Return on a $10…

A: Step 1 Effective Annual Return The rate of interest actually received on an investment or paid on a…

Q: Noel has $490,000 with which to purchase an ordinary annuity delivering monthly payments for 20…

A: To calculate the monthly payment Noel will receive, we can use the formula for the present value of…

Q: What are the general purposes of using mutual funds in individual investment portfolios

A: Mutual Funds offer a number of benefits or advantages to investor and the main basic idea behind…

Q: Which of the following describes a single premium variable annuity? A]Karen retires from her job…

A: Step 1 SPVAs are designed to provide flexibility and control over investments, as well as…

Q: Compute the payback statistic for Project X and recommend whether the firm should accept or reject…

A: Payback period - It represents the time period required for recovery of the initial investment in…

Q: A loan is amortized over 9 years, with monthly payments at a nominal rate of 9% compounded monthly.…

A: Given the following: First payment, P = $1,000 Nominal rate= 9% Term = 9 years Growth rate, g =…

Q: Aylmer-in-You (AIY) Inc. projects unit sales for a new opera tenor emulation implant as follows:…

A: Net Present Value:The difference between the present value of cash inflows and withdrawals over a…

Q: Abraham finds the juicer he wants to buy at two different stores. The discount store regularly…

A: The discount refers to the deduction made in the price of a commodity. It is used by sellers to…

Q: Consider the following maturity / yield to maturity for all treasuries. Interest compounds…

A: a) A zero-coupon security is a type of bond that does not pay interest but instead is issued at a…

Q: You'd like to know how much you can borrow from the bank using a 25 year principal and interest…

A: Loan Installment is that amount which is paid by the borrower to his lendor . It's Include the…

Q: A proposed cost-saving device has an installed cost of $700,000. It is in Class 8 (CCA rate = 20%)…

A: Capital Cost Allowance: The capital cost allowance (CCA) is a deduction from an individual's or…

Q: A real estate broker decides to lease a car for 36 months. Suppose the annual interest rate is 7.8%,…

A: Monthly lease payment refers to the payment made on monthly basis for the repayment of the lease…

Q: Hans Brinker is assistant vice-president for marketing for Skagen Ice Skate Company (SIS). SIS does…

A: Covered Interest Rate Parity (CIRP) is an economic theory that explains the relationship between the…

Q: On April 1, 2016, Lerner Corporation issued $120,000 of five-year, 10% bonds at a market (effective)…

A:

Q: Problem #7: A financier has made a loan of $5 million. The contract for the loan calls for payment…

A: Step 1 Present Value The idea of present value holds that money today is worth more than it will be…

Q: A company has completed the operating budget and the cash budget. It is now preparing the budgeted…

A: A budget is a financial plan that outlines an organization's or individual's expected income and…

Q: Rosa has a flow-through of net income from a general partnership of $160,000 for 2020. What is the…

A: The self-employment tax is the tax you need to pay on your net income if you are a self-employed…

Q: Use the ordinary annuity formula shown to the right to determine the accumulated amount in the…

A: An annuity is a payment series where the holder gets a fixed amount in return for a lump sum…

Q: Problem 9: A young engineer bought second hand car worth 15B, CDE.00 if paid in cash. On the…

A: First, let us put numbers to the alphabets A=1 B=5 C=7 D=6 E=8 Car worth = 15B,CDE =…

Q: A $100,000 mortgage loan at 6.3% compounded semi-annually has a 25-year amortization period.…

A: A mortgage is a covered loan borrowed to purchase a property. The property itself acts as collateral…

Q: Royal Jewelers Inc. has an aftertax cost of de debt is? (Do not round intermediate calcula Yield %

A: Before tax cost of debt = 11% Tax rate = 20% Preferred stock price (P) = $60 Dividend (D) = $6.40…

Q: A certificate of deposit usually has: Multiple Choice O O a penalty for early withdrawal of funds.…

A: A Certificate of deposit (CD) is a type of savings account that typically has a set time period,…

Q: omment the capital structure of Toyota by examining debt-to-equity ratio and the critically…

A: In finance debt-equity ratio is an important leverage ratio. This ratio indicates how much debt and…

Q: Consider the two (excess return) index-model regression results for stocks A and B. The risk-free…

A: Data given: Rf= 8% Rm= 14% Sharpe ratio : It is defined as the portfolio risk premium divided by the…

Q: Discuss the findings and conclusions of Miller (1977) when personal taxes are incorporated in the…

A: In 1977, economist Merton Miller extended the famous Modigliani and Miller (M&M) theorem by…

Q: What is the firm's current stock price if constant growth rate of 8% annually to infinity issued?

A: The price of a stock is the PV of future dividends discount at the required rate of return. We can…

Q: 1. What will happen to house prices if banks stop giving mortgages? (B) go down; (C) stay unchanged;…

A: Any sum borrowed to meet the personal or business funding requirements is regarded as a mortgage.…

Q: A $1,000 face value bond matures in 11 years, pays interest annually, and has a 6.25 percent coupon.…

A: Yield to maturity (YTM) is the total return anticipated on a bond if it is held until it matures. It…

Q: A currency dealer quotes the following rates on the Swiss franc-U.S. dollar exchange rate in the…

A: The bid price is the price that the individual is willing to pay for securities, goods, and…

Q: What does it take to become a personal financial advisor?

A: Personal financial advisor-They provide guidance to individuals on matters relating to personal…

Q: How do you complete a discounted cash flow analysis and what values are needed to complete one? I am…

A: Discounted cash flow (DCF) analysis is a valuation method used to estimate the value of an…

Q: 1. Which of the following is true of options? (a) The buyer decides if the options will be…

A: Answer 1: Option (a) is true of options: the buyer has the right to exercise the option, but is not…

Q: CMW Cola is a large mature firm with total assets of $50 billion, total equity value of $40 billion,…

A: The dividend discount model is a mathematical technique for forecasting the price of a business's…

Q: Answer the below questions. (a) For a single-name credit default swap, what is the difference…

A: A Credit Default Swap (CDS) is a financial contract between two parties where one party (the buyer…

Q: Consider a 3-month European call option on a non-dividend-paying stock. The current stock price is…

A: The call option is an instrument that allows its holder to buy the underlying asset at a fixed…

Q: Assume that you wish to save $25,000 in 5 years to remodel your kitchen. Assume that you can earn an…

A: We will use formula of present value of money to know how much amount should be invested now to have…

Q: Convertible debt and straight debt issued with warrants are similar securities, because both are…

A: With convertible debt, a company borrows money from a lender or investor with the understanding that…

Q: Bob is researching variables like age, religion, gender and work occupation in his area. Which force…

A: To put it another way, external environmental elements are those that are not under the control of…

Q: If 25 meters of fabric cost $15.60, what will 2.25 meters costs

A: Cost of 25 meter fabric = $15.60 Length of fabric = 2.25 meters

Q: A 15 year $1000 face value coupon bond pays a coupon rate of 3.8% and has a YTM of 4.4%. Coupon…

A:

Q: 15. If a project has an initial investment of $20,000, for 9 years a monthly interest rate equal to…

A: The magnitude and timing of cash flows of a project are known. The IRR has to be determined. IRR is…

Q: Discuss: Miller and Scholes (1972) model of corporate dividend policy that assumed market…

A: The Miller and Scholes model of corporate dividend policy, first proposed in 1972, is a theoretical…

Q: t say all answers above are incorrect, i need the yield on the debt percentage plz and thank u

A: The original solution that you have with you is incorrect. It's little unfortunate, but the fact is…

Q: Bally Manufacturing sent Intel Corporation an invoice for machinery with a $13,800 list price. Bally…

A: In a business-to-business arrangement often referred to as trade credit, a customer can buy products…

Q: se the data to compute the probability that an adult in the Tri-State region smokes. (b) What is…

A: To determine the probability of a smoker, we need to use the formula below: Probability of a smoker…

Q: Give typing answer with explanation and conclusion 1. ________ are items owed to a creditor.…

A: Accounting equation is one of the fundamental concept being used in accounting. Elements of…

Q: Intro BP has a bond outstanding with 15 years to maturity, a $1,000 par value, a coupon rate of…

A: Bonds are debt instruments issued by companies. Cost of debt, in case of bonds, is determined by…

Q: Landow Company uses variable costing for internal purposes and wants to restate income to that of…

A: Income under absorption costing is a method of calculating a company's income or profit that…

Q: Emmanuel Macron has the following budgeted business transactions for the month of May 2020:…

A: Budgeted cash position = Starting bank balance + Total cash inflows - Total cash outflows…

Please do the following question with full working

Step by step

Solved in 2 steps with 1 images

- Minnie owns a qualified annuity that cost 78,000. The annuity is to pay Minnie 650 per month for life after she reaches age 65. Minnie turns 65 on September 28, 2019, and receives her first payment on November 1, 2019. a. How much gross income does Minnie have from the annuity payments she receives in 2019? b. Shortly after receiving her payment on October 1, 2034, Minnie is killed in an automobile accident. How does the executor of Minnies estate account for the annuity on her return for the year 2034? c. Assume that the accident does not occur until November 1, 2043. How does the executor of Minnies estate account for the annuity on her 2043 return?Joan, a single mother, has AGI of $61,500 in 2019. In September 2019 , she pays $5,000 in qualified tuition for her dependent son who just started at Big University. What is Joan's American Opportunity credit for 2019? $0 $1,250 $2,125 $2,500 Some other amountAlex wants to provide funding in the event of his death for his daughter Ellie, age 8, to attend four years of college, starting at age 18. The current annual cost of tuition is $20,000. Assume inflation of 6.5% and after-tax earnings of 7%. If Alex wants to have enough life insurance to assure adequate funds for Ellie when she begins college (should he die today), approximately how much insurance should he have for this need alone? (Round your answer to the nearest dollar.) A)$113,764 B)$75,806 C)$75,451 D)$79,441

- After the birth of your first child, you decide to buy a life insurance policy for yourself but can't decide how much to buy. In the event of your untimely death, you estimate that the life insurance money can be invested in an account earning 8% interest compounded monthly. You would like your child to get a monthly payment of $1,500.00 for 18 years.How much should your life insurance policy be worth in order to achieve your goal? I should get a life insurance policy that is worth $_______\\nAssume you have established a trust account for your child, which she will have access to once she reaches the age of 25. This daughter just turned 24 today, so the first payment will occur at the end of this year, upon her 25th birthday. Under the terms of the trust agreement, she will receive $10,000 upon her 25th birthday, $20,000 upon her 26th birthday, $30,000 on her 27th birthday, and $50,000 on her 28th birthday. If she puts all of these payments into savings, and she can earn a rate of 5%, how much will she have in total on her 28th birthday? Calculate the FV of these cash flows at the end of year 4 (her 28th birthday).\\nA parent on the day that child is born wishes to determine what lump sum would have to be paid into an account bearing interest of 5% compounded annually, in order to withdraw P20,000 each on the child’s 18th, 19th, 20th, and 21st birthdays? How many periods with no payment made does the problem have? A. 5 B. 4 C. 18 D. 17

- Susan and Derick finalized an adoption in 2020. Their adoption fees totaled $10,000. They have AGI of $238,520 for 2020. What is their adoption credit? a. $4,000 b. $10,000 c. $7,263 d. $14,300Carl and Jenny adopt a Korean orphan. The adoption takes 2 years and two trips to Korea and is finalized in 2020. They pay $7,000 in 2019 and $7,500 in 2020 for qualified adoption expenses. In 2020, Carl and Jenny have AGI of $150,000. How much credit could they claim if their AGI was $219,520?Carl and Jenny adopt a Korean orphan. The adoption takes 2 years and two trips to Korea and is finalized in 2020. They pay $7,000 in 2019 and $7,500 in 2020 for qualified adoption expenses. In 2020, Carl and Jenny have AGI of $150,000. If an amount is zero, enter "0". If required, carry any division out to four decimal places and round final answers to the nearest dollar. a. What is the adoption credit Carl and Jenny can claim in 2020?$ b. How much credit could they claim if the adoption falls through and is never finalized?$ c. How much credit could they claim if their AGI was $219,520? $

- Krista and Landor are new parents. They have a two-month-old baby girl and they are considering expanding their family in the future. They have purchased life insurance with a child coverage rider in the amount of $5,000. Unfortunately, their baby girl becomes gravely ill and passes away. How will the insurer deal with their death claim relating to the child coverage rider? Select one: a. b. The insurer will pay the claim for the full amount. The insurer will pay a claim for only half of the full amount to keep the child coverage rider in force for the next child. c. The insurer will deny the claim as Krista and Landon did not purchase accidental death insurance for theirJohn and Joan pay $16,500 of qualified adoption expenses in 2018 to finalize the adoption of a qualified child. Their AGI is $197,000 for 2018. What is their adop tion credit for 2018? a. $0 b. $16,500 c. $13,460 d. $13,810Marie wants to provide retirement income for her dependent parents for 35 years should she die. Marie earns $67,500 and feels that her parents could live on 65% of that amount. If the insurance funds could be invested at 5%, how much life insurance does she purchase using the desired income method? Group of answer choices $1,273,499 $1,450,087 $932,743 $877,500