not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a. Extra dividend Price per share Shareholder wealth ny s a. Repurchase Price per share Shareholder wealth b. Extra dividend EPS

not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a. Extra dividend Price per share Shareholder wealth ny s a. Repurchase Price per share Shareholder wealth b. Extra dividend EPS

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 11P

Related questions

Question

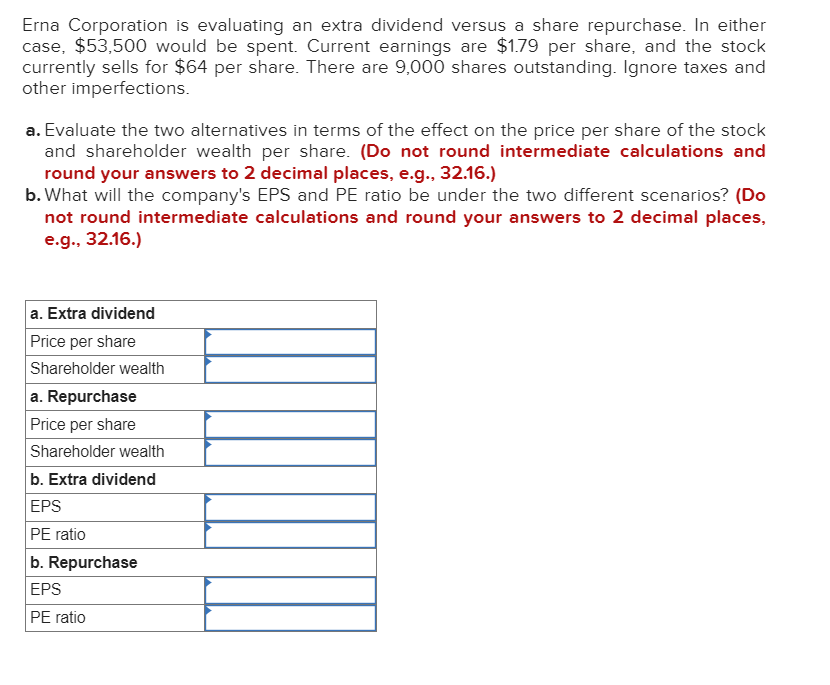

Transcribed Image Text:Erna Corporation is evaluating an extra dividend versus a share repurchase. In either

case, $53,500 would be spent. Current earnings are $1.79 per share, and the stock

currently sells for $64 per share. There are 9,000 shares outstanding. Ignore taxes and

other imperfections.

a. Evaluate the two alternatives in terms of the effect on the price per share of the stock

and shareholder wealth per share. (Do not round intermediate calculations and

round your answers to 2 decimal places, e.g., 32.16.)

b. What will the company's EPS and PE ratio be under the two different scenarios? (Do

not round intermediate calculations and round your answers to 2 decimal places,

e.g., 32.16.)

a. Extra dividend

Price per share

Shareholder wealth

a. Repurchase

Price per share

Shareholder wealth

b. Extra dividend

EPS

PE ratio

b. Repurchase

EPS

PE ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning