O years if it eams 8% annum

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

ChapterA: Appendix - Time Value Of Cash Flows: Compound Interest Concepts And Applications

Section: Chapter Questions

Problem 18E

Related questions

Question

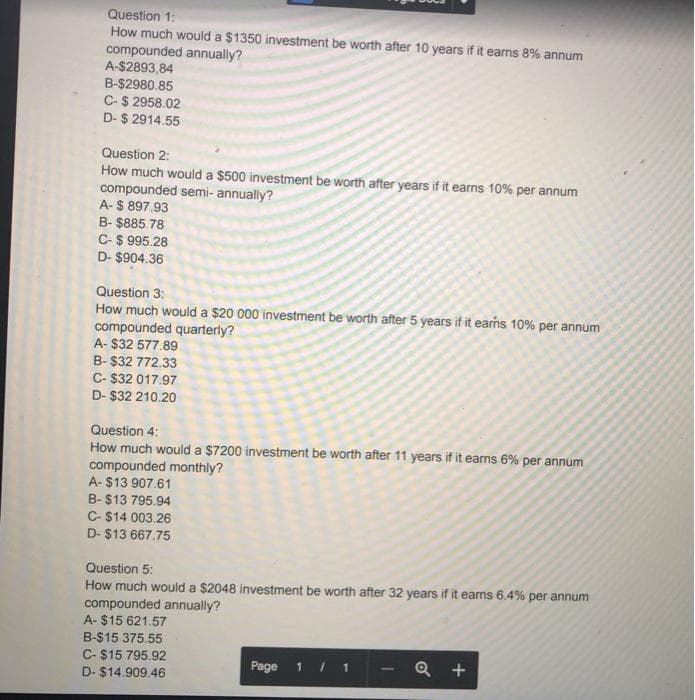

Transcribed Image Text:Question 1:

How much would a $1350 investment be worth after 10 years if it earns 8% annum

compounded annually?

A-$2893,84

B-$2980.85

C-$ 2958.02

D-$ 2914.55

Question 2:

How much would a $500 investment be worth after years if it earns 10% per annum

compounded semi- annually?

A-$ 897.93

B- $885.78

C-$ 995.28

D- $904.36

Question 3:

How much would a $20 000 investment be worth after 5 years if it earms 10% per annum

compounded quarterly?

A- $32 577.89

B- $32 772.33

C- $32 017.97

D- $32 210.20

Question 4:

How much would a $7200 investment be worth after 11 years if it earns 6% per annum

compounded monthly?

A- $13 907.61

B- $13 795.94

C- $14 003.26

D- $13 667.75

Question 5:

How much would a $2048 investment be worth after 32 years if it earns 6.4% per annum

compounded annually?

A- $15 621.57

B-$15 375.55

C- $15 795.92

Page

Q +

1.

D- $14.909.46

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning