Old Town Entertainment has two employees in Year 1. Clay earns $4,800 per month, and Philip, the manager, earns $10,400 per month. Neither is paid extra for working overtime. Assume the Social Security tax rate is 6 percent on the first $110,000 of earnings and the Medicare tax rate is 1.5 percent on all earnings. The federal income tax withholding is 16 percent of gross earnings for Clay and 20 percent for Pilip. Both Clay and Philip have been employed all year. Required a. Calculate the net pay for both Clay and Philip for March. b. Calculate the net pay for both Clay and Philip for December. c. Is the net pay the same in March and December for both employees? d. What amounts will Old Town report on the Year 1 W-2s for each employee?

Old Town Entertainment has two employees in Year 1. Clay earns $4,800 per month, and Philip, the manager, earns $10,400 per month. Neither is paid extra for working overtime. Assume the Social Security tax rate is 6 percent on the first $110,000 of earnings and the Medicare tax rate is 1.5 percent on all earnings. The federal income tax withholding is 16 percent of gross earnings for Clay and 20 percent for Pilip. Both Clay and Philip have been employed all year. Required a. Calculate the net pay for both Clay and Philip for March. b. Calculate the net pay for both Clay and Philip for December. c. Is the net pay the same in March and December for both employees? d. What amounts will Old Town report on the Year 1 W-2s for each employee?

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter13: Accounting For Payroll And Payroll Taxes

Section13.3: Reporting Withholding And Payroll Taxes

Problem 1WT

Related questions

Question

Answer full question

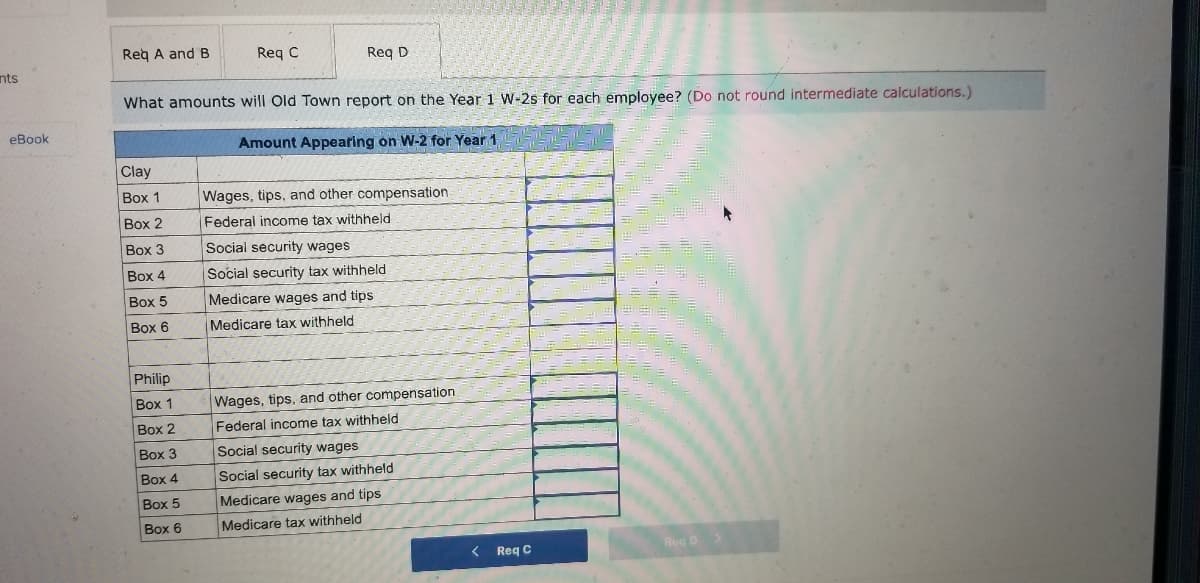

Transcribed Image Text:Reg A and B

Req C

Reg D

nts

What amounts will Old Town report on the Year 1 W-2s for each employee? (Do not round intermediate calculations.)

eBook

Amount Appearing on W-2 for Year 1

Clay

Вох 1

Wages, tips, and other compensation

Вох 2

Federal income tax withheld

Box 3

Social security wages

Box 4

Social security tax withheld

Box 5

Medicare wages and tips

Box 6

Medicare tax withheld

Philip

Box 1

Wages, tips., and other compensation

Box 2

Federal income tax withheld

Box 3

Social security wages

Box 4

Social security tax withheld

Box 5

Medicare wages and tips

Box 6

Medicare tax withheld

Req C

Transcribed Image Text:Saved

Help

Save & Exit

Submit

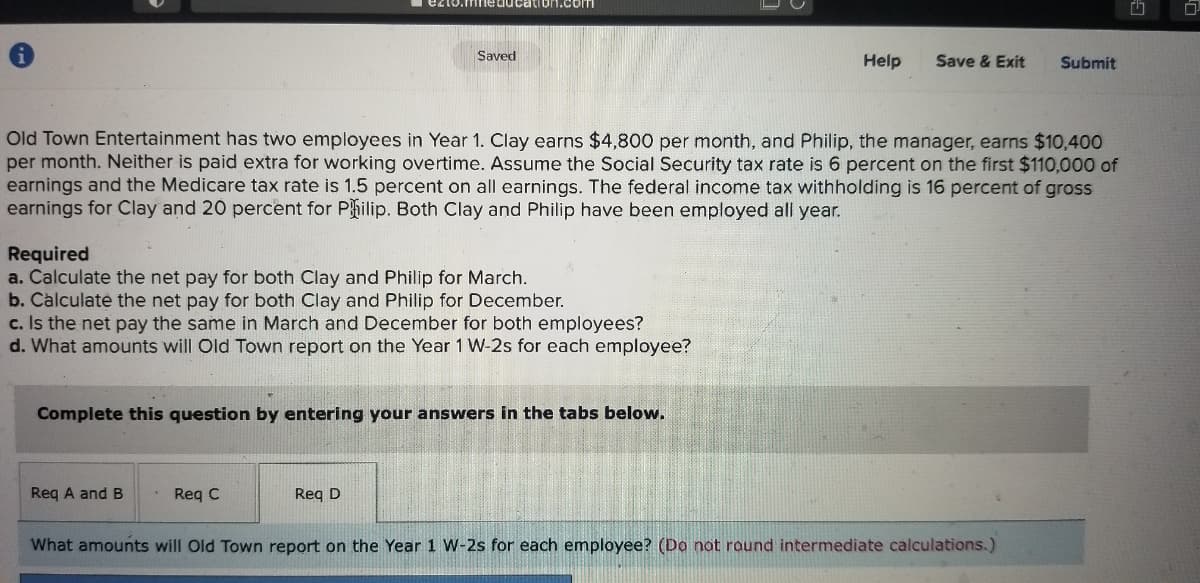

Old Town Entertainment has two employees in Year 1. Clay earns $4,800 per month, and Philip, the manager, earns $10,400

per month. Neither is paid extra for working overtime. Assume the Social Security tax rate is 6 percent on the first $110,000 of

earnings and the Medicare tax rate is 1.5 percent on all earnings. The federal income tax withholding is 16 percent of gross

earnings for Clay and 20 percent for Philip. Both Clay and Philip have been employed all year.

Required

a. Calculate the net pay for both Clay and Philip for March.

b. Calculate the net pay for both Clay and Philip for December.

c. Is the net pay the same in March and December for both employees?

d. What amounts will Old Town report on the Year 1 W-2s for each employee?

Complete this question by entering your answers in the tabs below.

Req A and B

• Req C

Req D

What amounts will Old Town report on the Year 1 W-2s for each employee? (Da not raund intermediate calculations.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College