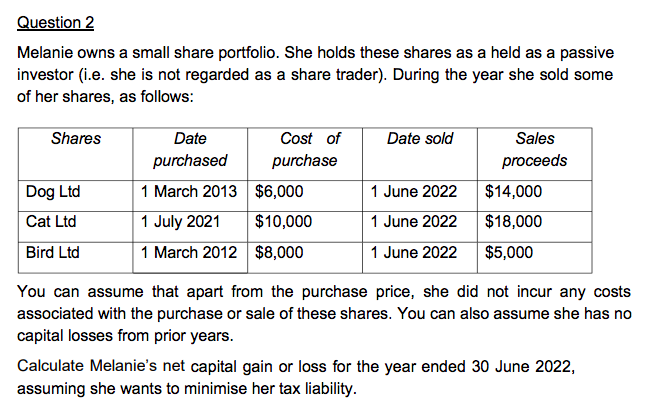

of her shares, as follows: Shares Dog Ltd Cat Ltd Bird Ltd Date purchased Cost of purchase 1 March 2013 1 July 2021 1 March 2012 $8,000 $6,000 $10,000 Date sold 1 June 2022 1 June 2022 1 June 2022 Sales proceeds $14,000 $18,000 $5,000 You can assume that apart from the purchase price, she did not incur any costs associated with the purchase or sale of these shares. You can also assume she has no capital losses from prior years. Calculate Melanie's net capital gain or loss for the year ended 30 June 2022, assuming she wants to minimise her tax liability.

of her shares, as follows: Shares Dog Ltd Cat Ltd Bird Ltd Date purchased Cost of purchase 1 March 2013 1 July 2021 1 March 2012 $8,000 $6,000 $10,000 Date sold 1 June 2022 1 June 2022 1 June 2022 Sales proceeds $14,000 $18,000 $5,000 You can assume that apart from the purchase price, she did not incur any costs associated with the purchase or sale of these shares. You can also assume she has no capital losses from prior years. Calculate Melanie's net capital gain or loss for the year ended 30 June 2022, assuming she wants to minimise her tax liability.

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter11: Investment Planning

Section: Chapter Questions

Problem 9FPE

Related questions

Question

Transcribed Image Text:Question 2

Melanie owns a small share portfolio. She holds these shares as a held as a passive

investor (i.e. she is not regarded as a share trader). During the year she sold some

of her shares, as follows:

Shares

Dog Ltd

Cat Ltd

Bird Ltd

Date

purchased

Cost of

purchase

1 March 2013

$6,000

1 July 2021

$10,000

1 March 2012 $8,000

Date sold

1 June 2022

1 June 2022

1 June 2022

Sales

proceeds

$14,000

$18,000

$5,000

You can assume that apart from the purchase price, she did not incur any costs

associated with the purchase or sale of these shares. You can also assume she has no

capital losses from prior years.

Calculate Melanie's net capital gain or loss for the year ended 30 June 2022,

assuming she wants to minimise her tax liability.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT