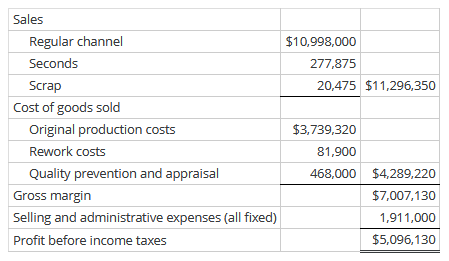

o customer returns. An income statement for the year follows. (See attached) a. Compute the total pre-tax profit lost by the company in its first year of operations by selling defective units as seconds or as scrap rather than selling the units through regular channels. $______ b. Compute the total failure cost for the company in its first year. $______ c. Compute total quality cost incurred by the company in

Elijah Electronics makes wireless headphone sets. The firm produced 58,500 wireless headphone sets during its first year of operation. At year-end, it had no inventory of finished goods. Elijah sold 54,990 units through regular

a. Compute the total pre-tax profit lost by the company in its first year of operations by selling defective units as seconds or as scrap rather than selling the units through regular channels. $______

b. Compute the total failure cost for the company in its first year. $______

c. Compute total quality cost incurred by the company in its first year. $______

Step by step

Solved in 3 steps with 1 images