Note Current assets (R327 500) include accounts receivable of R168 000, inventories of R75 000 and cash of R84 500. Inventories as at 31 December 2019 amounted to R105 000. Current labiltes comprise accounts payable only. All purchases and sales are on credit REQUIRED Calculate the following ratios. Where applicable, round off answers to two decimal places. Profit margin Debtor collection period Creditor payment period Inventory tumover Return on own capital icid test ratio 1. ...

Note Current assets (R327 500) include accounts receivable of R168 000, inventories of R75 000 and cash of R84 500. Inventories as at 31 December 2019 amounted to R105 000. Current labiltes comprise accounts payable only. All purchases and sales are on credit REQUIRED Calculate the following ratios. Where applicable, round off answers to two decimal places. Profit margin Debtor collection period Creditor payment period Inventory tumover Return on own capital icid test ratio 1. ...

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.6P: Single-Step Income Statement The following income statement items, arranged in alphabetical order,...

Related questions

Question

Please answer the last 3 questions

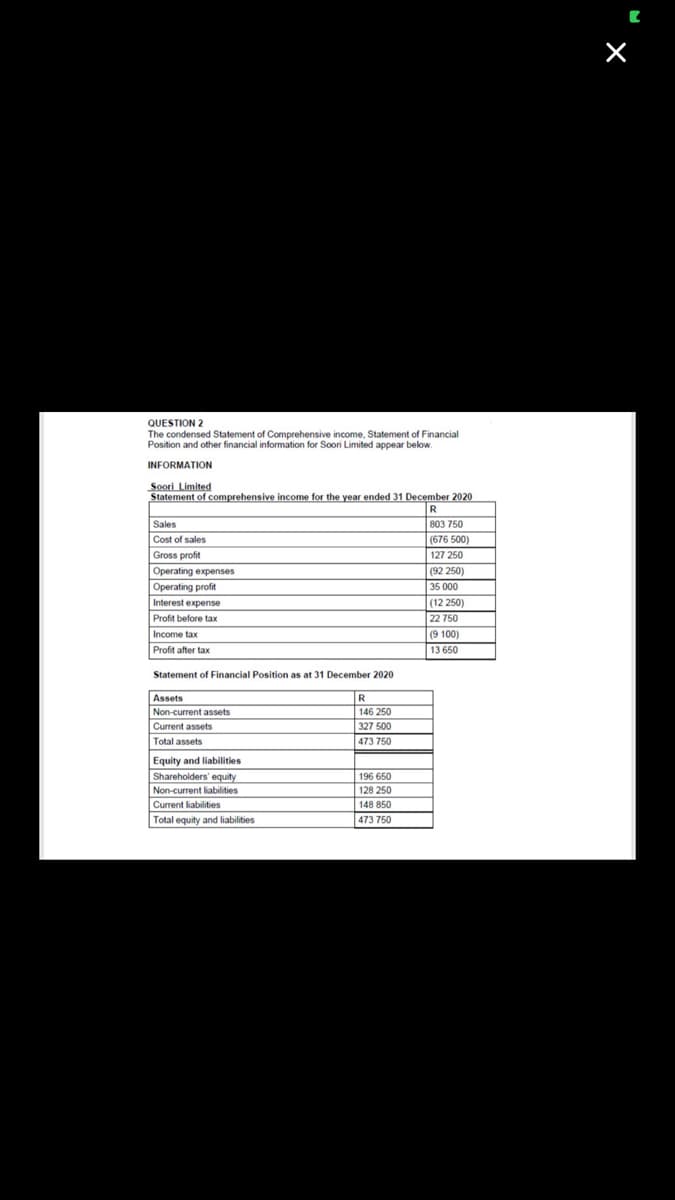

Transcribed Image Text:QUESTION 2

The condensed Statement of Comprehensive income, Statement of Financial

Position and other financial information for Soori Limited appear below.

INFORMATION

Soori Limited

Statement of comprehensive income for the year ended 31 December

R

Sales

803 750

(676 500)

127 250

Cost of sales

Gross profit

Operating expenses

Operating profit

Interest expense

(92 250)

35 000

(12 250)

Profit before tax

22 750

Income tax

(9 100)

Profit after tax

13 650

Statement of Financial Position as at 31 December 2020

Assets

R

Non-current assets

146 250

Current assets

327 500

Total assets

473 750

Equity and liabilities

Shareholders' equity

Non-current liabilities

196 650

128 250

Current liabilities

Total equity and liabilities

148 850

473 750

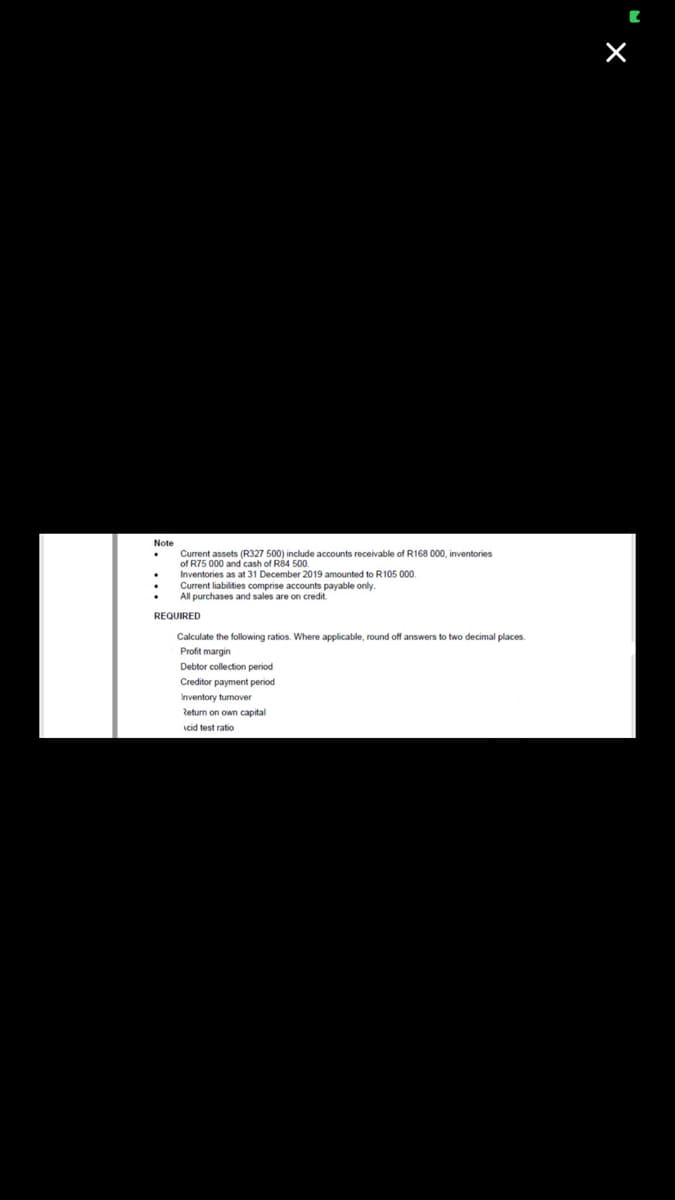

Transcribed Image Text:Note

Current assets (R327 500) include accounts receivable of R168 000, inventories

of R75 000 and cash of R84 500.

Inventories as at 31 December 2019 amounted to R105 000.

Current liabilities comprise accounts payable only.

All purchases and sales are on credit.

REQUIRED

Calculate the following ratios. Where applicable, round off answers to two decimal places.

Profit margin

Debtor collection period

Creditor payment period

Inventory turnover

Return on own capital

icid test ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning