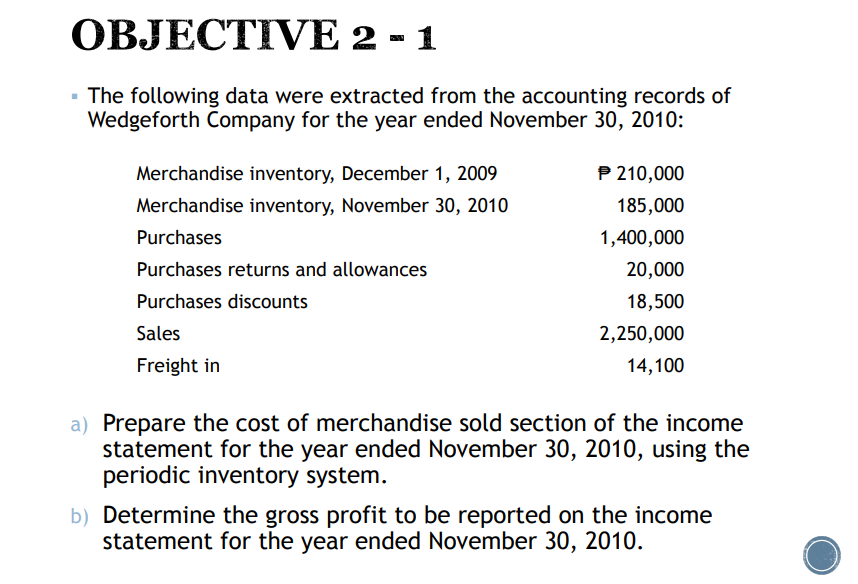

OBJECTIVE 2 - 1 - The following data were extracted from the accounting records of Wedgeforth Company for the year ended November 30, 2010: Merchandise inventory, December 1, 2009 P 210,000 Merchandise inventory, November 30, 2010 185,000 Purchases 1,400,000 Purchases returns and allowances 20,000 Purchases discounts 18,500 Sales 2,250,000 Freight in 14,100 a) Prepare the cost of merchandise sold section of the income statement for the year ended November 30, 2010, using the periodic inventory system. b) Determine the gross profit to be reported on the income statement for the year ended November 30, 2010. OBJECTIVE 2 - 2 Identify the errors in the following schedule of cost of merchandise sold for the current year ended July 31, 2010: Cost of merchandise sold: $ 140,000 Merchandise inventory, July 31, 2010 Purchases ... $975,000 $12,000 8,000 Plus: Purchases returns and allowances Purchases discounts 20,000 Gross purchases Less freight in ... $995,000 13,500 Cost of merchandise purchased 981,500 Merchandise available for sale $1,121,500 Less merchandise inventory, August 1, 2009 125,000 $ 996,500 .. .. Cost of merchandise sold

OBJECTIVE 2 - 1 - The following data were extracted from the accounting records of Wedgeforth Company for the year ended November 30, 2010: Merchandise inventory, December 1, 2009 P 210,000 Merchandise inventory, November 30, 2010 185,000 Purchases 1,400,000 Purchases returns and allowances 20,000 Purchases discounts 18,500 Sales 2,250,000 Freight in 14,100 a) Prepare the cost of merchandise sold section of the income statement for the year ended November 30, 2010, using the periodic inventory system. b) Determine the gross profit to be reported on the income statement for the year ended November 30, 2010. OBJECTIVE 2 - 2 Identify the errors in the following schedule of cost of merchandise sold for the current year ended July 31, 2010: Cost of merchandise sold: $ 140,000 Merchandise inventory, July 31, 2010 Purchases ... $975,000 $12,000 8,000 Plus: Purchases returns and allowances Purchases discounts 20,000 Gross purchases Less freight in ... $995,000 13,500 Cost of merchandise purchased 981,500 Merchandise available for sale $1,121,500 Less merchandise inventory, August 1, 2009 125,000 $ 996,500 .. .. Cost of merchandise sold

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter5: Accounting For Retail Businesses

Section: Chapter Questions

Problem 41E: Cost of goods sold and related items The following data were extracted from the accounting records...

Related questions

Question

Transcribed Image Text:OBJECTIVE 2 - 1

- The following data were extracted from the accounting records of

Wedgeforth Company for the year ended November 30, 2010:

Merchandise inventory, December 1, 2009

P 210,000

Merchandise inventory, November 30, 2010

185,000

Purchases

1,400,000

Purchases returns and allowances

20,000

Purchases discounts

18,500

Sales

2,250,000

Freight in

14,100

a) Prepare the cost of merchandise sold section of the income

statement for the year ended November 30, 2010, using the

periodic inventory system.

b) Determine the gross profit to be reported on the income

statement for the year ended November 30, 2010.

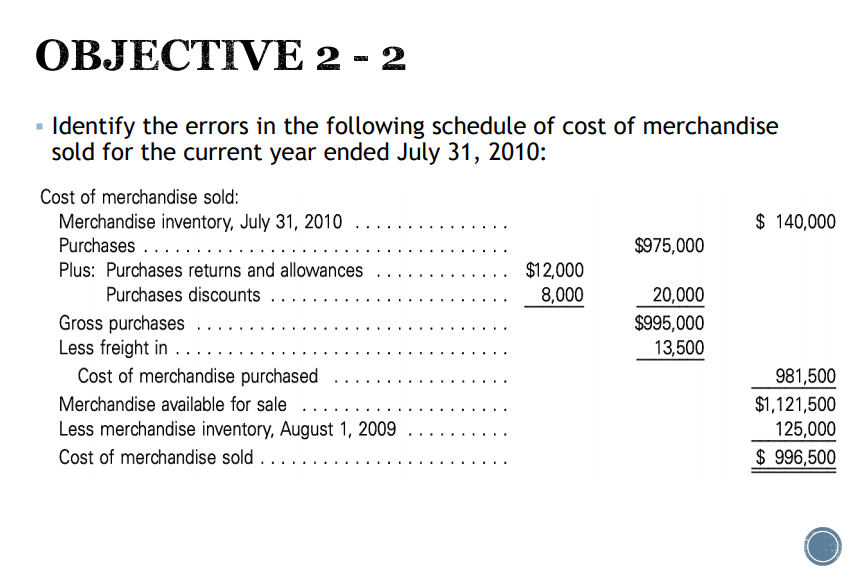

Transcribed Image Text:OBJECTIVE 2 - 2

Identify the errors in the following schedule of cost of merchandise

sold for the current year ended July 31, 2010:

Cost of merchandise sold:

$ 140,000

Merchandise inventory, July 31, 2010

Purchases ...

$975,000

$12,000

8,000

Plus: Purchases returns and allowances

Purchases discounts

20,000

Gross purchases

Less freight in ...

$995,000

13,500

Cost of merchandise purchased

981,500

Merchandise available for sale

$1,121,500

Less merchandise inventory, August 1, 2009

125,000

$ 996,500

.. ..

Cost of merchandise sold

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning