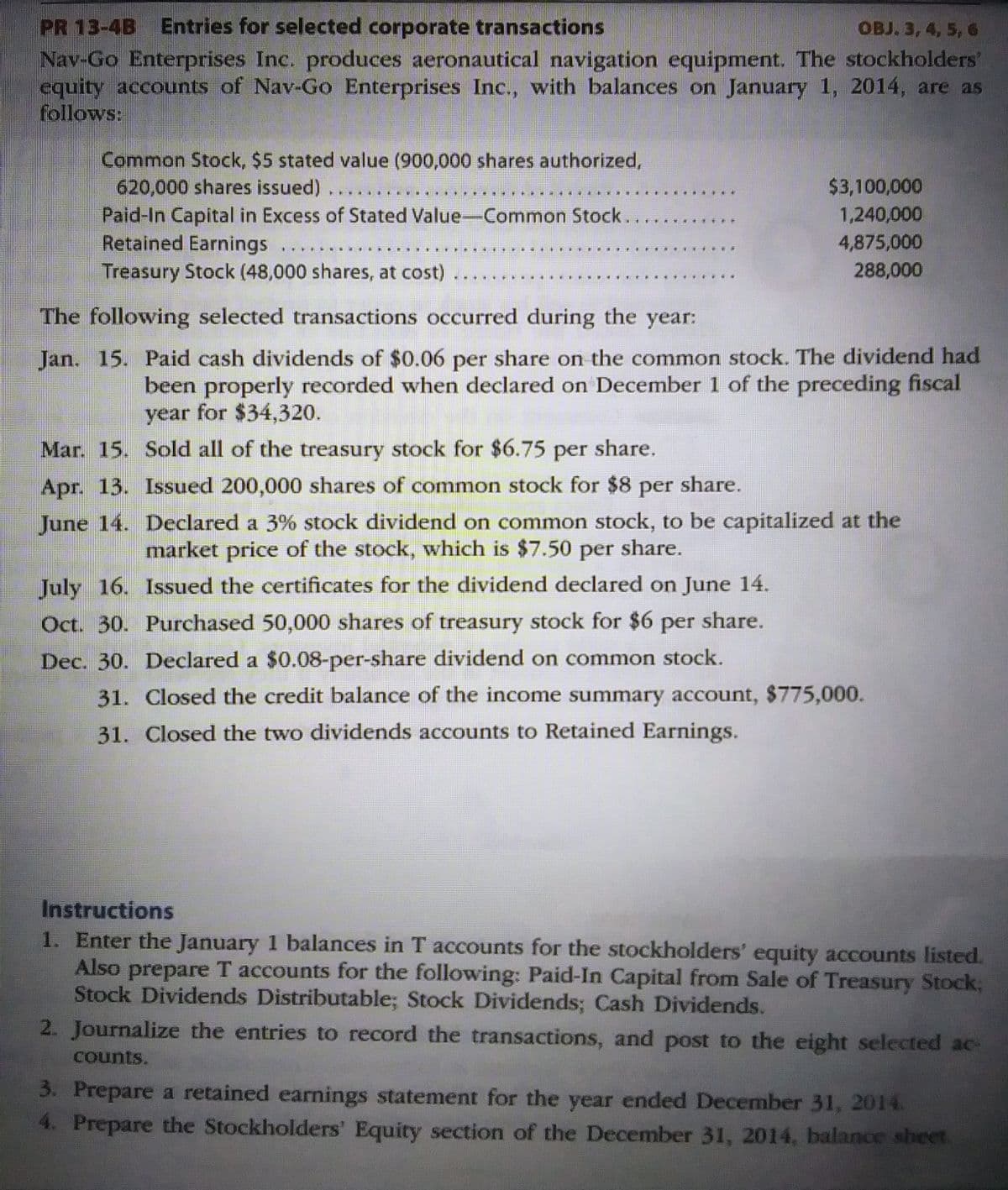

OBJ. 3, 4, 5, 6 PR 13-4B Entries for selected corporate transactions Nav-Go Enterprises Inc. produces aeronautical navigation equipment. The stockholders' equity accounts of Nav-Go Enterprises Inc., with balances on January 1, 2014, are as follows: Common Stock, $5 stated value (900,000 shares authorized, 620,000 shares issued) ****** Paid-In Capital in Excess of Stated Value-Common Stock.. Retained Earnings Treasury Stock (48,000 shares, at cost) ******* $3,100,000 1,240,000 4,875,000 288,000 The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of $0.06 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $34,320. Mar. 15. Sold all of the treasury stock for $6.75 per share. Apr. 13. Issued 200,000 shares of common stock for $8 per share. June 14. Declared a 3% stock dividend on common stock, to be capitalized at the market price of the stock, which is $7.50 per share. July 16. Issued the certificates for the dividend declared on June 14. Oct. 30. Purchased 50,000 shares of treasury stock for $6 per share. Dec. 30. Declared a $0.08-per-share dividend on common stock. 31. Closed the credit balance of the income summary account, $775,000. 31. Closed the two dividends accounts to Retained Earnings. Instructions 1. Enter the January 1 balances in T accounts for the stockholders' equity accounts listed. Also prepare T accounts for the following: Paid-In Capital from Sale of Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash Dividends. 2. Journalize the entries to record the transactions, and post to the eight selected ac- counts. 3. Prepare a retained earnings statement for the year ended December 31, 2014. 4. Prepare the Stockholders' Equity section of the December 31, 2014, balance sheet.

OBJ. 3, 4, 5, 6 PR 13-4B Entries for selected corporate transactions Nav-Go Enterprises Inc. produces aeronautical navigation equipment. The stockholders' equity accounts of Nav-Go Enterprises Inc., with balances on January 1, 2014, are as follows: Common Stock, $5 stated value (900,000 shares authorized, 620,000 shares issued) ****** Paid-In Capital in Excess of Stated Value-Common Stock.. Retained Earnings Treasury Stock (48,000 shares, at cost) ******* $3,100,000 1,240,000 4,875,000 288,000 The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of $0.06 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $34,320. Mar. 15. Sold all of the treasury stock for $6.75 per share. Apr. 13. Issued 200,000 shares of common stock for $8 per share. June 14. Declared a 3% stock dividend on common stock, to be capitalized at the market price of the stock, which is $7.50 per share. July 16. Issued the certificates for the dividend declared on June 14. Oct. 30. Purchased 50,000 shares of treasury stock for $6 per share. Dec. 30. Declared a $0.08-per-share dividend on common stock. 31. Closed the credit balance of the income summary account, $775,000. 31. Closed the two dividends accounts to Retained Earnings. Instructions 1. Enter the January 1 balances in T accounts for the stockholders' equity accounts listed. Also prepare T accounts for the following: Paid-In Capital from Sale of Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash Dividends. 2. Journalize the entries to record the transactions, and post to the eight selected ac- counts. 3. Prepare a retained earnings statement for the year ended December 31, 2014. 4. Prepare the Stockholders' Equity section of the December 31, 2014, balance sheet.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 12.4BPR: Entries for selected corporate transactions Nav-Go Enterprises Inc. produces aeronautical navigation...

Related questions

Question

i need help please :)

Transcribed Image Text:OBJ. 3, 4, 5, 6

PR 13-4B Entries for selected corporate transactions

Nav-Go Enterprises Inc. produces aeronautical navigation equipment. The stockholders'

equity accounts of Nav-Go Enterprises Inc., with balances on January 1, 2014, are as

follows:

Common Stock, $5 stated value (900,000 shares authorized,

620,000 shares issued)

****IFFEN

CERTI

Paid-In Capital in Excess of Stated Value-Common Stock.

Retained Earnings ....

Treasury Stock (48,000 shares, at cost)

....

****

*****

*****

***W

$3,100,000

1,240,000

4,875,000

288,000

The following selected transactions occurred during the year:

Jan. 15. Paid cash dividends of $0.06 per share on the common stock. The dividend had

been properly recorded when declared on December 1 of the preceding fiscal

year for $34,320.

Mar. 15.

Sold all of the treasury stock for $6.75 per share.

Apr. 13. Issued 200,000 shares of common stock for $8 per share.

June 14.

Declared a 3% stock dividend on common stock, to be capitalized at the

market price of the stock, which is $7.50 per share.

July 16. Issued the certificates for the dividend declared on June 14.

Oct. 30. Purchased 50,000 shares of treasury stock for $6 per share.

Dec. 30. Declared a $0.08-per-share dividend on common stock.

31. Closed the credit balance of the income summary account, $775,000.

31. Closed the two dividends accounts to Retained Earnings.

Instructions

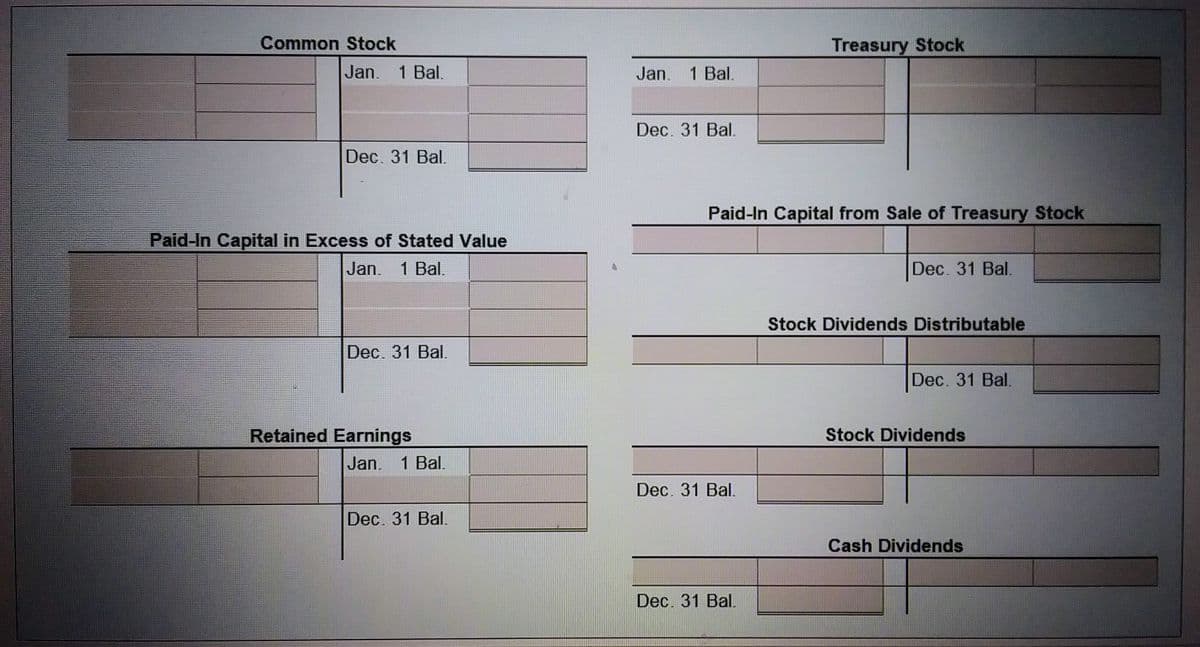

1. Enter the January 1 balances in T accounts for the stockholders' equity accounts listed.

Also prepare T accounts for the following: Paid-In Capital from Sale of Treasury Stock;

Stock Dividends Distributable; Stock Dividends; Cash Dividends.

2. Journalize the entries to record the transactions, and post to the eight selected ac-

counts.

3. Prepare a retained earnings statement for the year ended December 31, 2014.

4. Prepare the Stockholders' Equity section of the December 31, 2014, balance sheet

Transcribed Image Text:Common Stock

Jan. 1 Bal.

Dec. 31 Bal.

Paid-In Capital in Excess of Stated Value

Jan. 1 Bal.

Dec. 31 Bal.

Retained Earnings

Jan. 1 Bal.

Dec. 31 Bal.

Jan. 1 Bal.

Dec. 31 Bal.

Paid-In Capital from Sale of Treasury Stock

Dec. 31 Bal.

Treasury Stock

Dec. 31 Bal.

Dec. 31 Bal.

Stock Dividends Distributable

Dec. 31 Bal.

Stock Dividends

Cash Dividends

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning