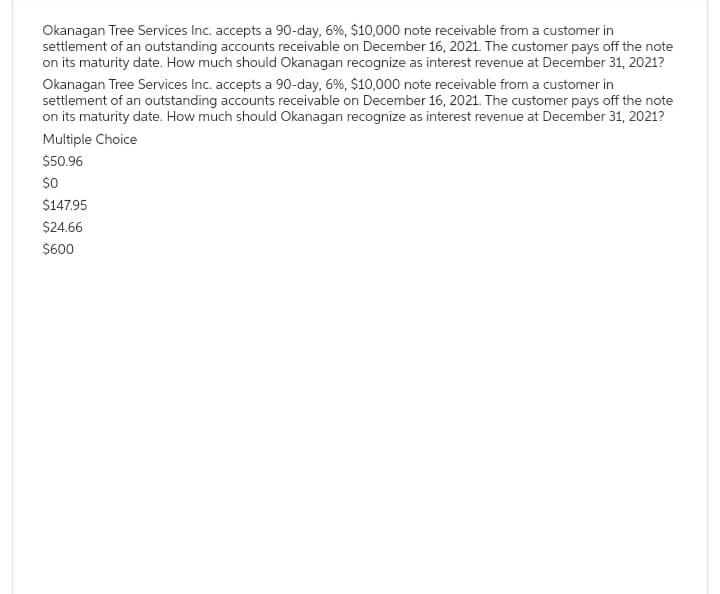

Okanagan Tree Services Inc. accepts a 90-day, 6 %, $10,000 note receivable from a customer in settlement of an outstanding accounts receivable on December 16, 2021. The customer pays off the note on its maturity date. How much should Okanagan recognize as interest revenue at December 31, 2021? Okanagan Tree Services Inc. accepts a 90-day, 6 %, $10,000 note receivable from a customer in settlement of an outstanding accounts receivable on December 16, 2021. The customer pays off the note on its maturity date. How much should Okanagan recognize as interest revenue at December 31, 2021? Multiple Choice $50.96 SO $147.95 $24.66

Okanagan Tree Services Inc. accepts a 90-day, 6 %, $10,000 note receivable from a customer in settlement of an outstanding accounts receivable on December 16, 2021. The customer pays off the note on its maturity date. How much should Okanagan recognize as interest revenue at December 31, 2021? Okanagan Tree Services Inc. accepts a 90-day, 6 %, $10,000 note receivable from a customer in settlement of an outstanding accounts receivable on December 16, 2021. The customer pays off the note on its maturity date. How much should Okanagan recognize as interest revenue at December 31, 2021? Multiple Choice $50.96 SO $147.95 $24.66

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 22MC: A company collects an honored note with a maturity date of 24 months from establishment, a 10%...

Related questions

Question

Sh3

Transcribed Image Text:Okanagan Tree Services Inc. accepts a 90-day, 6%, $10,000 note receivable from a customer in

settlement of an outstanding accounts receivable on December 16, 2021. The customer pays off the note

on its maturity date. How much should Okanagan recognize as interest revenue at December 31, 2021?

Okanagan Tree Services Inc. accepts a 90-day, 6%, $10,000 note receivable from a customer in

settlement of an outstanding accounts receivable on December 16, 2021. The customer pays off the note

on its maturity date. How much should Okanagan recognize as interest revenue at December 31, 2021?

Multiple Choice

$50.96

$0

$147.95

$24.66

$600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning