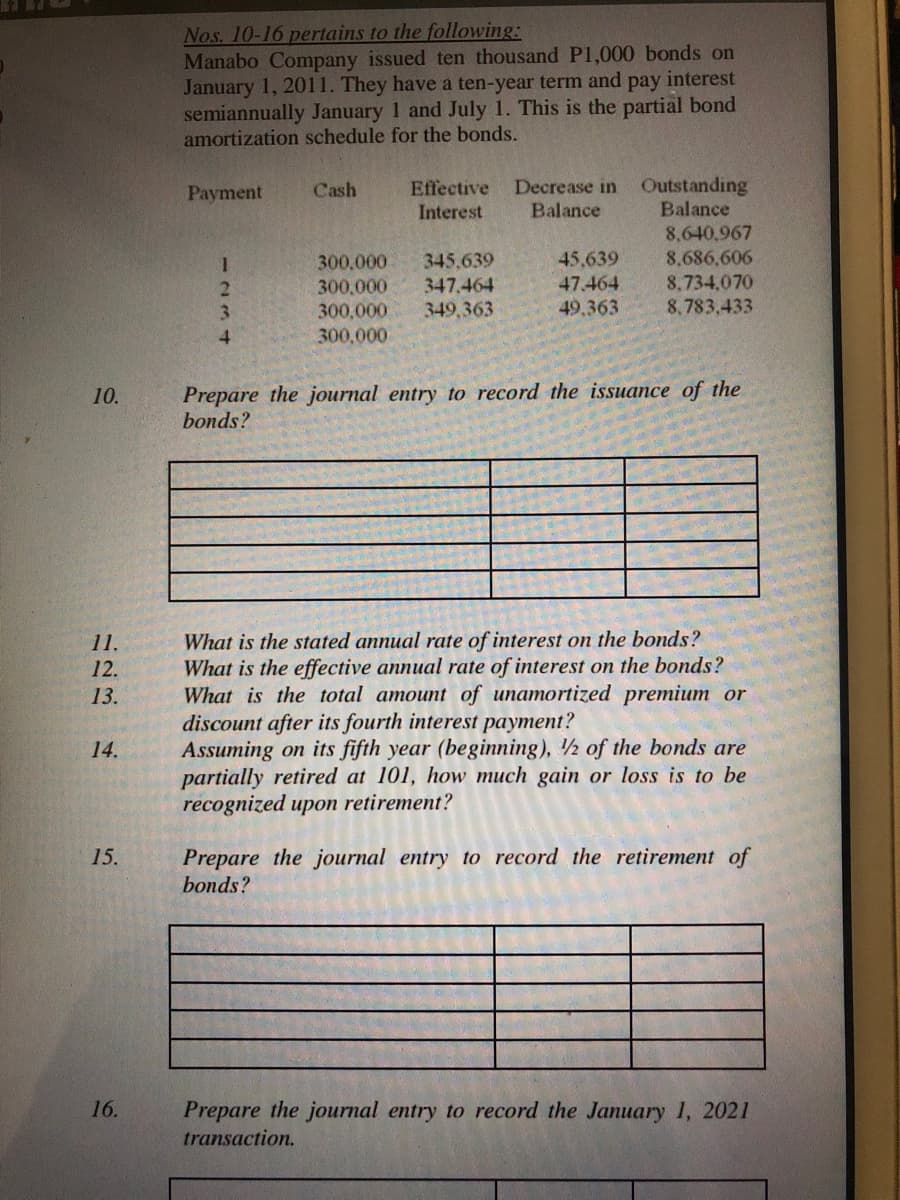

Nos. 10-16 pertains to the following: Manabo Company issued ten thousand P1,000 bonds on January 1, 2011. They have a ten-year term and pay interest semiannually January 1 and July 1. This is the partial bond amortization schedule for the bonds. Effective Decrease in Outstanding Balance Payment Cash Interest Balance 8,640,967 8,686,606 300,000 300,000 300,000 345,639 347.464 45,639 47.464 49.363 8,734,070 349,363 8,783.433 300,000 Prepare the journal entry to record the issuance of the bonds? What is the stated annual rate of interest on the bonds? What is the effective annual rate of interest on the bonds? 123+

Nos. 10-16 pertains to the following: Manabo Company issued ten thousand P1,000 bonds on January 1, 2011. They have a ten-year term and pay interest semiannually January 1 and July 1. This is the partial bond amortization schedule for the bonds. Effective Decrease in Outstanding Balance Payment Cash Interest Balance 8,640,967 8,686,606 300,000 300,000 300,000 345,639 347.464 45,639 47.464 49.363 8,734,070 349,363 8,783.433 300,000 Prepare the journal entry to record the issuance of the bonds? What is the stated annual rate of interest on the bonds? What is the effective annual rate of interest on the bonds? 123+

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 15MCQ

Related questions

Question

Transcribed Image Text:Nos. 10-16 pertains to the following:

Manabo Company issued ten thousand P1,000 bonds on

January 1, 2011. They have a ten-year term and pay interest

semiannually January 1 and July 1. This is the partial bond

amortization schedule for the bonds.

Effective

Interest

Decrease in

Balance

Outstanding

Balance

Payment

Cash

8,640,967

45,639

47.464

49.363

8,686,606

8,734,070

1.

300.000

345,639

347.464

300,000

300,000

300,000

349,363

8.783.433

4.

Prepare the journal entry to record the issuance of the

bonds?

10.

What is the stated annual rate of interest on the bonds?

What is the effective annual rate of interest on the bonds?

What is the total amount of unamortized premium or

discount after its fourth interest payment?

Assuming on its fifth year (beginning), ½ of the bonds are

partially retired at 101, how much gain or loss is to be

recognized upon retirement?

11.

12.

13.

14.

Prepare the journal entry to record the retirement of

bonds?

15.

Prepare the journal entry to record the January 1, 2021

transaction.

16.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT