Now suppose that the firm plans instead to increase long-term debt only to $1,100 and does not wish to issue any new shares of stock. What is now the balancing item?

Now suppose that the firm plans instead to increase long-term debt only to $1,100 and does not wish to issue any new shares of stock. What is now the balancing item?

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.8P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

Transcribed Image Text:d. Now suppose that the firm plans instead to increase long-term debt only to $1,100 and does

not wish to issue any new shares of stock. What is now the balancing item?

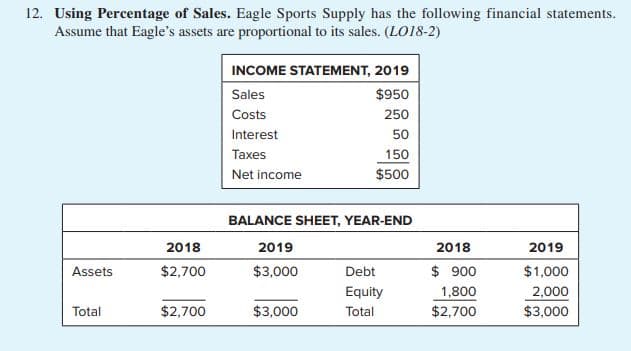

Transcribed Image Text:12. Using Percentage of Sales. Eagle Sports Supply has the following financial statements.

Assume that Eagle's assets are proportional to its sales. (LO18-2)

INCOME STATEMENT, 2019

Sales

$950

Costs

250

Interest

50

Taxes

150

Net income

$500

BALANCE SHEET, YEAR-END

2018

2019

2018

2019

Assets

$2,700

$3,000

Debt

$ 900

$1,000

Equity

1,800

2,000

$3,000

Total

$2,700

$3,000

Total

$2,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning