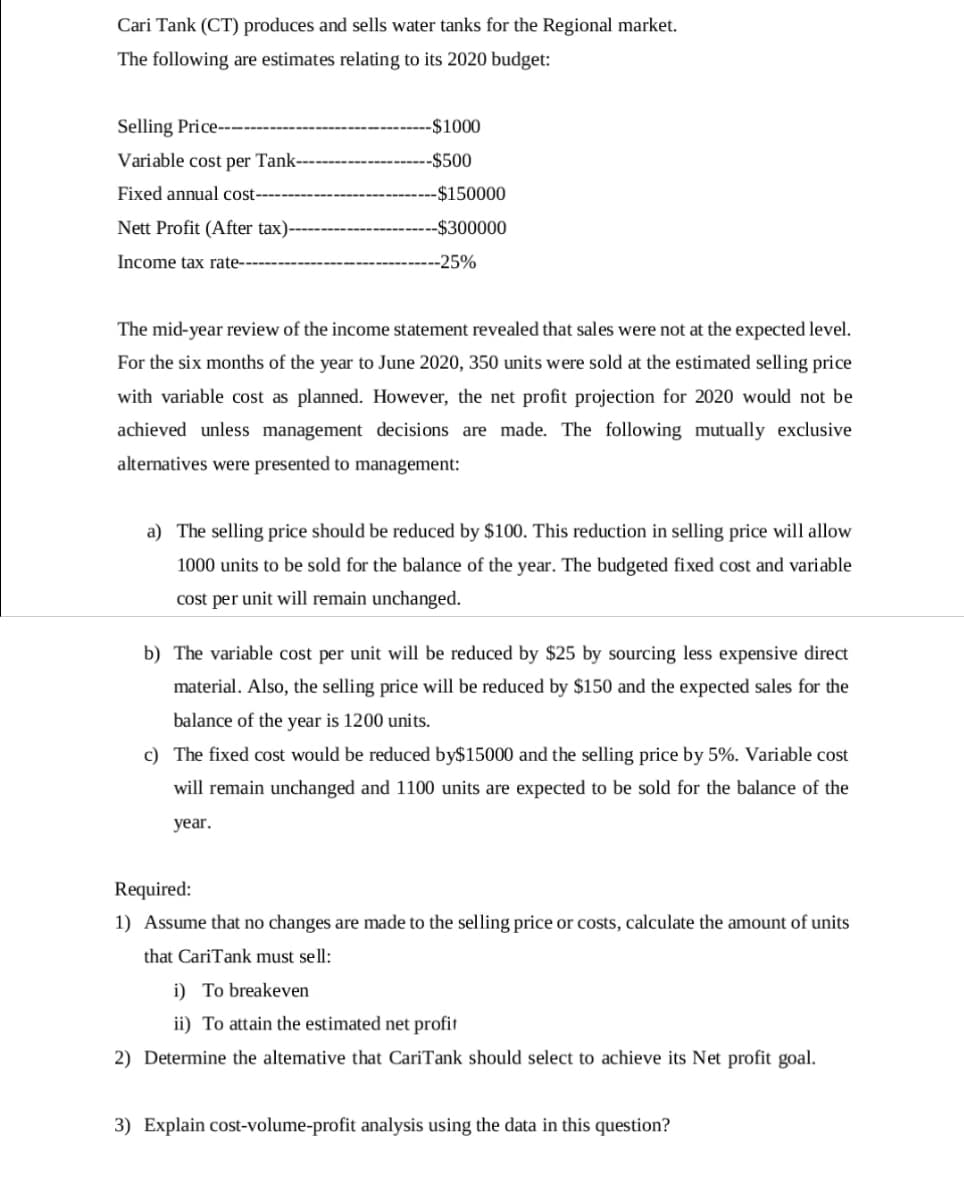

Cari Tank (CT) produces and sells water tanks for the Regional market. The following are estimates relating to its 2020 budget: Selling Price-- -$1000 Variable cost per Tank-- -$500 Fixed annual cost--- --$150000 Nett Profit (After tax)-- --$300000 Income tax rate------ -25% The mid-year review of the income statement revealed that sales were not at the expected level. For the six months of the year to June 2020, 350 units were sold at the estimated selling price with variable cost as planned. However, the net profit projection for 2020 would not be achieved unless management decisions are made. The following mutually exclusive alternatives were presented to management: a) The selling price should be reduced by $100. This reduction in selling price will allow 1000 units to be sold for the balance of the year. The budgeted fixed cost and variable cost per unit will remain unchanged. b) The variable cost per unit will be reduced by $25 by sourcing less expensive direct material. Also, the selling price will be reduced by $150 and the expected sales for the balance of the year is 1200 units. c) The fixed cost would be reduced by$15000 and the selling price by 5%. Variable cost will remain unchanged and 1100 units are expected to be sold for the balance of the year. Required: 1) Assume that no changes are made to the selling price or costs, calculate the amount of units that CariTank must sell: i) To breakeven ii) To attain the estimated net profit 2) Determine the altemative that CariTank should select to achieve its Net profit goal. 3) Explain cost-volume-profit analysis using the data in this question?

Cari Tank (CT) produces and sells water tanks for the Regional market. The following are estimates relating to its 2020 budget: Selling Price-- -$1000 Variable cost per Tank-- -$500 Fixed annual cost--- --$150000 Nett Profit (After tax)-- --$300000 Income tax rate------ -25% The mid-year review of the income statement revealed that sales were not at the expected level. For the six months of the year to June 2020, 350 units were sold at the estimated selling price with variable cost as planned. However, the net profit projection for 2020 would not be achieved unless management decisions are made. The following mutually exclusive alternatives were presented to management: a) The selling price should be reduced by $100. This reduction in selling price will allow 1000 units to be sold for the balance of the year. The budgeted fixed cost and variable cost per unit will remain unchanged. b) The variable cost per unit will be reduced by $25 by sourcing less expensive direct material. Also, the selling price will be reduced by $150 and the expected sales for the balance of the year is 1200 units. c) The fixed cost would be reduced by$15000 and the selling price by 5%. Variable cost will remain unchanged and 1100 units are expected to be sold for the balance of the year. Required: 1) Assume that no changes are made to the selling price or costs, calculate the amount of units that CariTank must sell: i) To breakeven ii) To attain the estimated net profit 2) Determine the altemative that CariTank should select to achieve its Net profit goal. 3) Explain cost-volume-profit analysis using the data in this question?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 20E: Eastman, Inc., manufactures and sells three products: R, S, and T. In January, Eastman, Inc.,...

Related questions

Question

Answer all question

Transcribed Image Text:Cari Tank (CT) produces and sells water tanks for the Regional market.

The following are estimates relating to its 2020 budget:

Selling Price---

-$1000

Variable cost per Tank-

-$500

Fixed annual cot-

-$150000

Nett Profit (After tax)-

-$300000

Income tax rate----

-25%

The mid-year review of the income statement revealed that sales were not at the expected level.

For the six months of the year to June 2020, 350 units were sold at the estimated selling price

with variable cost as planned. However, the net profit projection for 2020 would not be

achieved unless management decisions are made. The following mutually exclusive

alternatives were presented to management:

a) The selling price should be reduced by $100. This reduction in selling price will allow

1000 units to be sold for the balance of the year. The budgeted fixed cost and variable

cost per unit will remain unchanged.

b) The variable cost per unit will be reduced by $25 by sourcing less expensive direct

material. Also, the selling price will be reduced by $150 and the expected sales for the

balance of the year is 1200 units.

c) The fixed cost would be reduced by$15000 and the selling price by 5%. Variable cost

will remain unchanged and 1100 units are expected to be sold for the balance of the

year.

Required:

1) Assume that no changes are made to the selling price or costs, calculate the amount of units

that CariTank must sell:

i) To breakeven

ii) To attain the estimated net profit

2) Determine the altemative that CariTank should select to achieve its Net profit goal.

3) Explain cost-volume-profit analysis using the data in this question?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College