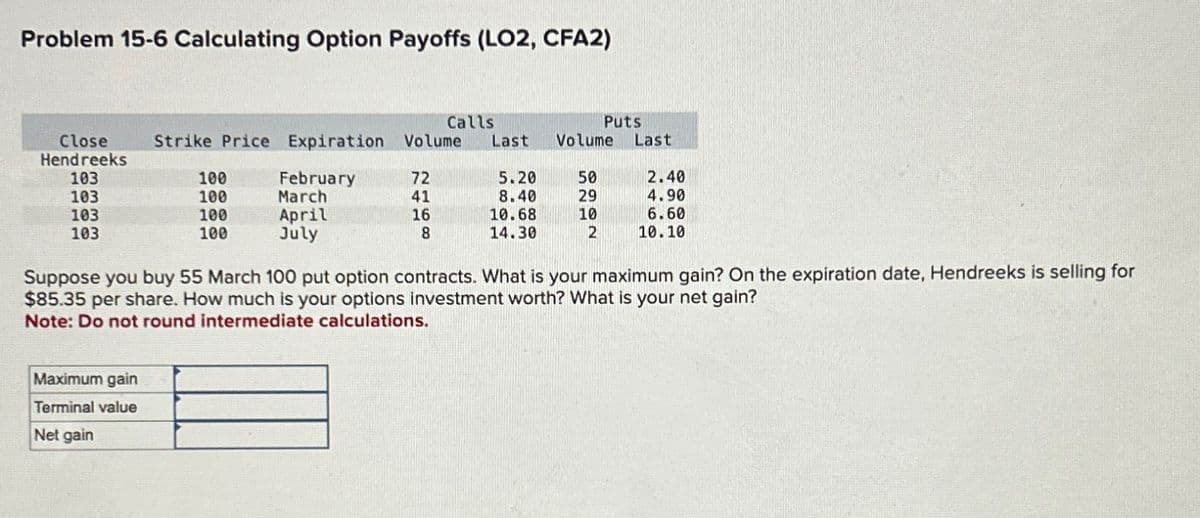

Problem 15-6 Calculating Option Payoffs (LO2, CFA2) Calls Puts Close Hend reeks Strike Price Expiration Volume Last Volume Last 103 100 February 72 5.20 50 2.40 103 100 March 41 8.40 29 4.90 103 100 April 16 10.68 10 6.60 103 100 July 8 14.30 2 10.10 Suppose you buy 55 March 100 put option contracts. What is your maximum gain? On the expiration date, Hendreeks is selling for $85.35 per share. How much is your options investment worth? What is your net gain? Note: Do not round intermediate calculations. Maximum gain Terminal value Net gain

Problem 15-6 Calculating Option Payoffs (LO2, CFA2) Calls Puts Close Hend reeks Strike Price Expiration Volume Last Volume Last 103 100 February 72 5.20 50 2.40 103 100 March 41 8.40 29 4.90 103 100 April 16 10.68 10 6.60 103 100 July 8 14.30 2 10.10 Suppose you buy 55 March 100 put option contracts. What is your maximum gain? On the expiration date, Hendreeks is selling for $85.35 per share. How much is your options investment worth? What is your net gain? Note: Do not round intermediate calculations. Maximum gain Terminal value Net gain

Fundamentals of Financial Management (MindTap Course List)

14th Edition

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter18: Derivatives And Risk Management

Section18.A: Valuation Of Put Options

Problem 2P

Related questions

Question

Nikul

Transcribed Image Text:Problem 15-6 Calculating Option Payoffs (LO2, CFA2)

Calls

Puts

Close

Hend reeks

Strike Price Expiration Volume

Last Volume Last

103

100

February

72

5.20

50

2.40

103

100

March

41

8.40

29

4.90

103

100

April

16

10.68

10

6.60

103

100

July

8

14.30

2

10.10

Suppose you buy 55 March 100 put option contracts. What is your maximum gain? On the expiration date, Hendreeks is selling for

$85.35 per share. How much is your options investment worth? What is your net gain?

Note: Do not round intermediate calculations.

Maximum gain

Terminal value

Net gain

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning