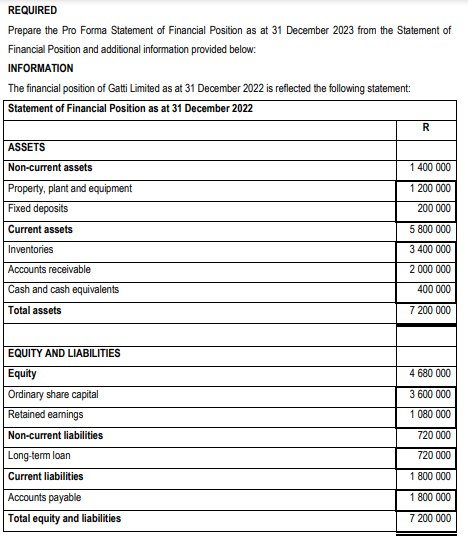

Prepare the Pro Forma Statement of Financial Position as at 31 December 2023 from the Statement of Financial Position and additional information provided below: INFORMATION The financial position of Gatti Limited as at 31 December 2022 is reflected the following statement:

Prepare the Pro Forma Statement of Financial Position as at 31 December 2023 from the Statement of Financial Position and additional information provided below: INFORMATION The financial position of Gatti Limited as at 31 December 2022 is reflected the following statement:

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.9E

Related questions

Question

Please find attached and can you assist, thanks.

Transcribed Image Text:REQUIRED

Prepare the Pro Forma Statement of Financial Position as at 31 December 2023 from the Statement of

Financial Position and additional information provided below:

INFORMATION

The financial position of Gatti Limited as at 31 December 2022 is reflected the following statement:

Statement of Financial Position as at 31 December 2022

ASSETS

Non-current assets

Property, plant and equipment

Fixed deposits

Current assets

Inventories

Accounts receivable

Cash and cash equivalents

Total assets

EQUITY AND LIABILITIES

Equity

Ordinary share capital

Retained earnings

Non-current liabilities

Long-term loan

Current liabilities

Accounts payable

Total equity and liabilities

R

1 400 000

1

200 000

200 000

5 800 000

3 400 000

2 000 000

400 000

7 200 000

4 680 000

3 600 000

1

080 000

720 000

720 000

1 800 000

1 800 000

7 200 000

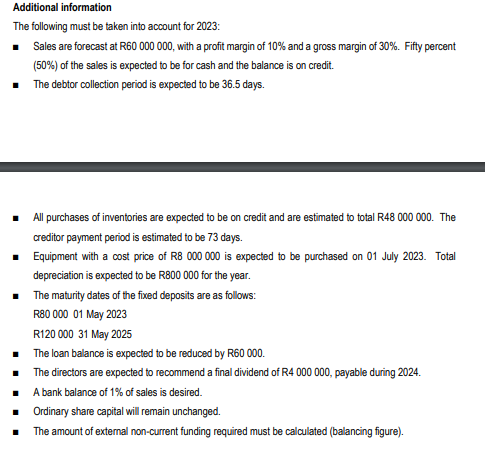

Transcribed Image Text:Additional information

The following must be taken into account for 2023:

■ Sales are forecast at R60 000 000, with a profit margin of 10% and a gross margin of 30%. Fifty percent

(50%) of the sales is expected to be for cash and the balance is on credit.

■ The debtor collection period is expected to be 36.5 days.

All purchases of inventories are expected to be on credit and are estimated to total R48 000 000. The

creditor payment period is estimated to be 73 days.

■ Equipment with a cost price of R8 000 000 is expected to be purchased on 01 July 2023. Total

depreciation is expected to be R800 000 for the year.

The maturity dates of the fixed deposits are as follows:

R80 000 01 May 2023

R120 000 31 May 2025

The loan balance is expected to be reduced by R60 000.

■ The directors are expected to recommend a final dividend of R4 000 000, payable during 2024.

A bank balance of 1% of sales is desired.

Ordinary share capital will remain unchanged.

The amount of external non-current funding required must be calculated (balancing figure).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College