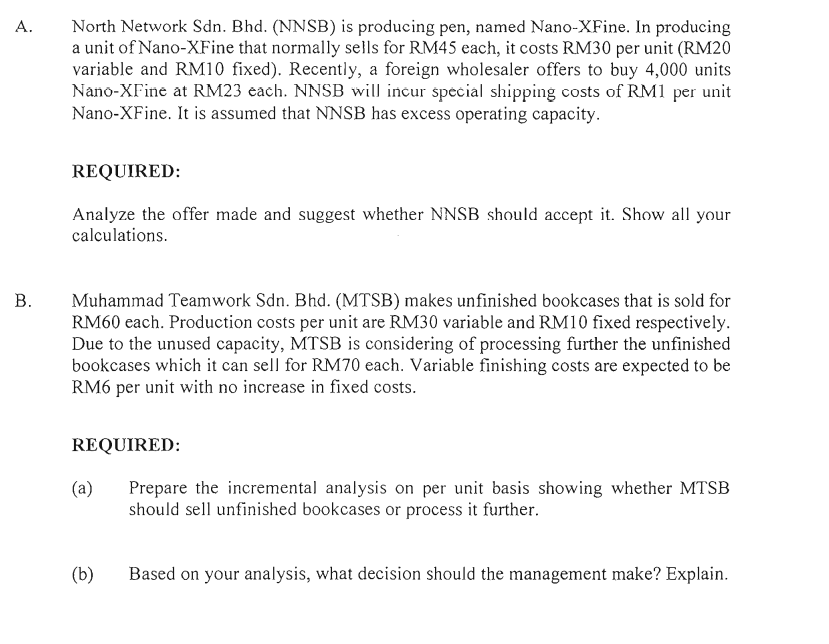

North Network Sdn. Bhd. (NNSB) is producing pen, named Nano-XFine. In producing a unit of Nano-XFine that normally sells for RM45 each, it costs RM30 per unit (RM20 variable and RM10 fixed). Recently, a foreign wholesaler offers to buy 4,000 units Nano-XFine at RM23 each. NNSB will incur special shipping costs of RM1 per unit Nano-XFine. It is assumed that NNSB has excess operating capacity. A. REQUIRED: Analyze the offer made and suggest whether NNSB should accept it. Show all your calculations.

North Network Sdn. Bhd. (NNSB) is producing pen, named Nano-XFine. In producing a unit of Nano-XFine that normally sells for RM45 each, it costs RM30 per unit (RM20 variable and RM10 fixed). Recently, a foreign wholesaler offers to buy 4,000 units Nano-XFine at RM23 each. NNSB will incur special shipping costs of RM1 per unit Nano-XFine. It is assumed that NNSB has excess operating capacity. A. REQUIRED: Analyze the offer made and suggest whether NNSB should accept it. Show all your calculations.

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 6MC: Jansen Crafters has the capacity to produce 50,000 oak shelves per year and is currently selling...

Related questions

Question

Transcribed Image Text:North Network Sdn. Bhd. (NNSB) is producing pen, named Nano-XFine. In producing

a unit of Nano-XFine that normally sells for RM45 each, it costs RM30 per unit (RM20

variable and RM10 fixed). Recently, a foreign wholesaler offers to buy 4,000 units

Nano-XFine at RM23 each. NNSB will incur special shipping costs of RM1 per unit

Nano-XFine. It is assumed that NNSB has excess operating capacity.

А.

REQUIRED:

Analyze the offer made and suggest whether NNSB should accept it. Show all your

calculations.

Muhammad Teamwork Sdn. Bhd. (MTSB) makes unfinished bookcases that is sold for

RM60 each. Production costs per unit are RM30 variable and RM10 fixed respectively.

Due to the unused capacity, MTSB is considering of processing further the unfinished

bookcases which it can sell for RM70 each. Variable finishing costs are expected to be

RM6 per unit with no increase in fixed costs.

REQUIRED:

(a)

Prepare the incremental analysis on per unit basis showing whether MTSB

should sell unfinished bookcases or process it further.

(b)

Based on your analysis, what decision should the management make? Explain.

B.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College