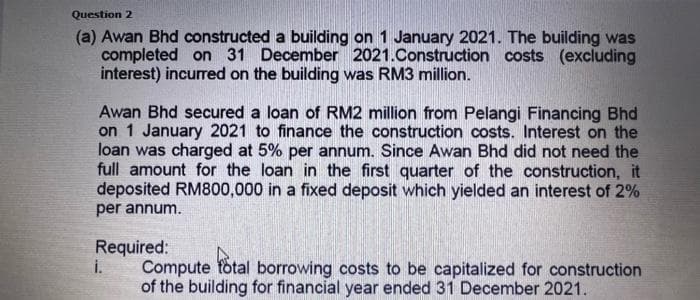

Question 2 (a) Awan Bhd constructed a building on 1 January 2021. The building was completed on 31 December 2021.Construction costs (excluding interest) incurred on the building was RM3 million. Awan Bhd secured a loan of RM2 million from Pelangi Financing Bhd on 1 January 2021 to finance the construction costs. Interest on the loan was charged at 5% per annum. Since Awan Bhd did not need the full amount for the loan in the first quarter of the construction, it deposited RM800,000 in a fixed deposit which yielded an interest of 2% per annum. Required: i. Compute fotal borrowing costs to be capitalized for construction of the building for financial year ended 31 December 2021.

Q: Hoodoo Voodoo Company has total assets of $66,900, net working capital of $20,650, owners' equity of...

A: Current liabilities = Total assets - Equity - Long term debt

Q: What is Riverbend’s DRD assuming it owns 60 percent of Hobble Corporation?

A: Solution:- Given, Riverbend incorporated received $200,000 dividend from stock Riverbend's taxable i...

Q: A company purchased machinery for $ 200,000 on 1st January. It has an estimated useful life of 10 ye...

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as D...

Q: Beaver Company expects to sell 1,600 units of a finished goods product in January and 1,860 units in...

A: Lets understand the basics. Budget is an estimation of future profit in advance. Management prepares...

Q: Using Excel to Determine the Adjusted Cash Balance PROBLEM For the month of August, Pratt Company ha...

A: Adusted cash book is prepared to find the discrepancy in the transactions which may happen during th...

Q: Secure, Inc. manufactures travel locks. The budgeted selling price is $24 per lock. The variable cos...

A: Sales - variable costs = Contribution margin Contribution margin - Fixed costs = Operating income ...

Q: Account Balance Salman, capital Rs.48,800 Advertising expense 650 Accounts payable 4,300 Sales commi...

A: Introduction: Trial balance: All final ledger accounts balances are posted in trial balance to check...

Q: PROBLEM 30-15 Comprehensive Problem ou are engaged in the first-time audit of the financial statemen...

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any ...

Q: The following information relates to Modern, Inc.'s overhead costs for the month: Static budget vari...

A: Variance is a result of the difference between the actual and the planned results. Volume variance r...

Q: Secure, Inc. manufactures travel locks. The budgeted selling price is $24 per lock. The variable cos...

A: Operating income shows the amount a company earned as net profit from its operation.

Q: Wildhorse Limited sells equipment on September 30, 2021, for $43,210 cash. The equipment originally ...

A: Depreciation as per straight line method = (Cost - Residual value)/useful life

Q: On January 1, 2020, Crane Corporation issued $8 million of 10-year,7% convertible debentures at 106....

A: Bonds payable is a liability account that contains vthe amount owned to bond holders by the issuers.

Q: Answer the questions below list of transactions: Jan 1 - Owner transferred cash by check from perso...

A: Accounting equation: It implies to a financial equation that establishes a relationship among the th...

Q: Analyze and compare Hilton and Marriott Obj. 4Hilton Worldwide Holdings, Inc. (HLT) and Marriott Int...

A: Operating income is an accounting statistic that indicates the amount of profit realized from a busi...

Q: lease read and answer journal entry questions using table.

A: Recording the Monthly transaction of DS unlimited

Q: Lemony Lemonade has 3,200 gallons of lemonade in WIP Inventory, with 76% of materials already add...

A: Equivalent units for conversion costs = No. of units in WIP inventory*Degree of completion

Q: Mack Company purchased equipment in 2018 for $122,000 and estimated an S12,000 salvage value at the ...

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets ...

Q: The following data is provided for Garcon Company and Pepper Company. Garcon Beginning finished good...

A: In this question, we have to compute the Cost of Goods Manufactured and Cost of Goods sold

Q: Lompany purchased equipment in 2018 for $122,000 and estimated an S12,000 salvage value at the end o...

A: Given info Cost of equipment $122,000 Salvage value $12000 Accumulated depreciation as at 31, Decem...

Q: Starbucks is today the world’s leading roaster and retailer of specialty coffee. The company purchas...

A: Financial ratios Financial ratios are helpful in assessing the profitability, leverage, liquidity, e...

Q: Which of the following is not a management accounting report? A.Income statement B.Sales forecast...

A: Management reports are those reports which are prepared for the management decision making, where da...

Q: Compute Swiftys accounts receivable turnover for the year, assuming the receivables are sold. (Rou

A: Accounts receivable is the amount that shows that the income has been earned by the company but the ...

Q: Jinchuriki Inc.'s Financial Statement for years 2014-2015. Compute of the Average Collection Period....

A: Average collection period: It implies to a financial measure that shows a total amount of time it ta...

Q: Carreras Café is a Spanish restaurant in a college town. The owner expects that the number of meals ...

A: The income statement represents the net income or net loss that is calculated by deducting the expen...

Q: EXHIBIT 1 Account Balances June 30 $ 21,315 26,505 2,202 157,950 5,928 29,250 585,000 390,000 66,660...

A: Balance Sheet June 01, XXX ASSETS Current Assets Accounts Receivable $ ...

Q: 1. A resident citizen taxpayer sold a vacant lot (held as investment) in the Philippines. Other data...

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any ...

Q: You are shopping around to determine which bank account yields the highest return. You have three ch...

A: Future Value = Present Value x (1 + r)^n

Q: Activity-based costing is employed by Karson Company. iPods and MP3 players are the firm's two prima...

A: Cost per unit = Total allocated cost / Total units of MP3 player / Ipods

Q: Employer gave a certain car to its employee in consideration of the latter's services rendered to th...

A: The correct answer is given in the following steps for your reference

Q: A parent sold a land to an 80% owned subsidiary at a loss. The subsidiary continue to use the land a...

A: Parent company: Parent company is an entity who takes the holding stake in the subordinate company. ...

Q: Activity-based costing is employed by Karson Company. iPods and MP3 players are the firm's two prima...

A: Activity Based Costing Method is a type of costing which identifies activities in the organization a...

Q: t apply to

A: Gift is the amount which is given by the donor to the person from his or her own will means there is...

Q: re journal entries to record the fo ary 22, purchased, an asset, mer uary 10, paid creditor for part...

A: Journal is prepared for recording the business transactions, all the business transactions are recor...

Q: Company cell phone bill received, but not paid, $80 what will be the general entry?

A: Under generally accepted principals, expenses and losses are debited. Liabilities and revenues were ...

Q: 5. Comerica's Balance Sheet information is given in the table below Assets Liabilities Reserves $75,...

A: Excess Reserves: The excess reserve is any money over the necessary minimum that the bank is holding...

Q: A certain operation is now performed by hand, the labor cost per unit is P 54 and annual fixed charg...

A: It is an analysis that determines the point at which the total revenues will be equal to total costs...

Q: Dividends paid per common share divided by the market price per common share produces the: Select on...

A: Net income ratio = Net incomeNet sales×100 Current ratio = Current Assets Current Liabilities Gross ...

Q: Indicate whether the following statements are true or false:a. Managerial accounting information is ...

A: Controlling (also known as cost accounting or management accounting) is the accounting department th...

Q: t

A: A sole proprietorship is a simplest and most common form for beginning a business. It's an unincorpo...

Q: Dec. 6 Paid $1,800 for salaries and w 8 Received $1,900 cash from cu: 10 Sold merchandise for cash $...

A: These are the accounting transactions that are having a monetary impact on the financial statement o...

Q: Down Under Products, Limited of Australia has budgeted sales of its popular boomerang for the next f...

A: Production budget: It implies to one of the components of annual business financial plan that comput...

Q: Cordner Corporation has two production departments, P1 and P2, and two service departments, S1 and S...

A: Under direct method of cost allocation , direct cost of service department 1 is allocated to other d...

Q: What are the tax ramifications if section 179 is used to depreciate the total amount of an asset tha...

A: Introduction Section 179 allows immediate expense deduction businesses for purchase of depreciable b...

Q: capital ratio. The partners withdrew the following amounts during the period: P 30,000 for Pat, P 40...

A: Distribution of Profit to Partners Partners are eligible to distribute the profit on interest on cap...

Q: Question 2 How will you disclose following items while preparing Cash Flow Statement of Gagan Ltd. a...

A: “Since you have posted a question with many sub-parts, we will solve three sub-parts for you. To get...

Q: Sipan Retail Company was recently created with a beginning cash balance of $12,000. The owner expect...

A: Solution Concept In preparation of the cash budget the cash inflow and outflow are to be considered ...

Q: In relation to the total budgeted overhead: • is direct labor hours a fixed or variable? (total budg...

A: Direct labor hours is a variable component as it is paid for per hour basis. For each unit produced,...

Q: Required:Match each of the control procedures listed below with the most closely related control pro...

A: The control procedures are given as,

Q: Ramon incorporated his sole proprietorship by transferring inventory, a building, and land to the co...

A: Adjusted tax basis is cost of asset after adjusting various tax related items.

Q: Sell or Process Further Turner Manufacturing Company makes a partially completed assembly unit that ...

A: Differential analysis is the process of comparing and contrasting the costs and advantages of severa...

Step by step

Solved in 2 steps with 1 images

- Salmah Bhd constructed a building on 1 Jan 2017. The building was completed on 31st December 2019. Construction cost (excluding interest) incurred on the building was RM 1,500,000. +150 000 Salmah Bhd secured a loan of RM 1,000,000 from Sheila Finance Bhd to finance the construction costs at 10% interest rate per annum. Repayment period of loan was 5 years. Since Salmah Bhd did not need the full amount of the loan in the 1st 5 year of the construction, it deposited RM 600,000 in fixed deposit which yielded an interest 8% per annum. The deposit matured on 31st December 2017. The company policy is to capitalised borrowing costs as part of the cost of assets. The useful life of building was estimated to be 50 years. You are required: a) Calculate the cost of building b) Show the income statement (extract) for the years ended 31 December 2017 until 31st December 2020.Question 6 The following events occurred during the year ended 30 June 2020 for Electrical Limited. On 1 June 2020, Electrical Ltd. signed a three-month 12% per annum note payable to purchase a new equipment costing $48,000. Interest and principal are paid at maturity. On 29 June 2020, Electrical Ltd. received deposit in advance of $12,000 from a construction company for completing the electrical work for a new project during the next 6 months. Electricity charges of $40,000 from 24 April to 23 June are payable on 10 July. Electrical’s main product is backed by warranty. Sales of this product for the year totalled $445,000. The opening balance of provision for warranty claims was $10,600. During the year, Electrical’s warranty expense was $31,700 and claims paid to customers totalled $25,200. June sales totalled $212,000. Electrical Ltd. collected GST of…Question 2 A business is preparing its financial statements for the year end 31 December 2021 and has the following items it needs to consider: i) Development costs of £600,000 were capitalised in the statement of financial position two years ago, on 1 January 2020, and are being amortised over 4 years from that date. Tax relief was provided in full as the costs were incurred. ii) A penalty of £2,000 was incurred in June 2021 for the late filing of a tax return. Payment was made in July 2021. Penalties are not an allowable deduction for tax purposes. iii) At 31 December 2021 land, held within PPE, was revalued from its cost of £1.7 million to £2.4 million. The revaluation gain is taxable on disposal of the asset. iv) The taxable profit for the year to 31 December 2021 is £8 million. £600,000 of income tax is outstanding at the year end and is due for payment by 30 September 2022. Tax is payable at 20% in the years ending 31 December 2020 and 2021. Required: Briefly outline the tax…

- 15. LIME Co. decided to construct a building to expand its operations. The entity decided to obtain a 5-year loan from MAROON Bank for P10,000,000 at 12% on December 31, 2019, to finance the construction of the building. The construction started on January 2, 2020, and the building was completed on December 31 of the same year. Payments were made as follows: January 2 – P1,500,000; April 1 – P2,000,000; June 1 – P2,100,000; October 1 – P1,700,000; December 1 – P2,200,000. How much borrowing cost shall be capitalized? * a. ₱ 1,100,000 b. ₱ 1,140,000 c. ₱ 580,000 d. ₱ 1,200,000QUESTION 2 On 1 September 2017, Seven Food Bhd purchased a packaging machine under hire purchase agreement with Tujuh Todak Bhd. The cash price of the machine was RM104,800 and the interest charged was 7% per annum. Seven Food Bhd paid 30% of the cash price as a deposit. The hire purchase period was 24 months and the instalments are paid at the end of each month starting 30 September 2017. The economic life of the machine was 7 years and Seven Food Bhd used straight line method to depreciate the machine. Seven Food Bhd and Tujuh Todak Bhd close their accounts on 31 December every year. Seven Food Bhd used gross method to account for the hire purchase and employed sum-of-the-years digits method to recognise the interest expense on the instalment payment date. In April 2018, Seven Food Bhd faced financial difficulties in settling their debts. The company was unable to pay the hire purchase instalments for April and May 2018. After serving “the notice of intention to repossess” to Seven…LIME Co. decided to construct a building to expand its operations. The entity decided to obtain a 5-year loan from MAROON Bank for P10,000,000 at 12% on December 31, 2019, to finance the construction of the building. The construction started on January 2, 2020, and the building was completed on December 31 of the same year. Payments were made as follows: January 2 – P1,500,000; April 1 – P2,000,000; June 1 – P2,100,000; October 1 – P1,700,000; December 1 – P2,200,000. How much borrowing cost shall be capitalized? * ₱ 580,000 ₱ 1,140,000 ₱ 1,200,000 ₱ 1,100,000

