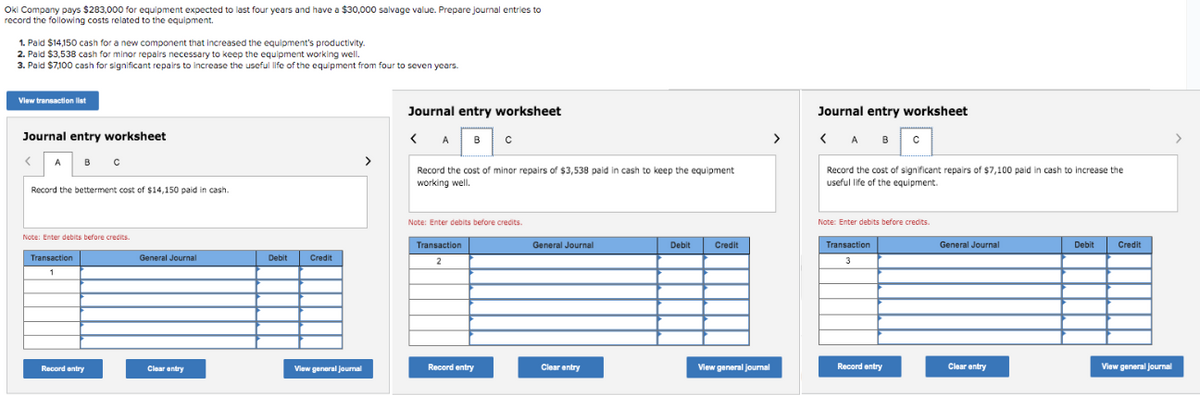

Oki Company pays $283,000 for equipment expected to last four years and have a $30,000 salvage value. Prepare journal entries to record the following costs related to the equipment. 1. Paid $14,150 cash for a new component that increased the equipment's productivity. 2. Paid $3,538 cash for minor repairs necessary to keep the equipment working well. 3. Paid $7100 cash for significant repairs to increase the useful life of the equipment from four to seven years. View transaction list Journal entry worksheet Record the betterment cost of $14,150 paid in cash. Note: Enter debits before credits. Transaction 1 Record entry General Journal Clear entry Debit Credit > View general Journal Journal entry worksheet Journal entry worksheet

Oki Company pays $283,000 for equipment expected to last four years and have a $30,000 salvage value. Prepare journal entries to record the following costs related to the equipment. 1. Paid $14,150 cash for a new component that increased the equipment's productivity. 2. Paid $3,538 cash for minor repairs necessary to keep the equipment working well. 3. Paid $7100 cash for significant repairs to increase the useful life of the equipment from four to seven years. View transaction list Journal entry worksheet Record the betterment cost of $14,150 paid in cash. Note: Enter debits before credits. Transaction 1 Record entry General Journal Clear entry Debit Credit > View general Journal Journal entry worksheet Journal entry worksheet

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter9: Depreciation (deprec)

Section: Chapter Questions

Problem 1R: Dunedin Drilling Company recently acquired a new machine at a cost of 350,000. The machine has an...

Related questions

Question

Transcribed Image Text:Okl Company pays $283,000 for equipment expected to last four years and have a $30,000 salvage value. Prepare journal entries to

record the following costs related to the equipment.

1. Paid $14,150 cash for a new component that increased the equipment's productivity.

2. Paid $3,538 cash for minor repairs necessary to keep the equipment working well.

3. Paid $7,100 cash for significant repairs to increase the useful life of the equipment from four

View transaction list

Journal entry worksheet

<

A в с

Record the betterment cost of $14,150 paid in cash.

Note: Enter debits before credits.

Transaction

1

Record entry

General Journal

Clear entry

Debit

Credit

View general Journal

>

seven years.

Journal entry worksheet

<A B C

Record the cost of minor repairs of $3,538 paid in cash to keep the equipment

working well.

Note: Enter debits before credits.

Transaction

2

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

>

Journal entry worksheet

<ABC

Record the cost of significant repairs of $7,100 paid in cash to increase the

useful life of the equipment.

Note: Enter debits before credits.

Transaction

3

Record entry

General Journal

Clear entry

Debit

Credit

View general Journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT