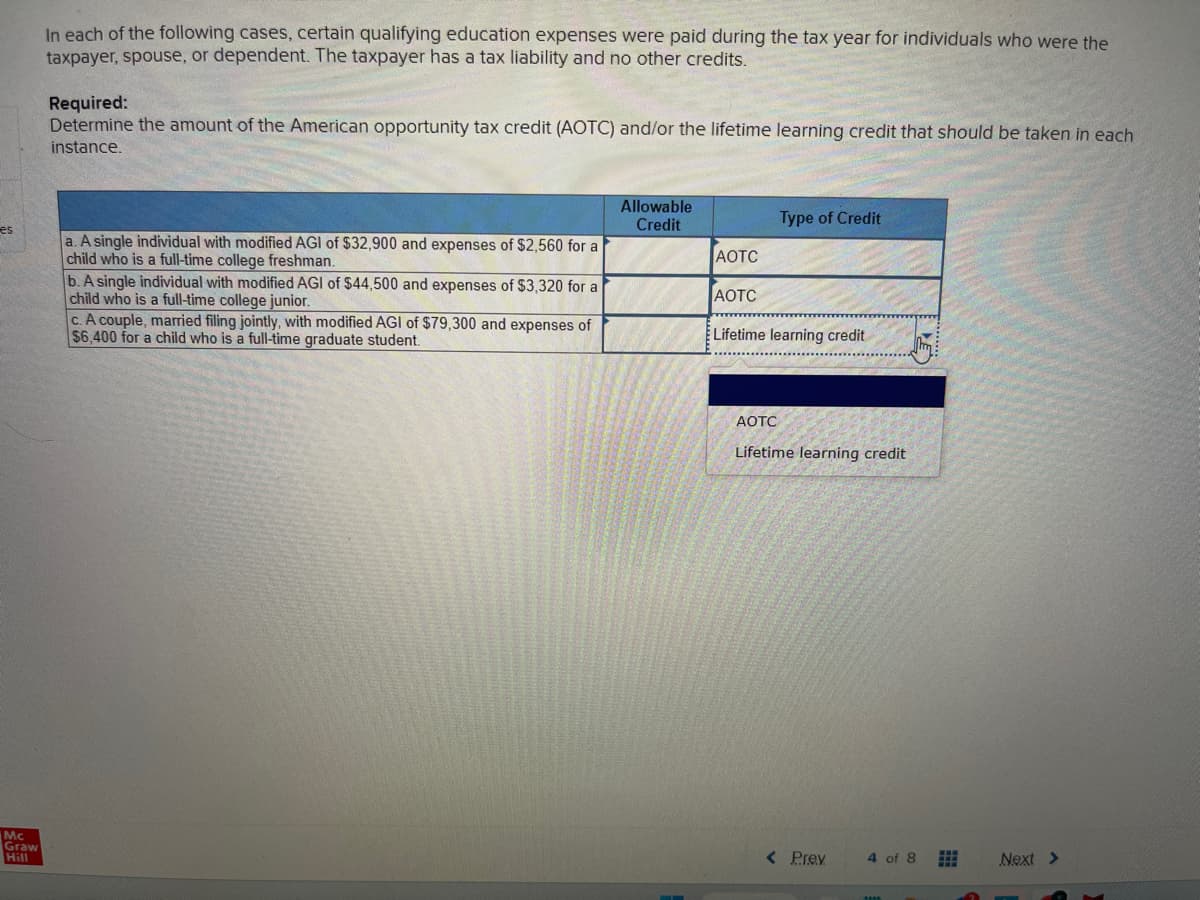

es In each of the following cases, certain qualifying education expenses were paid during the tax year for individuals who were the taxpayer, spouse, or dependent. The taxpayer has a tax liability and no other credits. Required: Determine the amount of the American opportunity tax credit (AOTC) and/or the lifetime learning credit that should be taken in each instance. a. A single individual with modified AGI of $32,900 and expenses of $2,560 for al child who is a full-time college freshman. b. A single individual with modified AGI of $44,500 and expenses of $3,320 for a child who is a full-time college junior. c. A couple, married filing jointly, with modified AGI of $79,300 and expenses of $6,400 for a child who is a full-time graduate student. Allowable Credit Type of Credit AOTC AOTC Lifetime learning credit AOTC Lifetime learning credit

es In each of the following cases, certain qualifying education expenses were paid during the tax year for individuals who were the taxpayer, spouse, or dependent. The taxpayer has a tax liability and no other credits. Required: Determine the amount of the American opportunity tax credit (AOTC) and/or the lifetime learning credit that should be taken in each instance. a. A single individual with modified AGI of $32,900 and expenses of $2,560 for al child who is a full-time college freshman. b. A single individual with modified AGI of $44,500 and expenses of $3,320 for a child who is a full-time college junior. c. A couple, married filing jointly, with modified AGI of $79,300 and expenses of $6,400 for a child who is a full-time graduate student. Allowable Credit Type of Credit AOTC AOTC Lifetime learning credit AOTC Lifetime learning credit

Chapter3: Computing The Tax

Section: Chapter Questions

Problem 18CE

Related questions

Question

Transcribed Image Text:es

Mc

Graw

Hill

In each of the following cases, certain qualifying education expenses were paid during the tax year for individuals who were the

taxpayer, spouse, or dependent. The taxpayer has a tax liability and no other credits.

Required:

Determine the amount of the American opportunity tax credit (AOTC) and/or the lifetime learning credit that should be taken in each

instance.

a. A single individual with modified AGI of $32,900 and expenses of $2,560 for al

child who is a full-time college freshman.

b. A single individual with modified AGI of $44,500 and expenses of $3,320 for a

child who is a full-time college junior.

$79,300 and expenses of

c. A couple, married filing jointly, with modified AGI of

$6,400 for a child who is a full-time graduate student.

Allowable

Credit

Type of Credit

AOTC

AOTC

Lifetime learning credit

AOTC

Lifetime learning credit

< Prev

4 of 8 #

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT