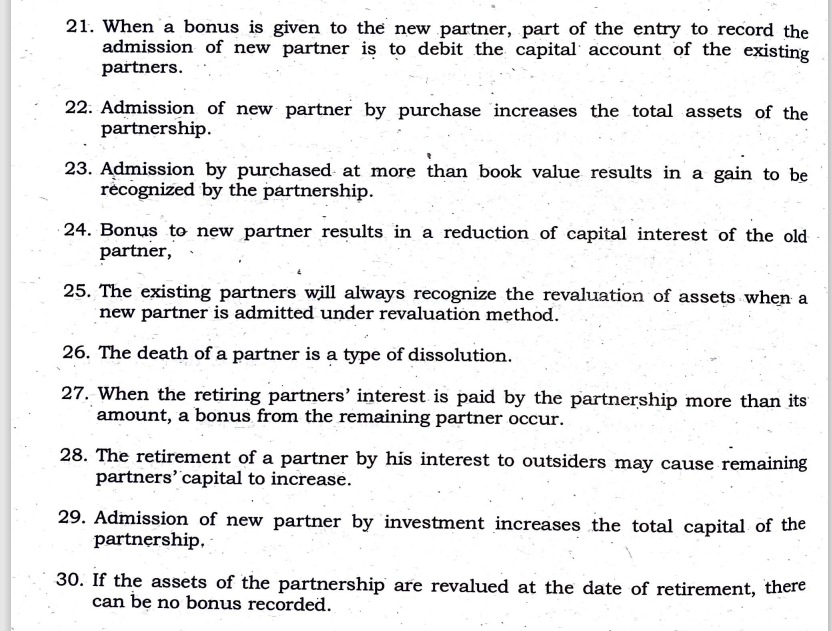

21. When 'a bonus is given to the new partner, part of the entry to record the admission of new partner is to debit the capital account of the existing partners. 22. Admission of new partner by purchase increases the total assets of the partnership. 23. Admission by purchased at more than book value results in a gain to be récognized by the partnership.

21. When 'a bonus is given to the new partner, part of the entry to record the admission of new partner is to debit the capital account of the existing partners. 22. Admission of new partner by purchase increases the total assets of the partnership. 23. Admission by purchased at more than book value results in a gain to be récognized by the partnership.

Chapter21: Partnerships

Section: Chapter Questions

Problem 6BCRQ

Related questions

Question

TRUE OR FALSE

Transcribed Image Text:21. When 'a bonus is given to the new partner, part of the entry to record the

admission of new partner is to debit the capital account of the existing

partners.

22. Admission of new partner by purchase increases the total assets of the

partnership.

23. Admission by purchased- at more than book value results in a gain to be

recognized by the partnership.

24. Bonus to new partner results in a reduction of capital interest of the old

partner,

25. The existing partners will always recognize the revaluation of assets when a

new partner is admitted under revaluation method.

26. The death of a partner is a type of dissolution.

27. When the retiring partners' interest is paid by the partnership more than its

amount, a bonus from the remaining partner occur.

28. The retirement of a partner by his interest to outsiders may cause remaining

partners' capital to increase.

29. Admission of new partner by investment increases the total capital of the

partnership,

30. If the assets of the partnership are revalued at the date of retirement, there

can be no bonus recorded.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT