nus is given to the old partners-

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 21DQ

Related questions

Question

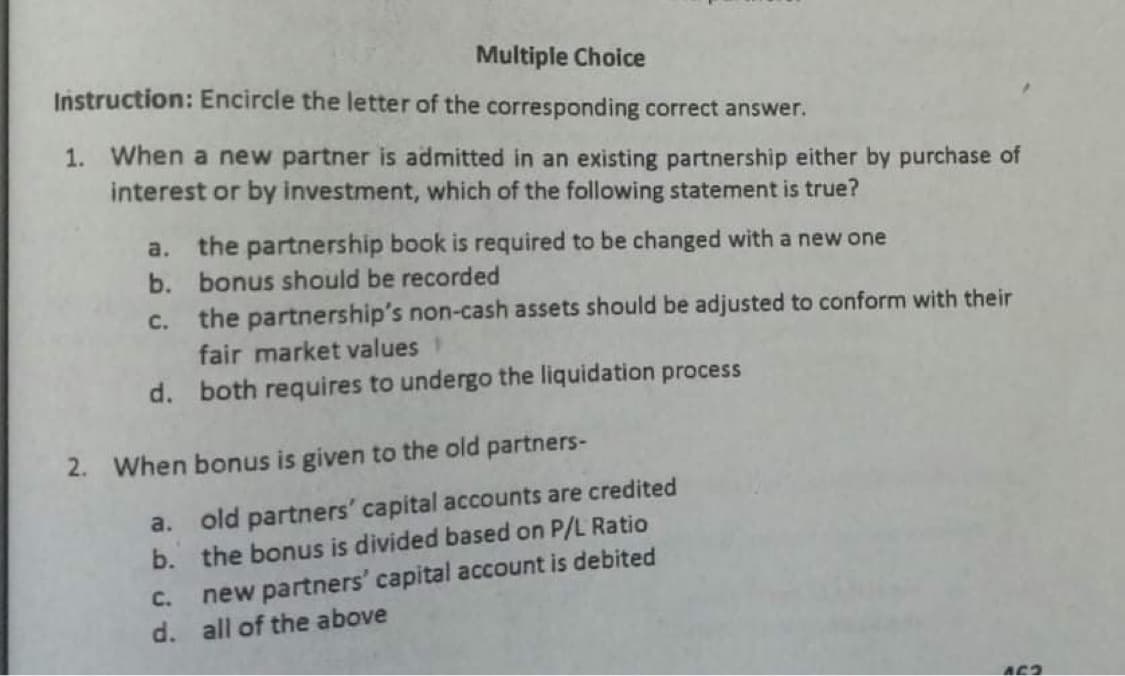

Transcribed Image Text:Multiple Choice

Instruction: Encircle the letter of the corresponding correct answer.

1. When a new partner is admitted in an existing partnership either by purchase of

interest or by investment, which of the following statement is true?

a. the partnership book is required to be changed with a new one

b. bonus should be recorded

c. the partnership's non-cash assets should be adjusted to conform with their

fair market values

d. both requires to undergo the liquidation process

2. When bonus is given to the old partners-

a. old partners' capital accounts are credited

b. the bonus is divided based on P/L Ratio

new partners' capital account is debited

d. all of the above

C.

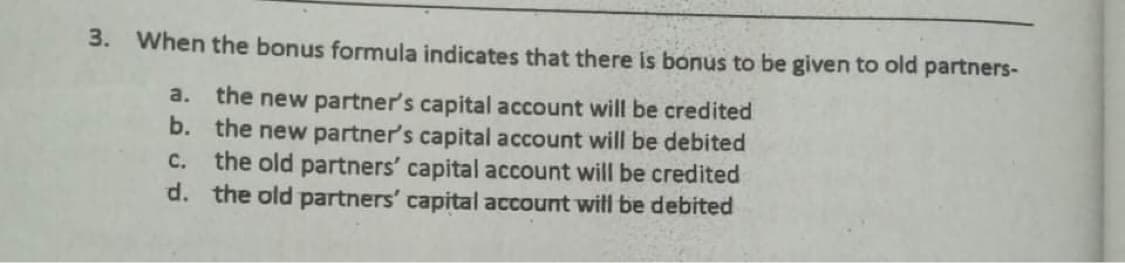

Transcribed Image Text:3. When the bonus formula indicates that there is bonus to be given to old partners-

a. the new partner's capital account will be credited

b. the new partner's capital account will be debited

C. the old partners' capital account will be credited

d. the old partners' capital account witl be debited

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College