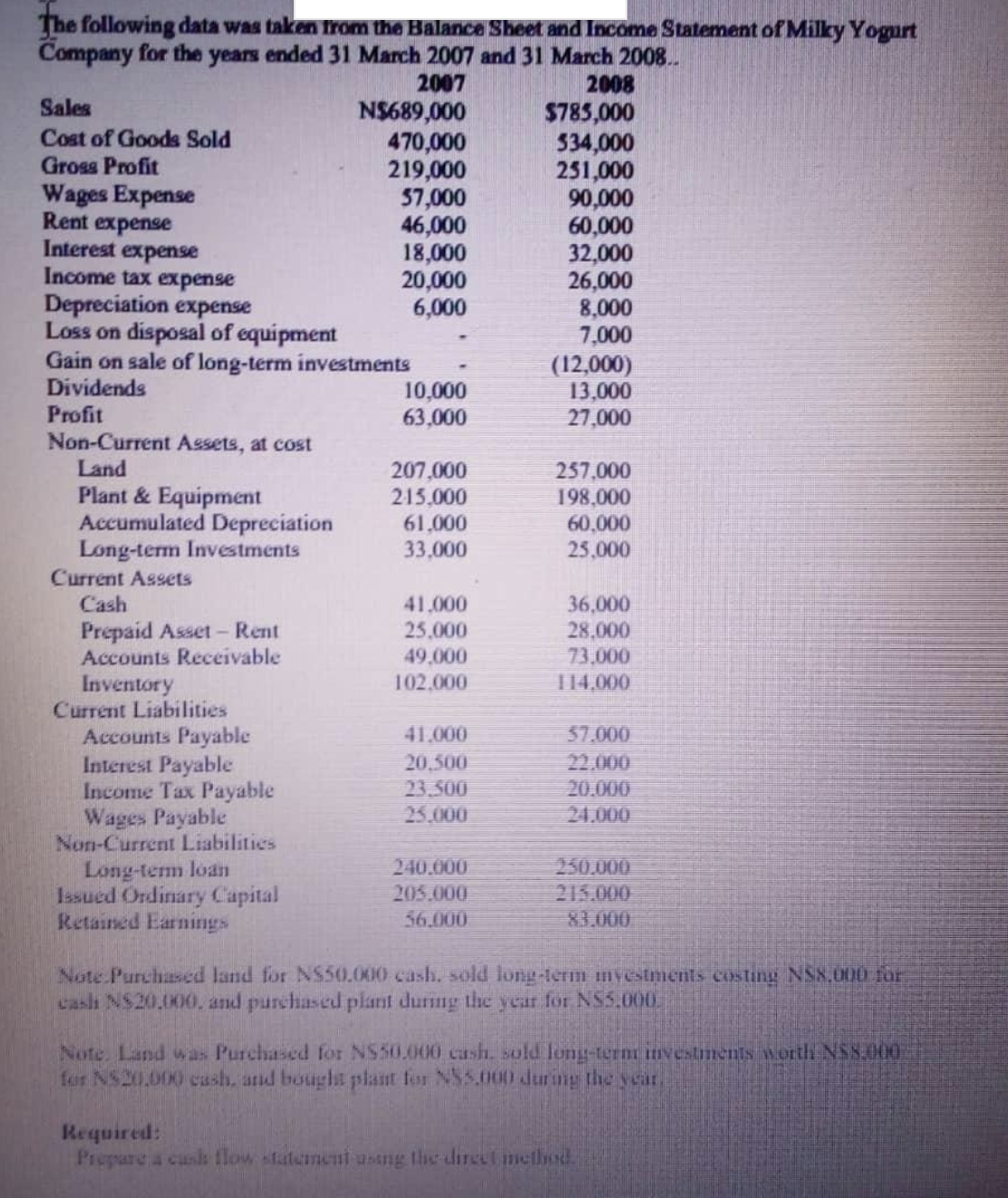

Non-Current Liabilities Long-term loan Issued Ordinary Capital Retained Earnings 250.000 215.000 83.000 240.000 205.000 56.000 Note Purchased land for NS50.000 cash. sold long-term mvestments costing NS8.000 for casli NS20,000., and purchased plant durng the year for NS5.000. Note. Land was Purchased for NS50.000 cash. sold long-tern mvestments worth NSS:000 for NS20.000 cash, and bought plant for NS5.000 during the year. Required: Prepare a cuss flow staterneul usng the direul method.

Non-Current Liabilities Long-term loan Issued Ordinary Capital Retained Earnings 250.000 215.000 83.000 240.000 205.000 56.000 Note Purchased land for NS50.000 cash. sold long-term mvestments costing NS8.000 for casli NS20,000., and purchased plant durng the year for NS5.000. Note. Land was Purchased for NS50.000 cash. sold long-tern mvestments worth NSS:000 for NS20.000 cash, and bought plant for NS5.000 during the year. Required: Prepare a cuss flow staterneul usng the direul method.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter3: The Adjusting Process

Section: Chapter Questions

Problem 29E

Related questions

Question

Prepare cash flow statement using direct method.

Please provide typed answer or excel

Transcribed Image Text:The following data was taken trom the Balance Sheet and Income Statement of Milky Yogurt

Company for the years ended 31 March 2007 and 31 March 2008.

2008

$785,000

534,000

251,000

90,000

60,000

32,000

26,000

8,000

7,000

2007

NS689,000

470,000

219,000

57,000

46,000

18,000

20,000

6,000

Sales

Cost of Goods Sold

Gross Profit

Wages Expense

Rent expense

Interest expense

Income tax expense

Depreciation expense

Loss on disposal of equipment

Gain on sale of long-term investments

Dividends

Profit

Non-Current Assets, at cost

10,000

63,000

(12,000)

13,000

27,000

Land

Plant & Equipment

Accumulated Depreciation

Long-term Investments

Current Assets

Cash

207,000

215,000

61.000

33,000

257,000

198,000

60,000

25,000

36,000

28.000

73,000

114,000

41.000

Prepaid Asset- Rent

Accounts Receivable

25,000

49.000

102.000

Inventory

Current Liabilities

Accounts Payable

Interest Payable

Income Tax Payable

Wages Payable

Non-Current Liabilities

Long-tem loan

Issued Ordinary Capital

Retained Earnings

41.000

57.000

20,500

23.500

25.000

22.000

20.000

24,000

250.000

215.000

81.000

240.000

205.000

56.000

Note Purchased land for NS50.000 cash. sold long-term nyestments costing NS8,000 for

tasli NS20,000. and purchased plant during the year for NS5.000.

Note. Land was Purchased for NS50.000 cash. sold long-term mvestments worth NS8000

for NS20.000 cash, and bougla plant for NSS.000 durng the year.

Required:

Prepare a cuso tlow staterneHi usng the direal method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning