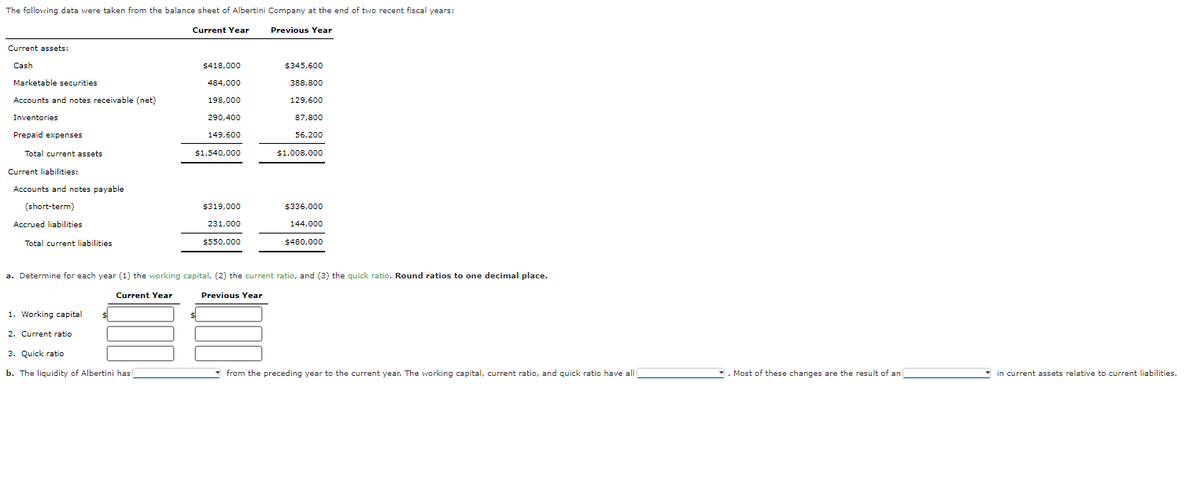

Current Year Previous Year Current assets: Cash $418.000 $345.600 Marketable securities 484.000 388.800 Accounts and notes receivable (net) 198,000 129,600 Inventories 290,400 87.800 Prepaid expenses 149.600 56.200 Total current assets $1.540.000 $1.008.000 Current liabilities: Accounts and notes payable (short-term) $319.000 $336.000 Accrued liabilities 231.000 144,000 Total current liabilities $550.000 $480.000 . Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year -- Working capital E. Current ratio . Quick ratio - The liquidity of Albertini has - from the preceding year to the current year. The working capital, current ratio, and quick ratio have all . Most of these changes are the result of an in current assets relative to current liabilities.

Current Year Previous Year Current assets: Cash $418.000 $345.600 Marketable securities 484.000 388.800 Accounts and notes receivable (net) 198,000 129,600 Inventories 290,400 87.800 Prepaid expenses 149.600 56.200 Total current assets $1.540.000 $1.008.000 Current liabilities: Accounts and notes payable (short-term) $319.000 $336.000 Accrued liabilities 231.000 144,000 Total current liabilities $550.000 $480.000 . Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year -- Working capital E. Current ratio . Quick ratio - The liquidity of Albertini has - from the preceding year to the current year. The working capital, current ratio, and quick ratio have all . Most of these changes are the result of an in current assets relative to current liabilities.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 6E: The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal...

Related questions

Question

Transcribed Image Text:The following data were taken from the balance sheet of Albertini Company at the end of two recent fiscal years:

Current Year

Previous Year

Current assets:

Cash

$418,000

$345,600

Marketable securities

484,000

388,800

Accounts and notes receivable (net)

198,000

129,600

Inventories

290,400

87,800

Prepaid expenses

149,600

56,200

Total current assets

$1,540,000

$1,008,000

Current liabilities:

Accounts and notes payable

(short-term)

$319,000

$336,000

Accrued liabilities

231,000

144,000

Total current liabilities

$550,000

$480,000

a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place.

Current Year

Previous Year

1. Working capital

2. Current ratio

3. Quick ratio

b. The liquidity of Albertini has

from the preceding year to the current year. The working capital, current ratio, and quick ratio have all

Most of these changes are the result of an

in current assets relative to current liabilities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning