mula to apportion

Chapter24: Multistate Corporate Taxation

Section: Chapter Questions

Problem 19CE

Related questions

Question

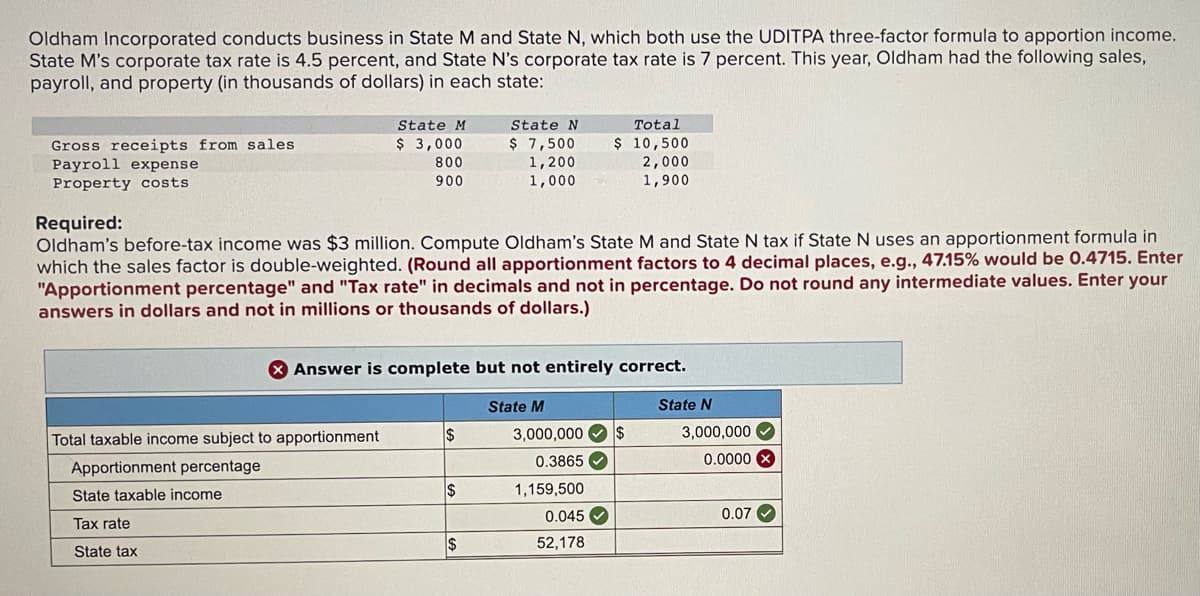

Oldham Incorporated conducts business in State M and State N, which both use the UDITPA three-factor formula to apportion income

State M's corporate tax rate is 4.5 percent, and State N's corporate tax rate is 7 percent. This year, Oldham had the following sales, payroll, and property (in thousands of dollars) in each state:

Gross receipts from sales

Payroll expense

Property costs

State M

3,000

800

900

State N

$ 7,500

1,200

1,000

Total

$ 10,500

2,000

1,900

Required:

Oldham's before-tax income was $3 million. Compute Oldham's State M and State N tax if State N uses an apportionment formula in which the sales factor is double-weighted.

(Round all apportionment factors to 4 decimal places, e.g., 47.15% would be 0.4715. Enter

"Apportionment percentage" and "Tax rate" in decimals and not in percentage. Do not round any intermediate values. Enter your

answers in dollars and not in millions or thousands of dollars.)

Transcribed Image Text:Oldham Incorporated conducts business in State M and State N, which both use the UDITPA three-factor formula to apportion income.

State M's corporate tax rate is 4.5 percent, and State N's corporate tax rate is 7 percent. This year, Oldham had the following sales,

payroll, and property (in thousands of dollars) in each state:

State M

State N

Total

$ 7,500

1,200

1,000

$ 10,500

2,000

1,900

$ 3,000

Gross receipts from sales

Payroll expense

Property costs

800

900

Required:

Oldham's before-tax income was $3 million. Compute Oldham's State M and State N tax if State N uses an apportionment formula in

which the sales factor is double-weighted. (Round all apportionment factors to 4 decimal places, e.g., 47.15% would be 0.4715. Enter

"Apportionment percentage" and "Tax rate" in decimals and not in percentage. Do not round any intermediate values. Enter your

answers in dollars and not in millions or thousands of dollars.)

X Answer is complete but not entirely correct.

State M

State N

Total taxable income subject to apportionment

2$

3,000,000 OS

3,000,000

0.3865 O

0.0000 X

Apportionment percentage

State taxable income

1,159,500

0.045 O

0.07 V

Tax rate

52,178

State tax

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

Recommended textbooks for you