ns man pr plan loss of production will decrease Roybus's free cash flow by $181 million at the end of this year and by $63 million at the end of next year. a. If Roybus has 32 million shares outstanding and a weighted average cost of capital of 13.8%, what change in Roybus's stock price would you expect upon this announcement? (Assume that the value of Roybus's debt is not affected by the event.) b. Would you expect to be able to sell Roybus stock on hearing this announcement and make a profit? Explain.

ns man pr plan loss of production will decrease Roybus's free cash flow by $181 million at the end of this year and by $63 million at the end of next year. a. If Roybus has 32 million shares outstanding and a weighted average cost of capital of 13.8%, what change in Roybus's stock price would you expect upon this announcement? (Assume that the value of Roybus's debt is not affected by the event.) b. Would you expect to be able to sell Roybus stock on hearing this announcement and make a profit? Explain.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 28CE

Related questions

Question

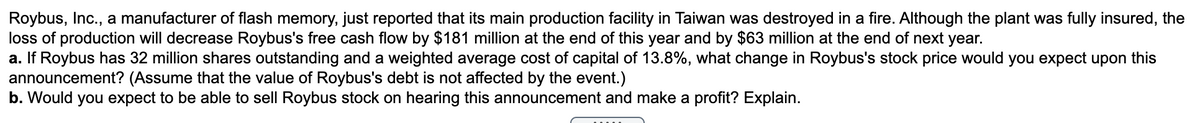

Transcribed Image Text:Roybus, Inc., a manufacturer of flash memory, just reported that its main production facility in Taiwan was destroyed in a fire. Although the plant was fully insured, the

loss of production will decrease Roybus's free cash flow by $181 million at the end of this year and by $63 million at the end of next year.

a. If Roybus has 32 million shares outstanding and a weighted average cost of capital of 13.8%, what change in Roybus's stock price would you expect upon this

announcement? (Assume that the value of Roybus's debt is not affected by the event.)

b. Would you expect to be able to sell Roybus stock on hearing this announcement and make a profit? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT