ofitability remains a challenge for banks and thrifts with less than $2 billion of assets. The business problem facing a bank analyst relates to the factors that affect return on assets (ROA), an indicator of how profitable a company is relative to its total sets. Data collected from a sample of 20 community banks include the ROA (%), the efficiency ratio (%), as a measure of bank productivity (the lower the eficiency ratio, the better), and total risk-based capital (%), as a measure of capital adequacy. mplete parts (a) through (g) below. a Click the icon to view the data table. State the multiple regression equation. tX, represent the efficiency ratio (%) and let X, represent the total risk-based capital (%). Distribution Costs

ofitability remains a challenge for banks and thrifts with less than $2 billion of assets. The business problem facing a bank analyst relates to the factors that affect return on assets (ROA), an indicator of how profitable a company is relative to its total sets. Data collected from a sample of 20 community banks include the ROA (%), the efficiency ratio (%), as a measure of bank productivity (the lower the eficiency ratio, the better), and total risk-based capital (%), as a measure of capital adequacy. mplete parts (a) through (g) below. a Click the icon to view the data table. State the multiple regression equation. tX, represent the efficiency ratio (%) and let X, represent the total risk-based capital (%). Distribution Costs

Linear Algebra: A Modern Introduction

4th Edition

ISBN:9781285463247

Author:David Poole

Publisher:David Poole

Chapter4: Eigenvalues And Eigenvectors

Section4.6: Applications And The Perron-frobenius Theorem

Problem 22EQ

Related questions

Concept explainers

Contingency Table

A contingency table can be defined as the visual representation of the relationship between two or more categorical variables that can be evaluated and registered. It is a categorical version of the scatterplot, which is used to investigate the linear relationship between two variables. A contingency table is indeed a type of frequency distribution table that displays two variables at the same time.

Binomial Distribution

Binomial is an algebraic expression of the sum or the difference of two terms. Before knowing about binomial distribution, we must know about the binomial theorem.

Topic Video

Question

4

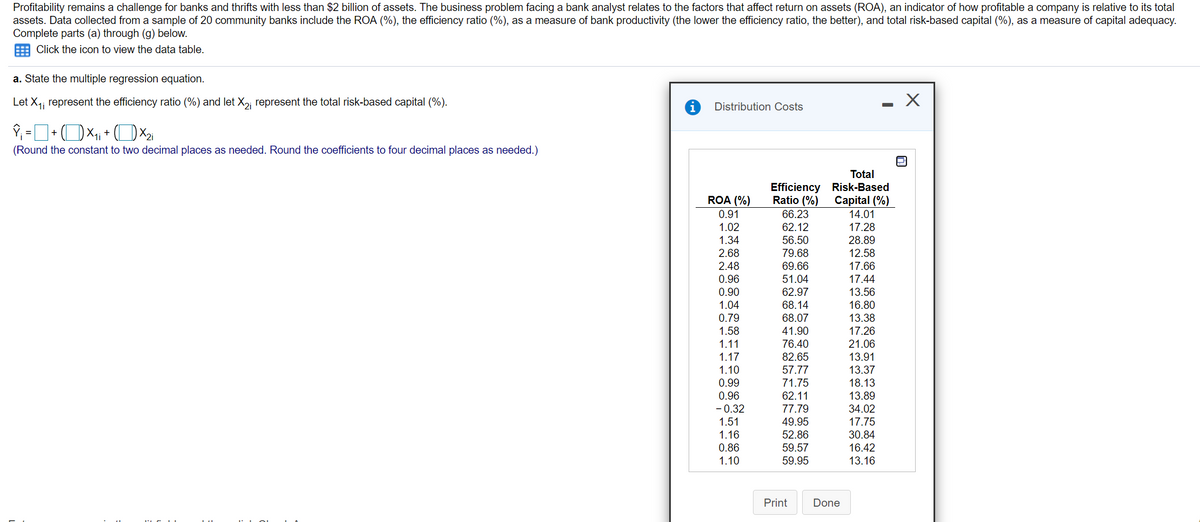

Transcribed Image Text:Profitability remains a challenge for banks and thrifts with less than $2 billion of assets. The business problem facing a bank analyst relates to the factors that affect return on assets (ROA), an indicator of how profitable a company is relative to its total

assets. Data collected from a sample of 20 community banks include the ROA (%), the efficiency ratio (%), as a measure of bank productivity (the lower the efficiency ratio, the better), and total risk-based capital (%), as a measure of capital adequacy.

Complete parts (a) through (g) below.

Click the icon to view the data table.

a. State the multiple regression equation.

Let X,; represent the efficiency ratio (%) and let X,, represent the total risk-based capital (%).

- X

i

Distribution Costs

+

+

1i

%3D

(Round the constant to two decimal places as needed. Round the coefficients to four decimal places as needed.)

Total

Efficiency Risk-Based

ROA (%)

Ratio (%)

Capital (%)

0.91

66.23

14.01

1.02

62.12

17.28

1.34

56.50

28.89

2.68

79.68

12.58

2.48

69.66

17.66

0.96

51.04

17.44

13.56

16.80

0.90

62.97

1.04

68.14

0.79

68.07

13.38

17.26

21.06

13.91

1.58

41.90

1.11

76.40

1.17

82.65

1.10

57.77

13.37

0.99

71.75

18.13

0.96

62.11

13.89

- 0.32

77.79

34.02

49.95

17.75

30.84

16.42

1.51

1.16

52.86

59.57

59.95

0.86

1.10

13.16

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt