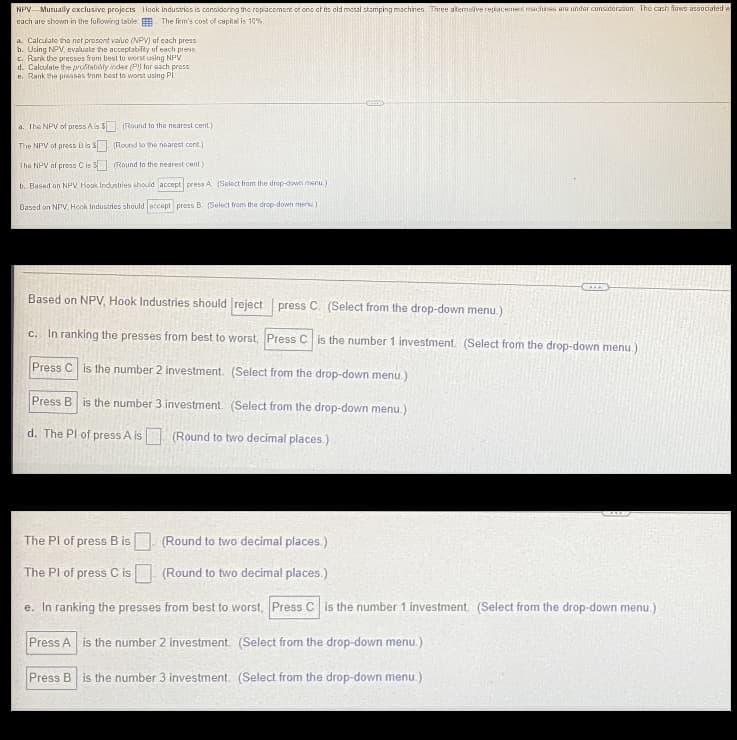

NPV Mutually exclusive projects Hock Industries is considering the replacement of one of its cld metal stamping machines. Three atemave replacement machines are under consideration. The cash f each are shown in the following table. The firm's cost of capital is 10% & Calculate the net prosent value (NPV) of each press b. Using NPV evaluate the acceptability of each press c. Rank the presses from best to worst using NV d. Calculate the profitability index (P) for each press Rank the presses from best to worst using Pl a. The NPV of press Ais (Round to the nearest cent) The NPV of press is (Round to the nearest cont) The NPV of press Cis (Round to the nearest cild) b. Based on NPV Hook Industries should accept press A (Select from the drop-down menu) Based on NPV, Hook Industries should accept press B. Select from the drop-down menu)

NPV Mutually exclusive projects Hock Industries is considering the replacement of one of its cld metal stamping machines. Three atemave replacement machines are under consideration. The cash f each are shown in the following table. The firm's cost of capital is 10% & Calculate the net prosent value (NPV) of each press b. Using NPV evaluate the acceptability of each press c. Rank the presses from best to worst using NV d. Calculate the profitability index (P) for each press Rank the presses from best to worst using Pl a. The NPV of press Ais (Round to the nearest cent) The NPV of press is (Round to the nearest cont) The NPV of press Cis (Round to the nearest cild) b. Based on NPV Hook Industries should accept press A (Select from the drop-down menu) Based on NPV, Hook Industries should accept press B. Select from the drop-down menu)

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:NPV Mutually exclusive projects Hook Industries is considering the replacement of one of its old metal stamping machines. Three alternative replacement machines are under consideration. The cash flows associated w

each are shown in the following table. The firm's cost of capital is 10%

a. Calculate the net presont value (NPV) of each press

b. Using NPV, evaluate the acceptability of each press

c. Rank the presses from best to worst using NPV

d. Calculate the profitability index (Pl) for each press.

e. Rank the presses from best to worst using Pl.

a. The NPV of press A is $(Round to the nearest cent.)

The NPV of press B is $

(Round to the nearest cont.)

The NPV of press C is $

(Round to the nearest cent.)

b. Based on NPV, Hook Industries should accept press A (Select from the drop-down menu.)

Based on NPV, Hook Industries should accept press B. (Select from the drop-down menu)

***D

Based on NPV, Hook Industries should reject press C. (Select from the drop-down menu.)

c. In ranking the presses from best to worst, Press C is the number 1 investment. (Select from the drop-down menu.)

Press C is the number 2 investment. (Select from the drop-down menu.)

Press B is the number 3 investment. (Select from the drop-down menu.)

d. The Pl of press A is (Round f two decimal places.)

The PI of press B is

(Round to two decimal places.)

The Pl of press C is

(Round to two decimal places.)

e. In ranking the presses from best to worst, Press C is the number 1 investment. (Select from the drop-down menu.)

Press A is the number 2 investment. (Select from the drop-down menu.)

Press B is the number 3 investment. (Select from the drop-down menu.)

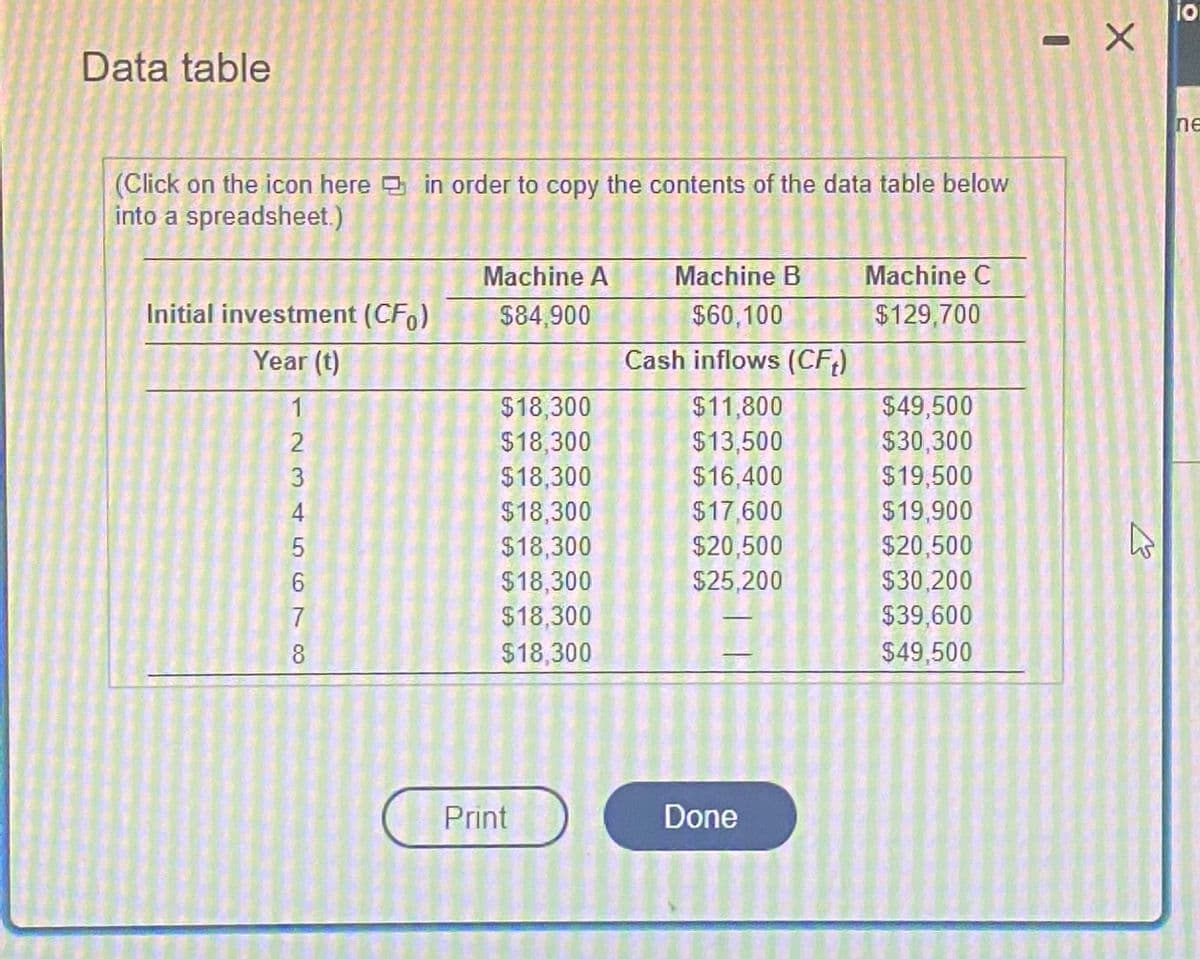

Transcribed Image Text:Data table

(Click on the icon here in order to copy the contents of the data table below

into a spreadsheet.)

Machine A

Machine B

Machine C

Initial investment (CF)

$84,900

$60,100

$129,700

Year (t)

Cash inflows (CFt)

1

$18,300

$11,800

$49,500

2

$18,300

$13,500

$30,300

$18,300

$16,400

$19,500

$18,300

$17,600

$19,900

$18,300

$20,500

$20,500

$18,300

$25,200

$30,200

$39,600

$18,300

$18,300

$49,500

567AWN

3

4

8

Print

Done

X

K

jo

ne

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning