None

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter16: Multijurisdictional Taxation

Section: Chapter Questions

Problem 3CE

Related questions

Question

None

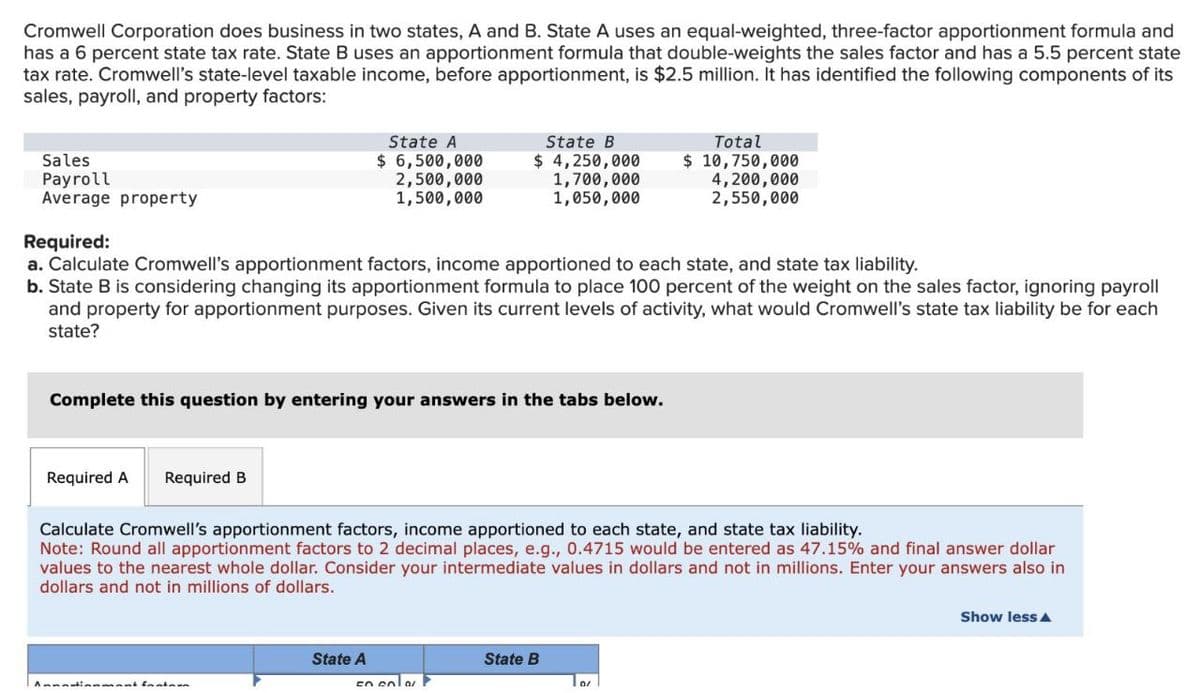

Transcribed Image Text:Cromwell Corporation does business in two states, A and B. State A uses an equal-weighted, three-factor apportionment formula and

has a 6 percent state tax rate. State B uses an apportionment formula that double-weights the sales factor and has a 5.5 percent state

tax rate. Cromwell's state-level taxable income, before apportionment, is $2.5 million. It has identified the following components of its

sales, payroll, and property factors:

Sales

Payroll

Average property

Required:

State A

$ 6,500,000

2,500,000

1,500,000

State B

$ 4,250,000

1,700,000

1,050,000

Total

$ 10,750,000

4,200,000

2,550,000

a. Calculate Cromwell's apportionment factors, income apportioned to each state, and state tax liability.

b. State B is considering changing its apportionment formula to place 100 percent of the weight on the sales factor, ignoring payroll

and property for apportionment purposes. Given its current levels of activity, what would Cromwell's state tax liability be for each

state?

Complete this question by entering your answers in the tabs below.

Required A Required B

Calculate Cromwell's apportionment factors, income apportioned to each state, and state tax liability.

Note: Round all apportionment factors to 2 decimal places, e.g., 0.4715 would be entered as 47.15% and final answer dollar

values to the nearest whole dollar. Consider your intermediate values in dollars and not in millions. Enter your answers also in

dollars and not in millions of dollars.

Annationment Instan

State A

State B

Show less▲

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you