- Question 1 The following events occurred in December 2020 at SNL, a hockey equipment manufacturer. The company prepares its financial statements annually at the end of December. Also on 1 December SNL paid $50,000 for a truck. The truck has a 5 year expected useful life and an estimated $20,000 salvage value. The company’s policy is to amortize capital assets on a straight line basis. Amortization is recorded monthly. On 5 December, SNL received a large order for hockey sticks from a retail chain along with a cheque for $45,000 representing half payment. There is currently a shortage of hockey sticks and the retailer wants to be sure of delivery as soon as possible after Christmas. SNL has advised the retailer that the hockey sticks have not yet been manufactured but will be shortly. SNL expects to ship them in the second week of January, On 10 December, SNL paid a dividend to shareholders in the amount of $75,000. On 15 December, SNL reviewed its accounts receivable. Before…1- On November 1, 2018, Almadinah Company contracted Pfeifer Construction Co. to construct a building for $1,400,000 on land costing $100,000 (purchased from the contractor and included in the first payment). Almadinah made the following payments to the construction company during 2019. January,1 200,000 March, 31 310,000 May, 31 550,000 December,1 440,000 Total 1,500,000 Almadinah Construction completed the building, ready for occupancy, on December 31, 2019. Salalah had the following debt outstanding at December 31, 2019. Specific Construction Debt 1. 15%, 3-year note to finance purchase of land and construction of the building, dated December 31, 2018, with interest payable annually on December 31 760,000 Other Debt 2. 10%, 5-year note payable, dated December 31, 2015, with interest payable annually on December 31 560,000 3. 12%, 10-year bonds…3. Ali Company borrowed OMR50, 000 in December 2019 for a period of three months from Azzan and will make its interest payment three months later. The total interest for the three months will be OMR 1500. At the end of the year 2019 in the financial statement, the company reported Interest Expense of OMR 500 in Income Statement. a. This action was the result of which accounting principle? Explain. b. Do you think, the borrowed money will increase the assets/ Liabilities of the business? Yes/ No Justify your answer

- QUESTION THREE On 1 January 2011, Godson Ltd entered into a GHC11,000,000 contract for the construction of an office complex in Kumasi. The building was completed at the end of December 2011. During the period, the following payments were made to the contractor; Payment Date Amount (GHC'000) 1 January 2011 1,000 31 March 2011 3,000 30 September 2011 6,000 31 December 2011 1,000 Total 11,000 Godson's borrowings as at its year end of 31 December 2011 were as follows ; 10% 4 years Loan Note with simple interest payable annually, which relates specifically to the building project; debts outstanding at 31 December 2011 amounted to GHC3,500,000. Interest of GHC325,000 was incurred on these borrowing during the year, and interest income of GHC100,000 was earned on these funds while they were held in anticipation of payment.12.5% Five-year Loan Note with Simple interest payment annually; debt outstanding at 1 January 2011 amounted to GHC5,000,000 and remained unchanged during the year.10%…QUESTION ONE You have been provided with the following Trial Balance for Jojo & Lulu Ltd. Jojo & Lulu Ltd Trial balance as at 31st March 2020 Dr Cr K K Bank 1,200.00 Share capital 30,000.00 Cash 400.00 Long term loan 15,000.00 Insurance 2,000.00 Office expenses 15,000.00 Fixtures and Fittings 30,000.00 Accumulated depreciation - Fixtures and Fittings on 1 April 2019 10,000.00 Provision for bad and doubtful debts as at 1 April 2019 5,000.00 Purchases 60,000.00 Salaries 25,000.00 Sales 93,600.00 Stock at 1 April 2019 15,000.00 Accounts Payable 13,000.00 Accounts Receivable 18,000.00 166,600.00 166,600.00 Additional Information…EEE Co. decided to construct a building to expand its operations. The entity decided to obtain a 5-year specific loan from EFF Bank for $10,000,000 at 12% on December 31, 2018, to finance the construction of the building. The construction started on January 2, 2019 and the building was completed on December 31 of the same year. Payments were made as follows: January 2-$1,500,000 April 1 $2,000,000 June 1- $2,100,000 October 1- $1,700,000 December 1 -$2,200,000. What is the intial cost of the building? Can you please show me a solution to get the answer?