nstruction: Encircle the letter of the corresponding correct answer. 1. The process of winding-up the business activity is converting no cash, paying its liabilities and distribution of cash and the remain individual partners- a) realization c) liquidation

nstruction: Encircle the letter of the corresponding correct answer. 1. The process of winding-up the business activity is converting no cash, paying its liabilities and distribution of cash and the remain individual partners- a) realization c) liquidation

Chapter21: Partnerships

Section: Chapter Questions

Problem 65P

Related questions

Question

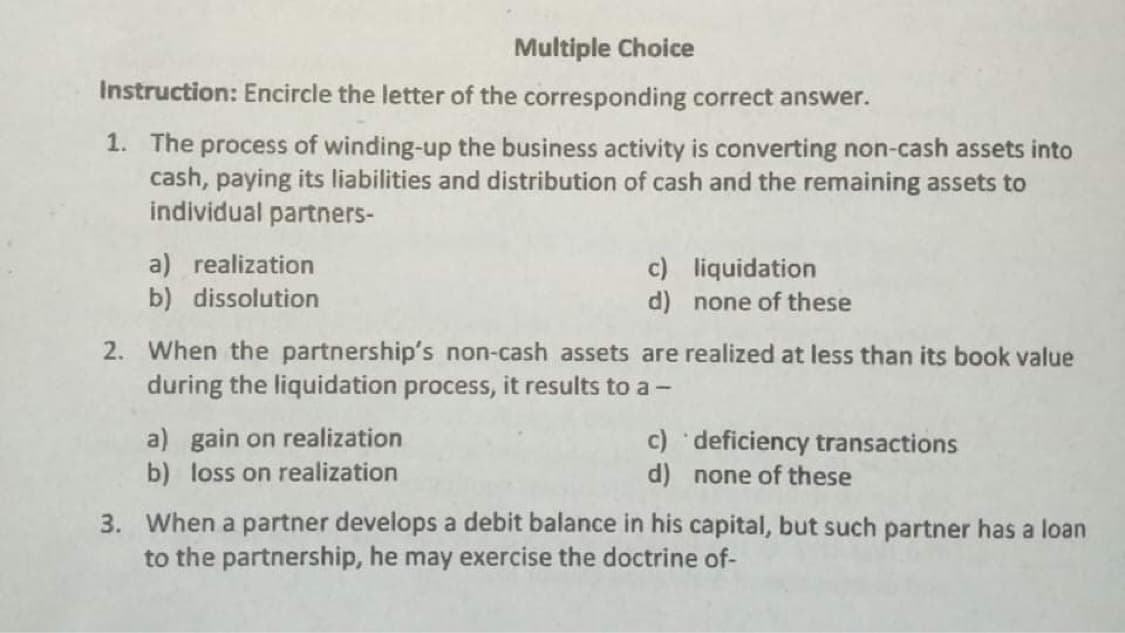

Transcribed Image Text:Multiple Choice

Instruction: Encircle the letter of the corresponding correct answer.

1. The process of winding-up the business activity is converting non-cash assets into

cash, paying its liabilities and distribution of cash and the remaining assets to

individual partners-

a) realization

b) dissolution

c) liquidation

d) none of these

2. When the partnership's non-cash assets are realized at less than its book value

during the liquidation process, it results to a -

a) gain on realization

b) loss on realization

c)odeficiency transactions

d) none of these

3. When a partner develops a debit balance in his capital, but such partner has a loan

to the partnership, he may exercise the doctrine of-

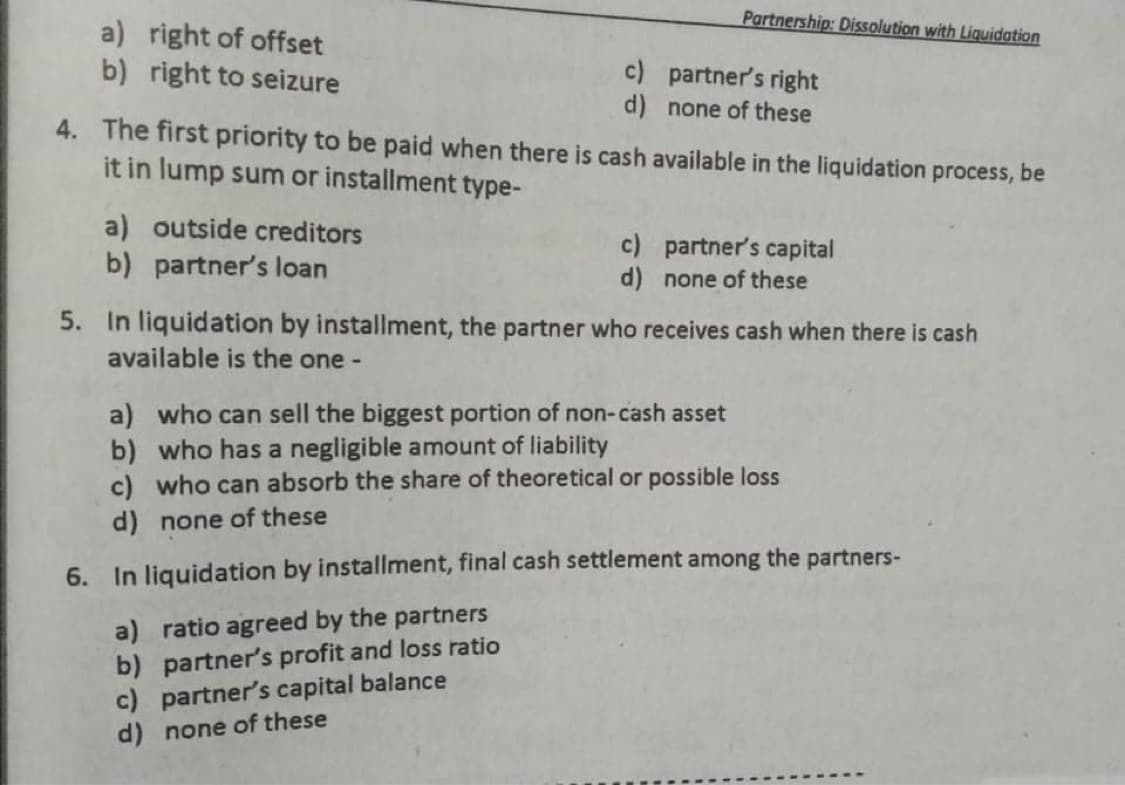

Transcribed Image Text:Partnership: Dissolution with Liquidation

a) right of offset

b) right to seizure

c) partner's right

d) none of these

4. The first priority to be paid when there is cash available in the liquidation process, be

it in lump sum or installment type-

a) outside creditors

b) partner's loan

c) partner's capital

d) none of these

5. In liquidation by installment, the partner who receives cash when there is cash

available is the one -

a) who can sell the biggest portion of non-cash asset

b) who has a negligible amount of liability

c) who can absorb the share of theoretical or possible loss

d) none of these

6. In liquidation by installment, final cash settlement among the partners-

a) ratio agreed by the partners

b) partner's profit and loss ratio

c) partner's capital balance

d) none of these

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College