Q: A student puts $10,000 in a savings account that pays 16% annual interest, compounded quarterly.…

A: Amount put in savings bank = $ 10,000 Interest Rate(r) = 16% compounded quarterly = 16/4 = 4% Total…

Q: Funds are deposited in a savings account at an interest rate of 8% per annum. What is the initial…

A: Annual interest rate = 8% Future value = P 10,000 Period = 10 Years

Q: You borrowed money from the bank with a simple interest 8%, find the present worth of P25,000, which…

A: In Simple Interest Case, FV = PV + (PV x r x n) FV = PV x {1 + (r x n)} Therefore, PV = FV / {1 + (r…

Q: Determine the present value of a financial instrument that pays $18,500 in 10 years if instruments…

A: Present Value: It refers to the real value or worth of any asset or project. It determines the fair…

Q: You invested $11,500 at the end of each quarter for 6 years in an investment fund. At the end of…

A: Information Provided: Invested amount = $11,500 Years = 6 Future value of invested amount =…

Q: If $25,000 is deposited in a 5% savings account and inflation is 3%, what is the value of the…

A: Given information : Deposited amount = $25,000 Interest rate on savings = 5% Inflation rate = 3%…

Q: Using Table 1-1 onpage 19, calculate the following:(a) The future value of lump-sum investment of…

A: Calculation of Future Value and Present Value:Excel Spreadsheet:

Q: 800

A: Formula to calculate the future value of ordinary annuity is: FV = C*[(1+I)^n - 1/i] Where C is the…

Q: If money is invested on a 10% simple interest, how much money should be invested to have Php…

A: Here, Simple Interest Rate is 10% Time period is 5 years Required Amount is Php 40,000.00

Q: How much must you deposit each year to have P30,000 at the end of 12years with money worth 8%. Show…

A: “Since you have posted multiple questions, we will solve first question for you. If you want any…

Q: 3. When will Php 30,000 earn interest of Php 15,000 if it is invested at the rate of 7.5% compounded…

A: Time value of money concept says that a sum of amount invested today will have more value in future…

Q: You borrow $30,000 for 10 years to pay tuition and fees. The annual interest rate is 12 percent.…

A: Loan amount (P) = $30,000 Interest rate = 12% Monthly interest rate (i) = 12%/12 = 1% Period = 10…

Q: Draw a Cash Flow Diagram for P10,535 being loaned out at an interest rate of 12% per year over a…

A: Simple Interest per annum = Principle * Rate * Time = P10,535 * 12% * 1 = 1264.2 Cash flow diagram…

Q: If $10,000 is borrowed today at 5% simple interest, how much is due at the end of 10 years? (a)…

A: Simple interest is a method used to calculate interest on the sum of money borrowed by the borrower.…

Q: Find the amount the bank will produce if $2100 is invested for 5 years, compounded daily at 6.48%

A: A study that proves that the 1value of money today is higher than the future value of money is term…

Q: What is the present value of a $120,000 cash flow to be received at the beginning of each of the…

A: Amount of Cash flow = $120000 at the beginning of the year Years(n) = 20 Annual rate(r) = 9%…

Q: Suppose that a certain EOY (end of year) cash flows are expected to be $1,000 for the second year,…

A: End of year cash flows are those cash flows which are generated at the end of each year for an…

Q: 1. How much interest will be earned on $10,000 in 5 months if the annual simple interest rate is…

A: Answer 1: Information Provided: Present value = $10,000 Time = 5 months Interest rate = 2%

Q: 1. If $10,000 is deposited into an account earning 10% interest annually, how much will be…

A: Hi student Since there are multiple questions, we will answer only first question. Interest is the…

Q: Given below are the future value factors for 1 at 10% for one to five periods. Interest is…

A: It is method of computing interest where interest is calculated over interest as well.

Q: A certain amount of money after a decade is said to be worth Php 11,000.00. Ifthe interest rate…

A: There are two distinct questions in this post. The first has been answered below.

Q: f 10,000 is deposited in the bank annually with a 12% per year interest rate. how long will the…

A: Annual Deposit = 10,000 Interest Rate = 12% Future Value Required = 1,000,000

Q: How much must be invested at the beginning of each year at 11%, compounded annually, to pay off a…

A: The problem relates to ANNUITY DUE. Annuity due is an annuity whose payment is due immediately at…

Q: The B/C ratio of an investment of $10,000 that provides a benefit of $1,500 at the beginning every…

A: Benefit-cost ratio (BCR) refers to the ratio which shows the relationship between present value of…

Q: A 10,000 loan is paid off over 10 years; interest is 6 percent effective. The borrower uses a…

A: Sinking funds are funds which are set aside for the repayment of a particular debt or loan.

Q: An investment of $8,000 is made at time 0 with returns of $3,500 at the end of each of years 1–4,…

A: present worth formula: pw=-initial investment+present value of future cashflow

Q: How much money can Company C spend now instead of spending $150,000 in year 8 if the interest rates…

A: present value is the value of future cashflow discounted to present day. present value=future…

Q: . What is the present worth of 4100 deposited at the end of every three months for 5years if the…

A: The future value is the amount deposited and interest accumulated over the period of time. The…

Q: If you deposit RM25,000 in an account earning an interest of 15% per annum, much would you have in…

A: Given: Present value = RM25000 Interest rate = 15% per annum Time period = 10 years To compute the…

Q: A student puts $10,000 in a savings account that pays 16% annual interest, compounded quarterly.…

A: The question is based on the concept of Future Value

Q: Calculate, to the nearest cent, the future value FV (in dollars) of an investment of $10,000 at the…

A: Future Value = Present value * (1+rate)^no. of period

Q: If an amount of $10,000 is deposited into a savings account at an annual interest rate of 4%,…

A: Here in this question we are required to calculate the compounded interest of investment after 8…

Q: Find the amount necessary to fund the given withdrawals yearly withdrawals of $1150 for 10 years;…

A: Present value of annuity: Annuity payment * Present Annuity Factor of $1 at i% for n years. Where, i…

Q: The amount of $10,000 is invested and will be worth $21,000 in nine years. What in the continuoushy…

A: Continuous Compounded Interest rate is the interest rate that is calculated on the principal amount…

Q: The present amount needed to generate an annual income of $50,000 for 20 years if the expected rate…

A: Hello. Since your question has multiple parts, we will solve the first question for you. If you want…

Q: You have borrowed $60,000 at an interest rate of10.5%. Equal payments will be made over a…

A: A series of fixed payments that are paid or received at an equal time interval is term as the…

Q: On January 1, you deposited $6,000 in an investment account. The account will earn 10 percentannual…

A: 1. . 1 Future value =Present value * (1+Interest rate)No. of years…

Q: The present worth of $5,000 in year 3, $10,000 in year 5, and $10,000 in year 8 at an interest rate…

A: The present worth of cash flows can be calculated as sum of discounted cash flows.

Q: If $10,000 is invested in a certain business at the start of the year, the investor will receive…

A: Basic Details: 1. Amount Invested = $10000 2. Annual Cash Flow = $3000 3. Term = 4 Years 4. Interest…

Q: If you invest $2,000 per year for 9 years and earn a 5% return on your investment during that…

A: The future value is the amount that will be received at the end of a certain period. In simple…

Q: A small company plans to spend $10,000 in year 2 and $10,000 in year 5. At an interest rate of…

A: Equivalent annual worth analysis is done to determine the net worth after subtracting equivalent…

Q: If you deposit $2600 in order to get annual revenues each year up to 7 years, at a rate of return…

A: Capital recovery factor is annuity of the investment made today over the period of time at the given…

Q: For this investment, an initial amount of $25,000 should be paid this year (t=0). As of next year…

A: The present value method is a method of finding the productivity of the project by discounting the…

Q: What is the present value of end-of-year cashflows of $1,000 per year, with the first cashflow…

A: Present value is the value today of future cash flows discounted to present terms using a specified…

Q: What is the present worth of cash flows that begin at $10,000 and increase at 5% per year for 10…

A: Present value is the sum of money that must be invested in order to achieve a specific future goal.…

Q: How much money should be invested at 10% so as to get 10,000 after 5 years when the interest is…

A: Answer: Calculation of the money that should be invested at 10% so as to get 10000 after 5 years:…

Step by step

Solved in 2 steps with 1 images

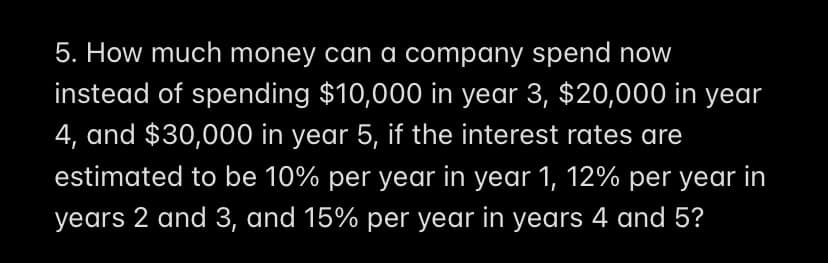

- How much money can a company spend now instead of spending $10,000 in year 3, $20,000 in year 4, and $30,000 in year 5, if the interest rates are estimated to be 10% per year in year 1, 12% per year in years 2 and 3, and 15% per year in years 4 and 5?Suppose a company had an initial investment of $40,000. The cash flow for the next five years are $20,000, $18,000, $19,000, $13,000, and $15,000, respectively. The interest rate is 8%. What is the discounted payback period?6. A report from the marketing department indicates that a new product will generate the following revenue stream: P62,500 in the first year, P89,400 in year two, P136,200 in year three, P128,300 in year four, and P112,000 in year five. If your firm's discount rate is 11% and the cash flows are received at the end of each year, what is the present value of this cash flow stream? a.P379,435.35b.P421,173.24c.P476,036.04d.P528,400.00

- 1)Using an interest rate of $4.5% compounded monthly, how much does a company need to deposit now,such that they have the ability to withdaw $5,000 at the start of each quarter and have $50,000 left over in15 years? 2)Given an interest rate of 2.8% compounded quarterly, what amount is required to be deposited todayalong with semi-annual contributions of $2,500 such that the cumulative balance in 15 years is $250,000? For example $12,345.67Answer:A contract between two parties (company A & B) was created such that in return for equipmentA would prouFor questions 4 and 5, use the following information: Cede & Co. expects its EBIT to be $165,500 every year forever. The company can borrow at 8 percent. The company currently has no debt and its cost of equity is 14 percent. If the tax rate is 21 percent, what is the value of the company? Round to the nearest dollar and format as "XXX,XXX"For questions 4 and 5, use the following information: Question 4 Cede & Co. expects its EBIT to be $165,500 every year forever. The company can borrow at 8 percent. The company currently has no debt and its cost of equity is 14 percent. If the tax rate is 21 percent, what is the value of the company? Round to the nearest dollar and format as "XXX,XXX" Question 5 Cede & Co. expects its EBIT to be $165,500 every year forever. The company can borrow at 8 percent. The company currently has no debt and its cost of equity is 14 percent. Using the answer from question 4, what will the value be if the company borrows $185,000 and uses the proceeds to repurchase shares? Round to the nearest dollar and format as "XXX,XXX"

- Suppose a company had an initial investment of $50,000. The cash flow for the next five years are $14,000, $18,000, $17,000, $14,000, and $13,000, respectively. The interest rate is 8%. - What is the discounted payback period?___ (Enter only whole numbers)Suppose that a bank has $10 billion of one-year loans and $30 billion of five-year loans. These are financed by $35 billion of one-year deposits and $5 billion of five-year deposits. The bank has equity totaling $2 billion and its return on equity is currently 12%. Estimate what change in interest rates next year would lead to the bank's return on equity being reduced to zero. Assume that the bank is subject to a tax rate of 30%.12. If you borrowed P 10,000.00 from a bank with 8% interest per annum, what is the total amount to be repaid at the end of one year?

- Victoria Enterprises expects earnings before interest and taxes (EBIT) next year of $1.6 million. Its depreciation and capital expenditures will both be $301,000, and it expects its capital expenditures to always equal its depreciation. Its working capital will increase by $47,000 over the next year. Its tax rate is 30%. If its WACC is 8% and its FCFs are expected to increase at 5% per year in perpetuity, what is its enterprise value?5.A corporation is considering the purchase of an interest in real estate syndication at a price of $75,000. In return, the syndication promises to pay $1,020 at the end of each month for the next 25 years (300 months). If purchased, what is the expected internal rate of return, compounded monthly? How much total cash would be received on the investment? How much is profit and how much is return of capital?A company forecasts free cash flow of $400 at Year 1 and $600at Year 2; after Year 2, the FCF grow at a constant rate of 5%.The company forecasts the tax savings from interest deductionsas $200 in Year 1, $100 in Year 2; after Year 2, the tax savingsgrow at a constant rate of 5%. The unlevered cost of equityis 9%. What is the horizon value of operations at Year 2?($15,750.0) What is the current unlevered value of operations?($14,128.4) What is the horizon value of the tax shield at Year 2?($2,625.0) What is the current value of the tax shield? ($2,477.1)What is the levered value of operations at Year 0? ($16,605.5)