Old fixtures: Cost, $91,000 Accumulated depreciation, $68,000 New fixtures: Cash paid, $110,000 Market value, $133,000

Old fixtures: Cost, $91,000 Accumulated depreciation, $68,000 New fixtures: Cash paid, $110,000 Market value, $133,000

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter15: Statement Of Cash Flows

Section: Chapter Questions

Problem 8DQ: Fully depreciated equipment costing 50,000 was discarded. What was the effect of the transaction on...

Related questions

Question

Exchanging assets—two situations

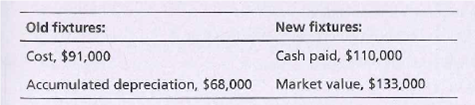

Partner Bank recently traded in office fixtures. Here are the facts:

Requirements

- Record Partner Bank’s trade-in of old fixtures for new ones. Assume the exchange had commercial substance.

- Now let’s change one fact. Partner Bank feels compelled to do business with Elm Furniture, a bank customer, even though the bank can get the fixtures elsewhere at a better price. Partner Bank is aware that the new fixtures’ market value is only $126,000. Record the trade-in. Assume the exchange had commercial substance.

Transcribed Image Text:Old fixtures:

Cost, $91,000

Accumulated depreciation, $68,000

New fixtures:

Cash paid, $110,000

Market value, $133,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning